Q.E. Policy Meets the Tea Party

Interest-Rates / US Debt Jan 23, 2011 - 01:28 AM GMTBy: John_Mauldin

This week's letter is a result of two lengthy conversations I had today, which have me in a reflective mode. Plus, I finished the last, final edits of my book, all of which is causing me to mull over the unsustainability of the US fiscal situation. There is a true Endgame here, and it may happen before we are ready.

This week's letter is a result of two lengthy conversations I had today, which have me in a reflective mode. Plus, I finished the last, final edits of my book, all of which is causing me to mull over the unsustainability of the US fiscal situation. There is a true Endgame here, and it may happen before we are ready.

The first conversation was with Kyle Bass, Richard Howard, and Peter Mauthe, over lunch (more on Peter, who has come to work with me, below). Kyle is the head of Hayman Advisors, a very successful macro hedge fund based here in Dallas. Then I recorded a Conversation with David Rosenberg and Lacy Hunt, which is one of the best we have ever done. Subscribers will be very happy. The new Conversation with George Friedman is now online, too. You can learn more about Conversations with John Mauldin at www.johnmauldin.com/conversations/ . And please comment on this and future letters in the readers' forums of my new website. Now, to this week's letter. My goal is to make this one a little shorter than normal. We'll see how I do.

The Unsustainable Meets the Irresistible

Kyle, Lacy, and David are typically pushed into the bearish category, but (not surprisingly to me) their forecast for the next few quarters is rather strong. None of us would be surprised by a high-3% number for GDP this quarter, and 4% is not out of the question. And we all see GDP tailing off as the year winds down. Inventory builds begin to slow, and in 2012 the 2% payroll holiday goes away. Plus, as I have written and David has noted, the pressure on state and local spending is getting larger with every passing day.

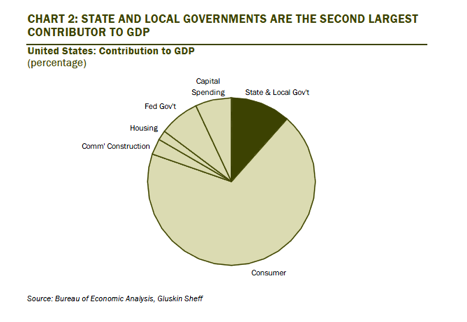

State and local spending is the second biggest component of the economy. The chart below, from David's letter this week, gives us a visual image of just how large it is. Note that budget deficits at the state and local levels total more than 1% of GDP. Revenues, though, are still off 10% (on average) from where they were at the peak. The "fiscal stimulus" from the US government has run out and states and local communities are having to balance their budgets the old-fashioned way - through spending cuts and increased taxes.

As this budget cutting works its way through the economy, and as inventories are no longer being built (they are already at adequate levels), the growth from the current stimulus (both QE2 and payroll and federal government expenditures) the economy will have to stand on its own in terms of organic growth. And as the year wears on it will become apparent there is less true organic growth than currently meets the eye.

State and Local Spending

A few more thoughts on state and local spending. First, Congress needs to go ahead and authorize a bill allowing states to file for bankruptcy. At the very least, this send s very clear message to the states that the federal government will not come to their aid. It is not fair to ask states that have done what they need to do to keep their fiscal houses in order, to support states that have overspent, typically by trying to fund their pensions and run other well-intentioned but underfunded programs.

Second, states need the ability to force public unions to come to the table. Many states have overpromised, and they are simply in a very deep hole and need concessions. Private workers have had to take the brunt of the recent crisis, and meanwhile government workers get far more on average than private employees.

There is an interesting table in a USA Today story from last year, comparing the compensation of federal and private employees. I am going to put the whole table in this letter and let you quickly scroll down through it. The link to the article is at the end. (Notice that government economists make more than private ones!) Now let me say that I begrudge no one their income. What I am saying is that the disparity, when budgets are tight, between what the private sector must deal with and what the public sector has on its plate, should not be as great as it is.

| Job | Federal | Private | Difference |

| Airline pilot, copilot, flight engineer | $93,690 | $120,012 | -$26,322 |

| Broadcast technician | $90,310 | $49,265 | $41,045 |

| Budget analyst | $73,140 | $65,532 | $7,608 |

| Chemist | $98,060 | $72,120 | $25,940 |

| Civil engineer | $85,970 | $76,184 | $9,786 |

| Clergy | $70,460 | $39,247 | $31,213 |

| Computer, information systems manager | $122,020 | $115,705 | $6,315 |

| Computer support specialist | $45,830 | $54,875 | -$9,045 |

| Cook | $38,400 | $23,279 | $15,121 |

| Crane, tower operator | $54,900 | $44,044 | $10,856 |

| Dental assistant | $36,170 | $32,069 | $4,101 |

| Economist | $101,020 | $91,065 | $9,955 |

| Editors | $42,210 | $54,803 | -$12,593 |

| Electrical engineer | $86,400 | $84,653 | $1,747 |

| Financial analysts | $87,400 | $81,232 | $6,168 |

| Graphic designer | $70,820 | $46,565 | $24,255 |

| Highway maintenance worker | $42,720 | $31,376 | $11,344 |

| Janitor | $30,110 | $24,188 | $5,922 |

| Landscape architects | $80,830 | $58,380 | $22,450 |

| Laundry, dry-cleaning worker | $33,100 | $19,945 | $13,155 |

| Lawyer | $123,660 | $126,763 | -$3,103 |

| Librarian | $76,110 | $63,284 | $12,826 |

| Locomotive engineer | $48,440 | $63,125 | -$14,685 |

| Machinist | $51,530 | $44,315 | $7,215 |

| Mechanical engineer | $88,690 | $77,554 | $11,136 |

| Office clerk | $34,260 | $29,863 | $4,397 |

| Optometrist | $61,530 | $106,665 | -$45,135 |

| Paralegals | $60,340 | $48,890 | $11,450 |

| Pest control worker | $48,670 | $33,675 | $14,995 |

| Physicians, surgeons | $176,050 | $177,102 | -$1,052 |

| Physician assistant | $77,770 | $87,783 | -$10,013 |

| Procurement clerk | $40,640 | $34,082 | $6,558 |

| Public relations manager | $132,410 | $88,241 | $44,169 |

| Recreation worker | $43,630 | $21,671 | $21,959 |

| Registered nurse | $74,460 | $63,780 | $10,680 |

| Respiratory therapist | $46,740 | $50,443 | -$3,703 |

| Secretary | $44,500 | $33,829 | $10,671 |

| Sheet metal worker | $49,700 | $43,725 | $5,975 |

| Statistician | $88,520 | $78,065 | $10,455 |

| Surveyor | $78,710 | $67,336 | $11,374 |

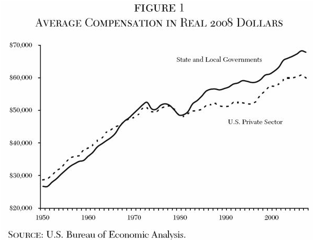

You can see in the next graph that this differential has built up over time. It used to be that a federal government job paid less but was more secure. Now it is still more secure but pays about 44% more on average (35% higher wages and 69% higher benefits). (source: Reason magazine)

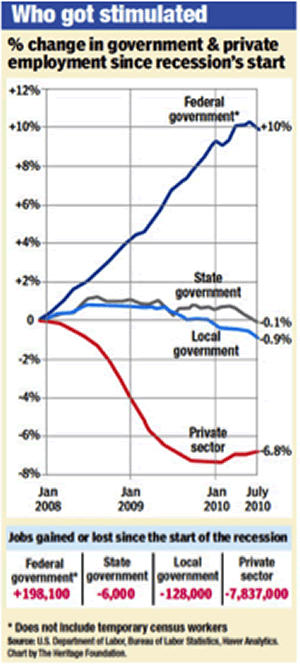

Further, while there has been a clear drop in private employment, we have seen 10% growth in federal employment (state and local employment was flat through the middle of last year, but is likely to fall this year, with budget cuts).

That clearly implies there is room at the federal level for some "austerity." The calls for a rollback to the budget and employment levels of 2007 will become more vocal as the set of facts we will address in a moment become evident.

Before we get to that, however, I want to take a side trip. Illinois recently passed a very real tax increase as a way to start the process of dealing with its massive deficits. It did so in a lame duck session of its state legislature, even though the voters had clearly elected a far more fiscally conservative legislature that would not have passed the tax increases.

The response of the governors of Indiana and Wisconsin, their closest neighbors? They immediately suggested to Illinois businesses that they are welcome to come to their states and set up shop and pay less taxes.

Higher taxes are hardly a cure. Look at the migration of businesses from high-tax states to low-tax states. Over the last ten years it has been pronounced. For those who argue that higher marginal taxes don't make a difference, the facts clearly overrule you. Oregon decided to tax the wealthiest 2% of its citizens. They collected 40% less than they projected, and over 25% of the people they expected to tax somehow "disappeared." And that is just in the first year. At some point, the "rich" get tired of being in the crosshairs of politicians and repair to more favorable climes.

This is all part of the national conversation we need to have on taxes and spending. That we need a complete tax overhaul, a thorough rethinking of how we raise the monies we need, should be obvious. To hear the "this is dead on arrival" conclusions of the various federal deficit commission reports, from the left and even from Republicans, is disheartening, at least to me. There are a lot of things I do not like in those reports, but they are a starting point for a much-needed national conversation. We are soon going to find ourselves in very deep kimchee, if the report Kyle showed me today is close to right.

QE Policy Meets the Tea Party

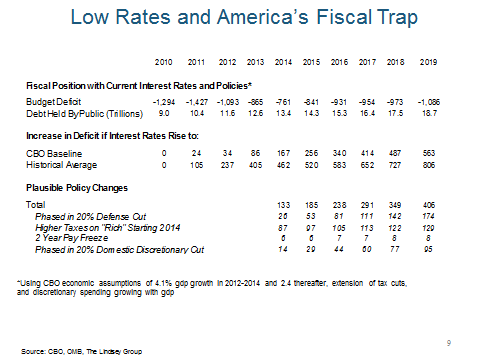

Kyle shared with me a presentation by the Lindsey Group called "QE Policy Meets the Tea Party." It was wide-ranging in scope, but what caught my eye was the table I print below. Larry Lindsey is one of the better economists in the country, a former Fed governor with stints at the White House. I have not met him, but his associate Marc Sumerlin is whip-brilliant. (http://www.thelindseygroup.com/)

America, they assert, is in a fiscal trap due to the low interest rates we currently enjoy. What if I told you we could cut defense and discretionary spending by 20%, put in a two-year pay freeze on federal employees, and go ahead and let the Bush tax cuts on the "rich" expire. Wouldn't that go a long way to fixing the deficit? The answer is, sadly, likely to be no.

As the table shows, if interest rates go back to their long-term historical average, spending could rise by $800 billion in just 8 years. Even under the more optimistic assumptions of the Congressional Budget Office, it is still $500+ billion. The government debt held by the public would be around 120% of GDP (back of my napkin), or close to what I said last week was completely unsustainable by the Irish. It will be no less so for the US. Spend a few moments with the table, and see how even deep cuts and freezes have so little impact. That is not to say they are not necessary, but this just shows that a much different approach is needed.

What approach might that be? Dealing with entitlements, of course. The very item that most politicians give lip service to but have no real solutions for. But that is a topic for another month's worth of letters.

The takeaway is that we are on an unsustainable path. Absent something more serious even than what the Lindsey Group has outlined, long before we get to 2019 the bond markets will have taken away our ability to finance our debt at low rates.

Peter Orszag wrote a column in the Financial Times today. (Orszag was the Director of the Office of Management and Budget under President Obama.) His closing paragraph:

"The bottom line is that there may well be U.S. public debt tremors this year, both during federal debate over raising the debt ceiling and with at least a limited number of crises in local and city governments. The bigger problem, though, lies beyond 2011, as the unsustainability of the federal government's fiscal trajectory becomes increasingly clear. I hope it does not ultimately require a crisis to restore fiscal sustainability at the federal level, but I fear it will."

A Bug in Search of a Windshield

One of my speech lines that usually gets a laugh (although I am not sure how it will go over in Japan next month) is that Japan is a bug in search of a windshield. In today's FT there is an article quoting an interview with the new Japanese finance minister, a rather surprise appointment from the opposition party and a budget hawk. Quote:

"'We face a dreadful dream that one day the long-term interest rate might rise,' Kaoru Yosano, the new minister for economic and fiscal policy, told the Financial Times. Japan has hit a 'critical point' where it risks losing investor confidence if politicians fail to reach agreement on how to rein in the ballooning national debt, a cabinet minister has warned."

Greece. Ireland. Japan. They are coming to the end of their ability to raise debt at an affordable level. There will be defaults in one form or another. Whether you call it restructuring or adjustments or printing money, it will happen.

If the US does not get its act together, we will soon be trying to avoid the windshield of the bond market, which will be coming at us faster than we can swerve to avoid it.

On a more optimistic note, I have just returned from giving a speech in Winnipeg. In the mid-'90s, Canada was in much worse shape than the US is in today. They made the tough choices and have since done very well. So has Sweden. We do not have to become Argentina or what will soon be Japan. Let us hope that we make the tough choices and avoid that windshield. The world does not want to suffer through a crippled US economy and government. That is almost unthinkable. So we must start to think the unthinkable and hedge our bets. Just in case.

Miami, Vegas, Thailand, and Some Needed Help

We are in the final stages of planning our annual Strategic Investment Conference. You do NOT want to miss this. It is going to be our biggest and best ever. It will be April 28-30 in La Jolla. Save that date.

Next week I go to Miami to speak at the Tiger 21 Conference. I am on a panel with former Majority Leader Richard Gephardt and former head of the GAO David Walker, following a speech by Newt Gingrich, rounded out by a serious assortment of financial types. I think they bring your humble analyst in as the comic relief, but I have fun all the same.

The next week I am off to Vegas for a day at Steve Blumenthal of CMG's conference, then it's on to Thailand. I sing for my supper in Phuket, but will then go to Bangkok for four days with my long-time friend Tony Sagami for some vacation and sightseeing time (although I plan to write a letter from there).

I am racking up the airline miles the first quarter of the year. I have to say that wifi on the plane is one of the greatest things since sliced bread. It is tough to keep up, but that helps.

I am MOST PLEASED to announce that Peter Mauthe has joined Millennium Wave Investments. Peter is well-known in the investment industry, having run some very well-established firms. He is a management professional. He is also a very savvy investment professional, as he is a recent past president of the American Association of Professional Technical Analysts. He really is a master of technical analysis, and I intend to sit at his feet and learn. Over time, you will see some of that wisdom creep into my writing.

Most importantly, if you go to LinkedIn, you will see that Peter has taken the title Chief Implementation Officer (yet another CIO title, but this one is a real description of his role). We have so many opportunities coming at us that Tiffani or I just do not have time to deal with. We are swamped. We have never been busier. We need someone who can manage that process and make things happen. And it has to be someone we can trust implicitly, as he will speak for us in so many business situations.

This is a true new era here at Millennium Wave Investments. I feel we are taking it to a whole new level this year, and I am excited. There are more and even better things coming, down the road. But this letter will still be in your inbox each week. The reason for everything is you, gentle reader, and I am reminded of that every day. Thanks for your support over the years.

Now, have a great week. I see some family time in my weekend and a hectic schedule next week. But I am having way more fun than the law allows.

Oh, and my throwaway line at the annual CFA Forecast Dinner in Winnipeg? It was minus 12 degrees Fahrenheit that night. "Seriously, you should show some sympathy to your speakers. Why not schedule your forecast dinner for July? You would be ahead of everyone else and the forecasts would be just as accurate." Which is to say, not so much. But I try, gentle reader, I try.

Your needing to stop so his shadow can catch up analyst,

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.