BubbleOmics Financial Markets and Economic Forecasts for the Year of the Rabbit

Stock-Markets / Financial Markets 2011 Jan 25, 2011 - 01:27 PM GMTBy: Andrew_Butter

On 4th February 2011 the Year of The Tiger transforms to The Year of The Rabbit. If you believe in Chinese horoscopes the “Rabbit” is going to be a walk-in-the-park compared to all the excitement of the past two years.

On 4th February 2011 the Year of The Tiger transforms to The Year of The Rabbit. If you believe in Chinese horoscopes the “Rabbit” is going to be a walk-in-the-park compared to all the excitement of the past two years.

http://www.theholidayspot.com/chinese_new_year/more_zodiacs/rabbit.htm

Of course, when you consult with soothsayers it’s a good idea to read around a bit and get a second opinion. I saw that I Ching says, “In the year of the Rabbit without concentration you will fail”. So the secret to success presumably, is “laid-back-concentration”?

This “second opinion” on Chinese astrology is a continuation of a discussion of bubble-dynamics of a year ago and re-jigged in June:

http://www.marketoracle.co.uk/Article19868.html

The Big Idea; (a) it is possible to recognise bubbles, (b) its also possible to figure out how big they are (goes to guessing how far they will fall), (c) post-bubble dynamics are predicated by the bubble that happened.

1: Gold

I’ve been saying gold is a bubble building for over a year. That line of soothsaying was based in the first instance on the historical relationship between gold prices and oil prices (at $90 oil gold “ought” to be $850 by that benchmark). So either gold is a bubble, or oil is under-priced (at $1,400 it “ought to be $150), or what’s happening now is a “new paradigm”.

Personally I’m a bit suspicious of “new paradigms”; I seem to remember that’s what they said about housing. Particularly since the logic behind stratospheric gold is the Fed is printing a lot of money, but yet, in the grand scheme of things the Fed didn’t print a lot of money.

The $1.25 trillion for TALF was supposed to have been “secured” by “assets”, which they say will turn around. Let’s see, that’s an interesting concept, given that the problem with TARP and PPIP was that the genius bureaucrats couldn’t figure out how to value a toxic asset. Looking at it another way, that was just an exercise in “forbearance” which says the problem was not about “solvency” it was about “liquidity”, as in The King Has New Clothes (let’s see about that too).

Either way, $600 billion for QE-II, well that’s just chump-change in the current scheme of things; you can’t even have a decent sized war with that amount of money.

I got to a “second-second opinion” on gold looking at US trade deficits and how they are financed. Interesting that since 2000 or so the price of gold tracks the cumulative amount of toxic debt that USA sold to foreigners to finance its trade deficit.

That’s until about 2007 at which point the line which had up until then a 95% R-Squared, diverges, which is symptomatic of a bubble. Intriguingly that line of logic ALSO says the price of gold now “ought” to be around $1,100.

http://www.marketoracle.co.uk/Article25358.html

So perhaps oil is a “bit” undervalued (which is believable - below), and gold is a bit pricy for now (although no one agrees with me on that, and as I said, I have been wrong before); either way I suspect that in 2011 all may be revealed.

But I confess, I’m not so convinced about my logic to short; although there again I’m not long. As a matter of principle I try and stay clear of things I don’t understand.

2: Oil

The “bubble” model presented eighteen months ago which said in June that by December 2010 oil should be flirting with $90; appears to be holding up pretty well; although according to that model (re-jigged a month ago) the “correct” price of oil now is $85 not $90.

http://www.marketoracle.co.uk/Article24849.html

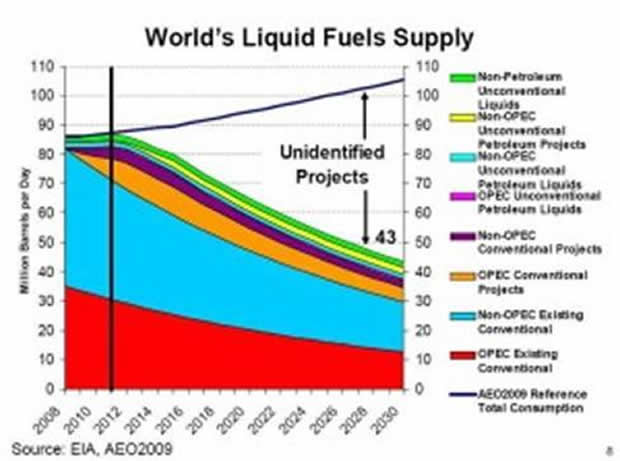

That’s of course assuming there isn’t a “new paradigm” in the wings… something to do with the idea that within 15 years “someone” is going to have to discover 40 million barrels a day of new capacity (currently the world uses about 70).

When that penny drops, if oil costs more to pull out of the ground than “hoped”, then quite soon it ought to start to be priced reference its replacement cost. Not on how much you can squeeze out of “Daisy” (you-me-and my SUV), without her dropping down dead.

Intriguingly, the Saudis who say they have the power to “control” oil prices (“if necessary”), are now saying that $100 is “fair”. Which is reassuring, except six months ago, they were saying $75 was “fair”.

It’s hard to see how you can miss investing in that one going to its logical conclusion, although I suspect an investment in diesel made from corn might be risky. At some point one of the geniuses in Washington might wake up to the fact that uses more energy than just refining the standard stuff you pump out the ground.

Off course all bet’s are off the table if “someone” starts lobbing bombs at Iran, in which case we will get to find out pretty quick if those sunburns work as advertised, then (a) 75% of the electricity and desalination capacity of UAE and Saudi Arabia will disappear (if they are seen to have been encouraging the bombings, which Wiki-Leaks suggests they are) (b) the world’s oil supply will drop 25% and oil prices will go to $225.

It’s hard to imagine that the US would be stupid enough to allow that, there again it was hard to imagine they would invade Afghanistan and then Iraq.

3: Toxic Assets

I was intrigued to see that in the third quarter sales (to foreigners) of “U.S. securities other than U.S. Treasury securities” rocketed from (minus) $123 billion in the third quarter of 2008 to $108 billion (positive) in the third quarter of 2010.

That’s what you and I call “Toxic Assets”. You can find those numbers on “Line 66” of “U.S. International Transactions Accounts Data” which is on the BEA website.

By the way, I understand that any connection to “Route 66” is purely coincidental, but I’m checking out the Feng Shui on that.

Not many people know this (or if they do, they don’t admit that they do), but America and the dollar were kept afloat from 2000 to mid-2008 in spite of racking up $3.0 trillion in cumulative trade deficits (in goods and services), because, and only because, of the wonders of securitization, which by-the-way is what those of us who laboured on the toxic asset production lines used to call it.

Over that period Goldman Sachs and the other God’s Workers sold $3.5 trillion worth of “toxic” to Norwegian Pension funds, RBS, and to other not-so-smart foreigners. That financed the shortfall in the trade deficit and thus kept the mighty dollar, well “mighty”.

Then, well all good things come to an end and the not-so-smart foreigners wised up a bit, and stopped buying. Which is one reason there was an “almost depression”, because no one could do the “Roll-Over” trick anymore. The situation was compounded because the less-nimble “Shadow-Banks” couldn’t offload their inventory fast enough. Goldman of course did manage to clear their most of their inventory in time, for example by creating synthetic-collateralized-debt-obligations, with names like ABACUS which proves they are truly God’s Chosen Workers.

What’s really interesting right now; is that the $108 billion of “toxic” sales to foreigners, in the third quarter of 2010, was of an order of magnitude as what Tim-Boy managed to sell directly and indirectly (to foreigners) in that period ($195 billion).

As was explained earlier, from 2000 to 2007, foreigners bought (net) $3.5 trillion of “Toxic”, but they only bought (net) $2.3 trillion of Treasuries. The difference of course is that if the US Government defaults on its Treasuries, that’s “serious” as in that would be a Sovereign Default, but the clients of God’s Workers default on the “toxics” all that happens is you go back in the accounts and call those “exports”, and you send the Norwegians a little note saying “Oops…SORRY…but any time you would like to collect you collateral (10,000 fixer-uppers in Detroit), just come on by”).

Prediction: In the Year of the Rabbit, “foreigners” (sometimes called “Aliens”), will buy $500 billion of toxic assets in America.

One of the reasons for that is because the Fed has stopped propping the price up to unrealistic levels through its TALF program. So now there are deals to be done, although buying that garbage is often a blind gamble, because the information you need to do a proper valuation, is simply not there.

There again, because of that, they are going cheap, real cheap. That’s what “bubbles” are about, first the gamblers pay too much (like Lehman did), then, as now, they get to pay too little, as the “mal-investments” get flushed away.

The good news is that the $500 billion ought to be enough to finance the US trade deficit in 2011.

4: US Trade Deficit

It’s hard to predict what the US Trade deficit will be, but assuming oil will average $100 and that the “hot-money’ recipients will run out of ideas on how to keep out American exporters, you can pretty much eyeball that:

Prediction: In the Year of the Rabbit the US Trade deficit will be $500 billion (round numbers).

5: The Dollar

Sorry folks, with an itsy little trade deficit of $500 billion, compensated for by a $500 billion fire-sale of toxic; it looks like the Austrians are just going to have to grin and bear one more year of the greatest fiat currency in the history of mankind.

Particularly since the only contender, the (once) brilliant new-look fiat currency the Euro, is discovering that it’s much better to sell “toxic” than to sell “sovereign” if you want to raise money to keep your economists, politicians, and bureaucrats in the lifestyle that they have become accustomed to.

6: US Treasuries

If ever nominal GDP in USA starts to take off, US Treasuries will too, I’ve got the 10-Year pegged for 3% in March (now it’s 3.4%), plenty of people think I’m wrong.

I say there was a bit of a bubble after the rumour got out that there would be QE-2 and the dealers played with Ben like a cat with a mouse by front-running the price, here’s a tip Ben, if you want to spend $600 billion on something, don’t tell everyone first.

http://www.marketoracle.co.uk/Article25128.html

7: S&P 500

Still in “post bubble” and thus about 20% under-valued, will be driven by nominal GDP in USA plus in the rest of the world (50% of S&P earnings are outside USA now), and the 30-Year yield.

Uninteresting (from a bubble perspective) the money in equities now is picking good companies, not playing the bubbles; so look for 10% to 15% growth in the index for a couple of years, it won’t go down below 1,100 and even if it does it won’t stay down long.

I’d say US-listed stocks right now are one of the safest medium to long-term investments around, plus there is the added advantage that the regulation, if “spotty” is pretty good. Which is more than can be said for places like India or China.

http://www.marketoracle.co.uk/Article25287.html

8: US Housing

15% more to go (down) on the S&P Case-Shiller unless inflation seriously kicks in, which is unlikely, good time to buy, as in “Shock them with your first offer”.

http://www.marketoracle.co.uk/Article25597.html

9: Hong Kong Housing

My prognosis in January 2010 was the Hong Kong property was not a bubble, and well it went up by about 20%, which is certainly not a “bust”, although with nominal GDP “only” growing at 9% that’s starting to look “bubbly”.

10: Dubai Property

The bottom of the “mispricing” was last year, but prices are still going down due to new inventory, commercial space, particularly offices, is dire, still it’s a good time to buy if you can find anything decent (hard) although prices of good stuff are up on last year.

The economy will improve thanks to higher oil prices, and whoever it was that borrowed that $100 billion, has cleverly made sure it’s not on Dubai Government’s balance sheet, so everything still works. Whose balance sheet it’s on is still a mystery, although the rumour is that the lenders took a haircut, and their treat for the Year of the Rabbit, will be to take a bath.

Otherwise just a peaceful year as predicted by the REAL experts:

THE YEAR OF THE RABBIT

A placid year; very much welcomed and needed after the ferocious year of the Tiger. We should go off to some quiet spot to lick our wounds and get some rest after all the battles of the previous year.

Good taste and refinement will shine on everything and people will acknowledge that persuasion is better than force, a congenial time in which diplomacy, international relations and politics will be given a front seat again. We will act with discretion and make reasonable concessions without too much difficulty.

Law and order will be lax; rules and regulations will not be rigidly enforced. No one seems very inclined to bother with these unpleasant realities. They are busy enjoying themselves, entertaining others or simply taking it easy. The scene is quiet and calm, even deteriorating to the point of somnolence. We will all have a tendency to put off disagreeable tasks as long as possible.

Money can be made without too much labour; our life style will be languid and leisurely as we allow ourselves the luxuries we have always craved for. A temperate year with unhurried pace, for once, it may seem possible for us to be carefree and happy without too many annoyances.

http://www.theholidayspot.com/chinese_new_year/more_zodiacs/rabbit.htm

I liked the part about “Money can be made without too much labour”, as in “just print it”.

I also liked the part about law and order, looks like the banks are going to able to get away with marking their assets to whatever they feel like, at least until the Year of The Dragon.

Enjoy!!

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe; currently writing a book about BubbleOmics. Andrew Butter is managing partner of ABMC, an investment advisory firm, based in Dubai ( hbutter@eim.ae ), that he setup in 1999, and is has been involved advising on large scale real estate investments, mainly in Dubai.

© 2011 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Rich

09 Oct 11, 13:35 |

S&P

S&P 500 bottomed at 1100 (just as you predicted) on October 3. Will that be the low for the year? I think not, but we'll watch and see. |