Tsunami May Sink the U.S. Dollar and Uranium Sector

Stock-Markets / Financial Markets 2011 Mar 15, 2011 - 02:30 PM GMTBy: Jeff_Berwick

What a few days it has been. It was and continues to be a humanitarian disaster of grand proportions - and one that happened on an island where there is more high end video and cellphone cameras than almost anywhere in the world - bringing us photos and videos that are both shocking and incredible.

What a few days it has been. It was and continues to be a humanitarian disaster of grand proportions - and one that happened on an island where there is more high end video and cellphone cameras than almost anywhere in the world - bringing us photos and videos that are both shocking and incredible.

The Bank of Japan has plunged in as all central banks are wont to do in this day and age, thinking it is somehow "helping" by counterfeiting trillions of Yen, but no amount of money printing can change reality - in fact it can only make things worse at it distorts price signals which investors use to make decisions on where to allocate scarce resources.

We, like most, are dependent on the Japanese Government and major news media for our information on events on the ground in terms of the ongoing nuclear situation in Japan. Things look bad at the moment but may not necessarily be as bad as they seem. This write-up seems to indicate that things are still under control but at this point it is difficult to gauge.

The Uranium Sector

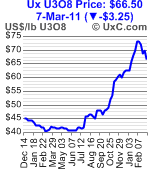

The Dollar Vigilante has had 5% of our portfolio in the uranium sector but the events of the last few days leave our investment thesis for this small part of our portfolio at risk.

Our one main holding, a Uranium Fund, was until recently up 110% since our purchase in September, but with a dip in the price of uranium over the last few weeks and now this ongoing crisis in Japan, it is only up 56% after falling 16% Monday.

The question now is, how do we invest or divest in this sector?

The answer to that remains nebulous and changes on an hour-by-hour basis at the moment.

To put it in its briefest terms possible, from an investment perspective, if there are no major deaths or sickness resulting from this nuclear situation then this should be a major buying opportunity in the uranium sector. However, if things continue to worsen and result in significant deaths or sickness we could be looking at a collapse of a significant percent of the uranium industry. Already environmentalist groups in the UK, US and Germany are lobbying hard to ban all new nuclear reactors.

It really shouldn't be this way. No matter what happens the general public should realize that it was foolish of the Japanese Government to license and subsidize nuclear power stations on one of the most active faultlines on the planet - within striking distance of a tsunami no less. It also will likely go without notice that most of these plants are four decades old and were already set to be decommissioned.

But no one said that anything to do with the nuclear industry has ever been rational. Three mile island caused a total of zero deaths and yet it almost destroyed the entire nuclear industry. Even Chernobyl, which was the only really serious nuclear accident in history, caused only 57 immediately attributable deaths - although many more deaths are attributable after the fact mostly due to countless errors by the Ukrainian SSR at the time.

The point is, however, that Three Mile Island, alone, with zero attributable deaths, nearly shuttered the entire industry. And so, with disaster on a razor's edge in Japan at the moment, a large percent of the industry, at least for the next decade or two, lies in the balance.

As investors, our educated guess just turned into a roll of the dice. Luckily, for us, our investment in this sector was only 5% of our portfolio so even a total loss - something we don't expect - would not be devastating.

Each investor has to make their own decision. We have not sold our uranium holdings and have been adding to one holding in particular today which we just released to TDV subscribers. It is a company with "uranium" in its name which has seen its stock knocked down from $1.23 to $0.91 just because of its name. However, the company itself actually holds cash and stock in a lithium company worth $1.20 per share and recently picked up a high grade silver property in Argentina - all of which you can currently buy at a 25% discount solely due to investor panic.

Repercussions for US Treasuries and the Dollar

All major markets including gold are down significantly today as investors become skittish.

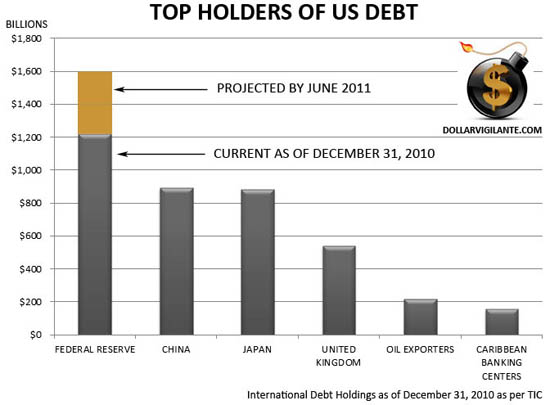

The most important aspect of this entire situation, however, is that the Japanese Government will need to sell a large quantity of its horde of US Treasuries to pay for reconstruction.

With China not adding to its holdings of US Treasuries, the Arab oil exporters looking more volatile every day and now Japan looking as though it may be an active seller that doesn't leave many buyers left for US Treasuries except its biggest holder and sole-buyer of nearly all new issuances from November until at least June - the Federal Reserve.

We'll be covering this in much more depth in the April issue of TDV but with the Bank of Japan printing trillions of Yen and the US Treasury market becoming even more of a one-buyer market (the Federal Reserve itself), the investment positions we hold in gold and gold stocks look to be set for further major gains once the short term panic subsides.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.