Stock Market SPX Closed Above Cycle Top Resistance

Stock-Markets / Stock Markets 2011 Feb 06, 2011 - 05:14 AM GMT The FDIC Failed Bank List announced three new bank closures this week. The Federal Deposit Insurance Corporation seized the American Trust Bank, based in Roswell, Ga., with $238.2 million in assets and $222.2 million in deposits; the North Georgia Bank of Watkinsville, Ga., with $153.2 million in assets and $139.7 million in deposits; and the Chicago-based Community First Bank, with $51.1 million in assets and $49.5 million in deposits.

The FDIC Failed Bank List announced three new bank closures this week. The Federal Deposit Insurance Corporation seized the American Trust Bank, based in Roswell, Ga., with $238.2 million in assets and $222.2 million in deposits; the North Georgia Bank of Watkinsville, Ga., with $153.2 million in assets and $139.7 million in deposits; and the Chicago-based Community First Bank, with $51.1 million in assets and $49.5 million in deposits.

Commodity Whack-A-Mole

(ZeroHedge) Ok, someone needs to step in here before people get hurt... Er, more. The chart below is not of some biotech strategically bought by various CT hedge funds having just announced a successful obesity Phase 3 trial. It is corn: one of the most widely consumed commodities in the world. And while corn appears to be today's limit up commodity, elsewhere cotton has just limited down as a continuation of the recent ICE plundering, courtesy of the exchange's margin hike; rice, after touching on highs, has decided to drop aggresively, as have cocoa (never mind the Ivory Coast government vacuum) and coffee. This is the kind of environment in which companies that do not have commodity price hedges can go bankrupt in a span of months.

Drop in Jobless Rate May Not Deter Fed From Carrying Out Stimulus Program

(Bloomberg) The surprising drop in the U.S. jobless rate to the lowest level in 21 months probably won’t deter Federal Reserve policy makers from carrying out their program to pump $600 billion into the economy, economists said.

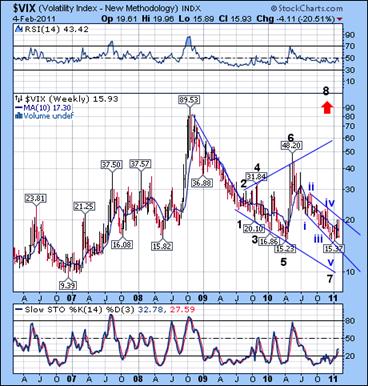

VIX retraced below its 10-week moving average.

--The VIX declined below its 10-week moving average in what appears to be a deep retracement. The pattern since the May Flash Crash has been the Broadening Wedge, which is a continuation pattern. Weekly Stochastics indicate that momentum may be building for a bullish breakout in the VIX.

--The VIX declined below its 10-week moving average in what appears to be a deep retracement. The pattern since the May Flash Crash has been the Broadening Wedge, which is a continuation pattern. Weekly Stochastics indicate that momentum may be building for a bullish breakout in the VIX.

(Dow Jones)--Just as there's no perfect hedge, Friday's market gyrations were a reminder that there's no perfect way to trade the stock market's "fear index" either. As scenes of unrest in Egypt and a Nasdaq glitch sent stocks lower, traders dove into complex new exchange-traded notes tied to the CBOE Volatility Index, or VIX, which jumped 24%. Volume in 16 such notes leapt to roughly $1.2 billion Friday, more than twice the 20-day average around $500 million, data collected by VelocityShares showed

SPX closed above Cycle Top Resistance.

SPX closed below weekly Cycle Top Resistance at 1328.61. It appears that the Master Cycle from July 1 has not rolled over as evidenced by the new high made this week. Last week’s rally formed point five of an Orthodox Broadening Top. This is the same pattern that formed just before the Flash Crash in May. The Cycle Bottom Support which called for a drop to 1025 last April is now calling for a drop below 1000 today.

SPX closed below weekly Cycle Top Resistance at 1328.61. It appears that the Master Cycle from July 1 has not rolled over as evidenced by the new high made this week. Last week’s rally formed point five of an Orthodox Broadening Top. This is the same pattern that formed just before the Flash Crash in May. The Cycle Bottom Support which called for a drop to 1025 last April is now calling for a drop below 1000 today.

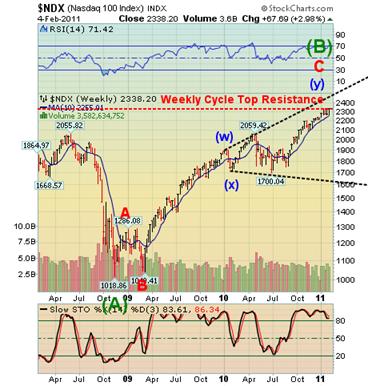

The NDX closed below Cycle Top Resistance.

--The NDX could not overcome its weekly Cycle Top Resistance at 2348.00. The NDX was able to better its prior weekly high by two points, but has not overcome its Orthodox Broadening Top. The NDX also sports an Orthodox Broadening Top that is clearer than the April top.

--The NDX could not overcome its weekly Cycle Top Resistance at 2348.00. The NDX was able to better its prior weekly high by two points, but has not overcome its Orthodox Broadening Top. The NDX also sports an Orthodox Broadening Top that is clearer than the April top.

The computer network of the Nasdaq Stock Market was targeted by the online hackers several times last year, setting off an alarm by the US authorities, a Wall Street Journal report said. The report, citing the people familiar with the matter, however, asserted that the exchange's trading platform was not "compromised". See ZeroHedge Report also.

Gold caught inside its Diagonal.

-- Gold is now caught inside its weekly Diagonal Formation. It rebounded from its Trading Cycle low which arrived on January 28th and may be finished with its retracement. An alternate arrangement may be a retest of its 10-week moving average at 1373.01. The next probable downside target is mid-Cycle support at 1023.00.

-- Gold is now caught inside its weekly Diagonal Formation. It rebounded from its Trading Cycle low which arrived on January 28th and may be finished with its retracement. An alternate arrangement may be a retest of its 10-week moving average at 1373.01. The next probable downside target is mid-Cycle support at 1023.00.

$WTIC ready to violate its 10-week moving average.

-- $WTIC still remains above its 10-week moving average at 89.75, but just barely. The Commodities Index ($CRB) achieved a Master Cycle low on January 26 and may seek a deeper low on or around February 7. This may set off a broad-based decline to the lower trendline of the Orthodox Broadening Formation. Crude oil fell after a government report showed that the U.S. added fewer jobs in January than economists forecast, bolstering concern that fuel demand will slip. Today’s jobless numbers showed many fewer people got jobs than expected and that many others have simply given up looking for work, which raises concerns about U.S. consumer demand. We already are looking at weak demand and very high stockpiles.

-- $WTIC still remains above its 10-week moving average at 89.75, but just barely. The Commodities Index ($CRB) achieved a Master Cycle low on January 26 and may seek a deeper low on or around February 7. This may set off a broad-based decline to the lower trendline of the Orthodox Broadening Formation. Crude oil fell after a government report showed that the U.S. added fewer jobs in January than economists forecast, bolstering concern that fuel demand will slip. Today’s jobless numbers showed many fewer people got jobs than expected and that many others have simply given up looking for work, which raises concerns about U.S. consumer demand. We already are looking at weak demand and very high stockpiles.

The Bank Index repelled by its Cycle Top Resistance.

--The $BKX has traded in a tight range for the past month beneath weekly Cycle Top Resistance at 56.09 and formed a probable right shoulder to a massive Head and Shoulders pattern. BKX impulse down from ts last peak at 54,87 and has since retraced 72.5% of its decline. It appears poised to resume its decline next week. Bank of America Corp. agreed to pay $410 million to settle a lawsuit over excessive fees charged for overdrafts by customers, according to a court filing. The lawsuit, or so-called multidistrict litigation unified in Miami federal court in 2009, has involved more than two dozen banks including Citigroup Inc., JPMorgan Chase & Co. and Wells Fargo & Co.

--The $BKX has traded in a tight range for the past month beneath weekly Cycle Top Resistance at 56.09 and formed a probable right shoulder to a massive Head and Shoulders pattern. BKX impulse down from ts last peak at 54,87 and has since retraced 72.5% of its decline. It appears poised to resume its decline next week. Bank of America Corp. agreed to pay $410 million to settle a lawsuit over excessive fees charged for overdrafts by customers, according to a court filing. The lawsuit, or so-called multidistrict litigation unified in Miami federal court in 2009, has involved more than two dozen banks including Citigroup Inc., JPMorgan Chase & Co. and Wells Fargo & Co.

The Shanghai Index trades at mid-Cycle Support.

--The Shanghai Index remains closed for its Chinese Lunar New Year. $SSEC appears poised to leap above its 10-week moving average, giving it a buy signal from a Master Cycle low.

--The Shanghai Index remains closed for its Chinese Lunar New Year. $SSEC appears poised to leap above its 10-week moving average, giving it a buy signal from a Master Cycle low.

The U.S. declined to brand China a currency manipulator while saying its No. 2 trading partner has made “insufficient” progress on allowing the yuan to rise.

China should follow through on President Hu Jintao’s commitments to allow more exchange-rate flexibility and boost domestic demand, the Treasury Department said in a report to Congress yesterday on foreign-exchange markets.

$USB may be building a base.

-- $USB appeared to hit its daily Cycle Bottom Support at 117.98 on Friday. It is still within its descending Broadening Wedge, which is a continuation formation. $USB has been extending its current Master Cycle that first made its low in mid-December, but had not hit its Cycle Bottom Support. We will know within a few days whether the bottom is finally in.

-- $USB appeared to hit its daily Cycle Bottom Support at 117.98 on Friday. It is still within its descending Broadening Wedge, which is a continuation formation. $USB has been extending its current Master Cycle that first made its low in mid-December, but had not hit its Cycle Bottom Support. We will know within a few days whether the bottom is finally in.

Several analysts are calling for a failure in the long bond. However, the neckline of a proposed Head & Shoulder pattern (grey) still lies near 115.00. The trendline of the long bond rally since 1994 lies near 112.50.

$USD declines to 78.5% retracement, currency tensions mounting.

-- $USD bounced from a Primary Cycle low this week. While the $USD has been made a 78.5% retracement of its rally from November 5, the Euro retracement had extended to a little more than the 61.8% level of its decline.

-- $USD bounced from a Primary Cycle low this week. While the $USD has been made a 78.5% retracement of its rally from November 5, the Euro retracement had extended to a little more than the 61.8% level of its decline.

Based on the resumption of exchange rate flexibility last June and the acceleration of the pace of real bilateral appreciation over the past few months, and in view of the commitment during President Hu’s visit that China will intensify its efforts to expand domestic demand and further enhance exchange rate flexibility, Treasury has concluded that the standards identified in Section 3004 of the Act during the period covered in this Report have not been met with respect to China. Treasury’s view, however, is that progress thus far is insufficient and that more rapid progress is needed. Treasury will continue to closely monitor the pace of appreciation of the RMB by China.

Regards, Tony

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.