A Look at Gold’s Long-term Outlook

Commodities / Gold and Silver 2011 Apr 05, 2011 - 04:09 PM GMTBy: Clif_Droke

Let’s step back for a moment and take a look at the big picture. Although the primary focus of traders should be on the short-term technical outlook for gold, silver and mining stocks, it’s good to have a good idea of where the precious metals are likely headed in the 3-4 year out look.

Let’s step back for a moment and take a look at the big picture. Although the primary focus of traders should be on the short-term technical outlook for gold, silver and mining stocks, it’s good to have a good idea of where the precious metals are likely headed in the 3-4 year out look.

Our primary analytical tools for discerning the longer-term trends that are likely to emerge are the yearly Kress Cycles. Fundamentals can be useful but the long-term cycles are even more important since they ultimately determine the overall direction that asset prices will take.

In the context of these long-term cycles we are in early stages of what might be called the “runaway deflationary” leg of the 120-year mega cycle. This cycle, which is scheduled to bottom in 2014, has been responsible for the long-term undercurrent of deflation within the economy for at least the last 10 years or longer. Deflation may not be visible to the naked eye if all you look at is retail prices (indeed, inflation seems to be the norm here). But since deflation is at its essence a contraction of debt, we can see that the deflationary cycle has been underway for quite some time. It has been responsible for the contraction in consumer credit in recent years, the decline in housing prices and the decrease in the demand for debt among consumers.

Deflation also causes the demand for gold to increase over time. Although most economists teach the exact opposite, namely that gold is mainly a hedge against inflation, gold comes into its own during hyper deflation. Since runaway deflation tends to erode paper asset values and decrease the demand for debt, consumers and investors are naturally drawn to gold as a way of preserving their savings since gold is less vulnerable to the vagaries of weak economies. Gold has proven itself as a long-term store of value and is universally regarded as a safe haven during periods of economic or social turbulence.

Gold has some things other going for it that other asset categories don’t. For instance, the demand for equities since March 2009 is being driven primarily by the Fed’s quantitative easing (QE2) program. In other words, it’s a liquidity driven bull market for stocks and as long as the Fed is priming the pump investors basically have little to fear. When QE2 ends, however, there is some question as to whether the demand for stocks will continue.

Demand for equities among retail investors has diminished considerably in the years since the credit crisis. Risk appetites among non-professionals have fallen dramatically and most large scale equity market participation done on the institutional side. That’s another strike against equities, longer-term, and one that gold doesn’t have to contend with.

Another problem that financial assets must contend with is what might be called the “domino effect.” Since most financial assets these days are debt-based to some degree or another, they are highly vulnerable to downturns in the financial market. This is a common theme in every financial or economic crisis.

For example, in their book “13 Bankers, the Wall Street Takeover and the Next Financial Meltdown,” authors Simon Johnson and James Kwak made the following pertinent observation: “The bankruptcy of Lehman Brothers in September 2008 accelerated the collapse of American International Group, forcing it into the arms of the Federal Reserve; Lehman’s failure also forced the Reserve Primary Fund to ‘break the buck,’ causing a sudden loss of confidence in all money market funds; in turn the flood of money out of money market funds caused the commercial paper market to freeze, endangering the ability of many corporations to operate on a day-to-day basis.”

Not only was the domino effect in full force during the 2008 crisis, but as Johnson and Kwak pointed out a loss of confidence was perhaps the single biggest factor influencing asset prices during the crisis. When the panic subsided, however, notice which major asset was the first to bottom and the first to experience a major turnaround. Indeed, investors’ loss of confidence in paper assets translated into an increase in confidence for the yellow metal, a confidence in gold’s ability to hold value that hasn’t yet subsided.

When financial catastrophes such the one in 2008 occur, it invariably causes a loss of confidence in most types of paper assets, especially assets that are heavily laden with debt. And while gold isn’t always immune to panic during a major financial crisis (as with the 2008 crash), it always is the first to recover once investors return to their senses. Indeed, the gold price has dramatically outperformed the stock market since the bear market low in 2009 as you can see in the following chart.

Investors’ confidence in the stability of the financial system has been restored in some measure since 2008. The seeds of the next crisis are being sown, however. To take one recent example, the Wall Street Journal has reported that the Wall Street pros are now betting on debt that doesn’t exist. It seems that banks and hedge funds are trading credit-default swaps – the same instruments that caused the last crisis -- tied to General Motors Co. debt. As Johnson and Kwak observed, financial innovation, especially as it pertains to debt, tends to lead to crisis at some point.

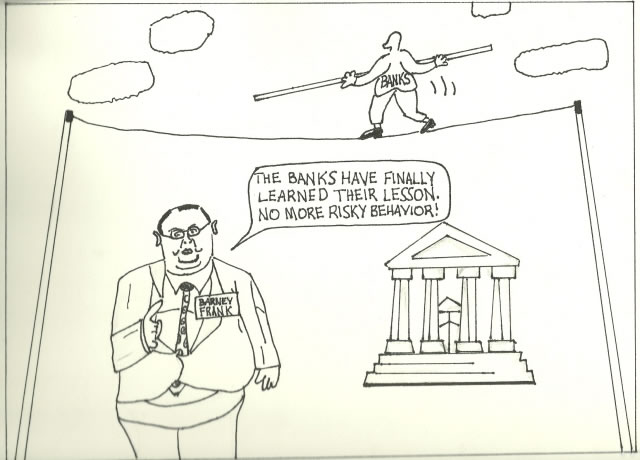

While banks remain busy concocting complex, potentially toxic financial products, federal regulators remain busy doing little of nothing to stave off the next catastrophe. In an interview with Charlie Rose of Businessweek, Congressman Barney Frank claimed that Congress has nullified through its legislative efforts the notion that banks are “too big to fail” and that taxpayers won’t have to bail them out at the next crisis. Somehow this doesn’t seem reassuring given the recent activities of the big banks.

Looking past the sensational upside price targets for gold that many analysts are offering, my offering for gold’s long-term outlook based on a simple reading of gold’s historical tendencies during periods of extreme deflation. Within the context of the long-term cycles – gold’s upward trend should remain firmly intact between now and the cycle’s bottom in late 2014.

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn’t matter when so many pundits dispense conflicting advice in the financial media. This amounts to “analysis into paralysis” and results in the typical investor being unable to “pull the trigger” on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my latest book, “Gold & Gold Stock Trading Simplified,” I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It’s the same system that I use each day in the Gold & Silver Stock Report – the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years. You won’t find a more straight forward and easy-to-follow system that actually works than the one explained in “Gold & Gold Stock Trading Simplified.”

The technical trading system revealed in “Gold & Gold Stock Trading Simplified” by itself is worth its weight in gold. Additionally, the book reveals several useful indicators that will increase your chances of scoring big profits in the mining stock sector. You’ll learn when to use reliable leading indicators for predicting when the mining stocks are about o break out. After all, nothing beats being on the right side of a market move before the move gets underway.

The methods revealed in “Gold & Gold Stock Trading Simplified” are the product of several year’s worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today’s fast moving and volatile market environment. You won’t find a more timely and useful book than this for capturing profits in today’s gold and gold stock market.

The book is now available for sale at: http://www.clifdroke.com/books/trading_simplified.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.