ECB President Trichet’s Remarks Beg Questions on Eurozone Interest Rates

Interest-Rates / ECB Interest Rates Mar 04, 2011 - 02:02 AM GMTBy: Asha_Bangalore

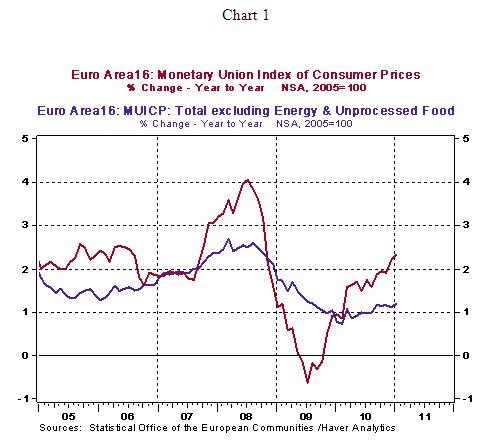

President Trichet of European Central Bank (ECB) noted at this morning's press conference that "strong vigilance is warranted with a view to containing upside risks to price stability." This statement implies that the ECB is considering tightening monetary policy in the very near term. President Trichet's hawkish stance is based on the region's inflation rate of 2.3% in January and inflation excluding food and energy was 1.2%. The all-items inflation reading exceeds the ECB's target of 2.0% and reflects a jump in energy prices. So, at the top of Trichet's to-do list is to prepare markets for a higher policy rate from the current level of 1.0%.

President Trichet of European Central Bank (ECB) noted at this morning's press conference that "strong vigilance is warranted with a view to containing upside risks to price stability." This statement implies that the ECB is considering tightening monetary policy in the very near term. President Trichet's hawkish stance is based on the region's inflation rate of 2.3% in January and inflation excluding food and energy was 1.2%. The all-items inflation reading exceeds the ECB's target of 2.0% and reflects a jump in energy prices. So, at the top of Trichet's to-do list is to prepare markets for a higher policy rate from the current level of 1.0%.

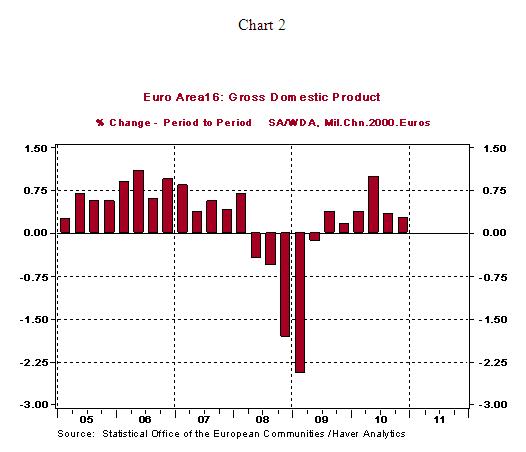

The Euro-area's growth rate of real GDP is positive (+0.3% in 2010:Q4, see Chart 2) and technically the recession has ended in the middle of 2009.

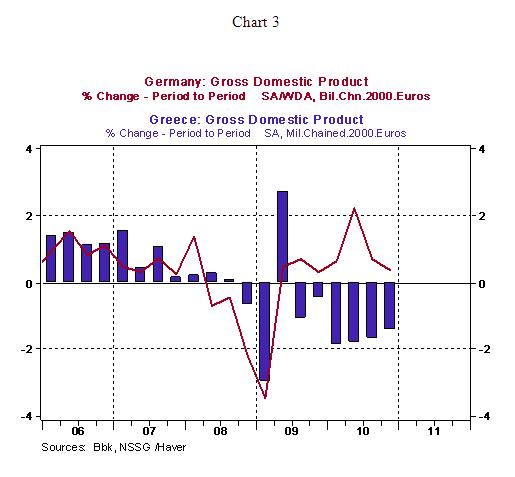

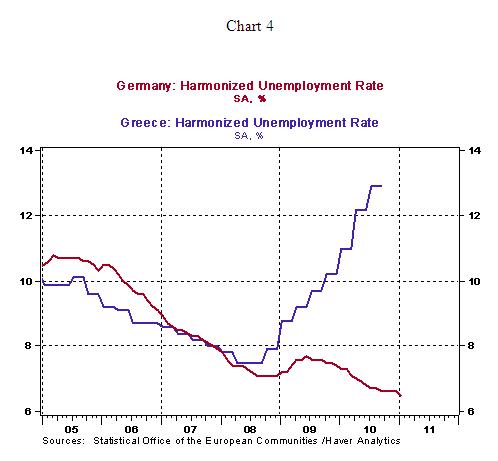

But, the economic situation of Germany (economic star) and that of Greece (the economic laggard, the ECB is the central bank both economies), do not call for the same remedy. Real GDP of Germany has posted gains in each of the last six quarters whereas the economic doldrums of Greece are severe with six quarter of steep declines in GDP and a staggering increase in the jobless rate (see Charts 3 and 4). Although the Greek and German economies are vastly dissimilar, the point here is that the periphery of the Euro-area (Greece, Portugal, Ireland, Spain) is experiencing a significantly different situation and an incorrect medicine will be applied across the board, if the ECB raises the policy rate in the months ahead.

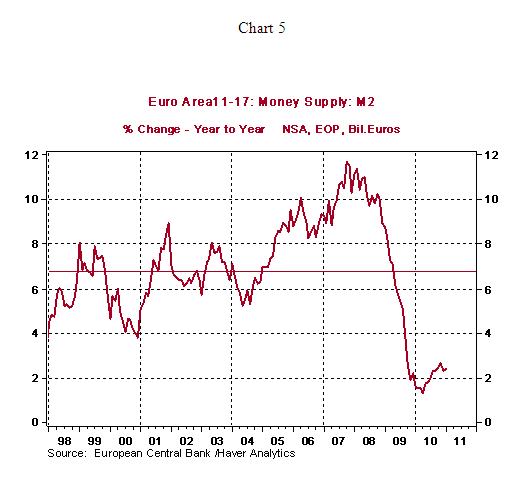

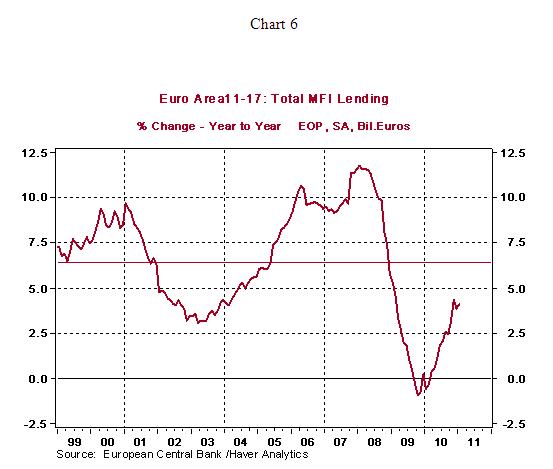

It appears that a tighter monetary policy, combined with the austerity already in place in the periphery, is a brutal policy combination to bring about economic stability in the region. Money supply is also growing at a tepid pace (see Chart 5) in the region, which weakens the case for Trichet's stance. M2 in the Euro area increased 2.4% from a year ago in January, which is noticeably below the average growth of M2 of 6.8% since the ECB's existence (see Chart 5). In addition, lending in the Euro-area is growing around 4.0% (see Chart 6) which is also below the historical average.

The slack in the economy, the slow pace of growth in money supply and credit, and a fragile banking system are not factors pointing to imminent inflation, particularly the second round effects of higher oil prices that should be prevented as Trichet noted this morning.

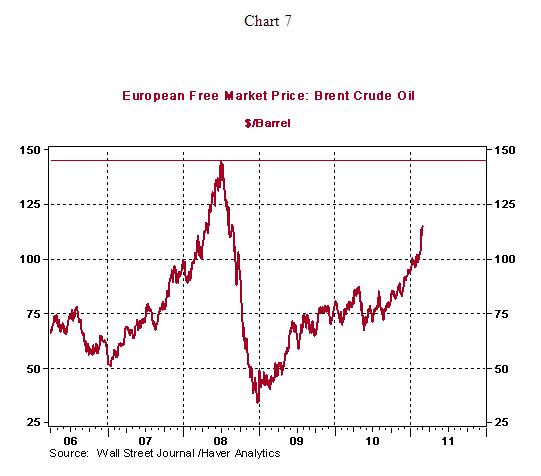

The ECB encountered an episode of rising oil prices recently in 2008. It raised the policy rate on July 3, 2008 (4.25%, +25 bps) and held it there for a brief period before reversing action on October 8, 2008 (3.75%, -50bps) and finally cutting the rate to 1.00% by May 2009. Oil prices were trading around $145 a barrel in July 2008 (see Chart 7) and they declined to about $77 by the end of the year. The latest rally in oil prices is largely due to the turmoil in the Middle East and North Africa; the Libyan crisis is the most recent cause. Oil prices fell, as of this writing, as proposals are being floated to end fighting in Libya. If the ECB lifts the policy rate, as Trichet implied, it could be another tentative policy tightening, given the economic status of the Euro-area.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.