Inter-market Analysis- All starts with the Fed rate cut - Technical Speculator Nov 2007

Commodities / CRB Index Nov 01, 2007 - 12:56 PM GMTBy: Donald_W_Dony

KEY POINTS:

KEY POINTS:

• Rate cut spells more weakness for U.S.

dollar, but upward pressure for major

currencies continues

• Gold first to increase, followed by CRB Index

• Utilities and U.S. bonds respond favourably

to rate reduction

• Long-term effect of dollar decline is building

inflation

• Intermarket actions still favour tangible

overweighting in portfolios

I think that the intermarket relationships among the four

markets (i.e., currencies, commodities, bonds and stocks) is

one of the most fascinating areas of analysis.

How one seemingly small event can trigger a multitude of

movements in other financial areas is of most interest to

me.

Case in point is the recent U.S. Federal Reserve rate cut.

Dollar down, commodities up

When the Fed chopped interest rates by half a point in

mid-September, the resulting ripple effect spread out

across the connected markets like throwing a stone into a

pond.

The first move came from the U.S. dollar itself. With the lower interest rate now being offered for an already-frail currency, the U.S. greenback slammed down through the last main support line of $0.80. This key level has always held the dollar up during periods of great weakness over the past 25 years – until now.

With the fall from grace below $0.80, other major world currencies jumped upward. The Canadian currency reached par with the U.S. dollar for the first time in 26 years. The Australian currency advanced to a record level of $0.9078, and the Euro shot above $1.40 for the first time against the U.S. currency.

Gold finally broke free of a multi-month consolidation, to leap above $700 again. Present levels are about $765, with a target price of $790 by December.

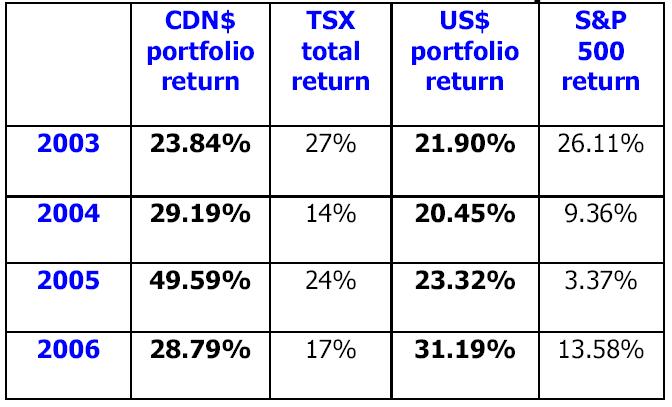

TS Model Growth Portfolios update

The Commodity Research Bureau (CRB) Index had been pinned under the 320 resistance line for the last 12

months. With the drop in rates, this index leaped through

that long-term barrier.

The reason commodities have been advancing since 2003

is largely because of the sinking U.S. dollar. One of the

rules in intermarket analysis is that a declining U.S.

currency is inflationary and fuels higher natural resource

prices.

I have posted a list of the 16 main intermarket rules on my website (www.technicalspeculator.com). Click on the tab on the right-hand side of the home page.

The domino effect of the Fed rate cut does not stop here.

Many interest-sensitive sectors reacted favourably to the

reduction. As utilities are the most affected by rate

movements, they were the first group to jump forward.

The Dow Jones Utilities Average (DJUA), which had stalled

in its upward path over the summer, once again began to

trend higher. By early October, the DJUA was back to its

all-time high of 520.

Since utilities are normally a leading indicator to the general stock market, this renewed strength sent out a very positive signal.

Bonds also responded positively. After more than three years of sliding prices, 10-year U.S. treasury bonds finally broke through the upward resistance level of $108.50 and set a new course toward $114.

This is the first page of the August issue. Go to www.technicalspeculator.com and click on member login to download the full 14 page newsletter.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.