U.S. Strategic Petroleum Reserve: What’s the Trigger for Release?

Commodities / Crude Oil Apr 11, 2011 - 10:07 AM GMTBy: Dian_L_Chu

In early March, White House Chief of Staff Bill Daley told NBC that the Administration was considering releasing oil from the Strategic Petroleum Reserve (SPR) if it deems the high oil prices would threaten the U.S. economic recovery.

In early March, White House Chief of Staff Bill Daley told NBC that the Administration was considering releasing oil from the Strategic Petroleum Reserve (SPR) if it deems the high oil prices would threaten the U.S. economic recovery.

President Obama, in a press conference on March 11, also reiterated that a plan to tap the SPR was "teed up" and said he would move quickly should ‘conditions’ worsen. However, the President refused to say what price could trigger a release.

SPR - How Many Barrels & Where

Based on information from the Dept. of Energy (DOE) web site, the SPR, established after the 1973-74 oil embargo, is stored in salt caverns along the Texas and Louisiana coastline (see DOE map), and is the largest stockpile of government-owned emergency crude oil in the world.

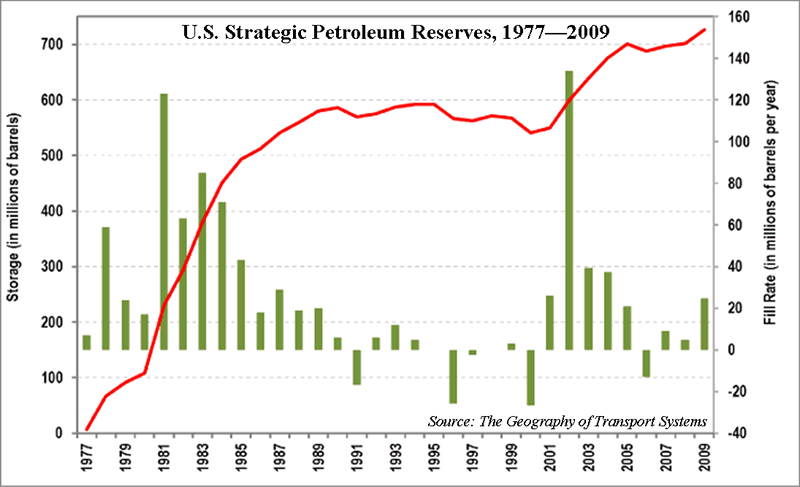

The SPR completed its fill program on December 27, 2009. Today's inventory of 726.5 million barrels, with a 60/40 split between sour and sweet crude, is the highest ever held in the SPR (see chart).

Decision to Market in 13 Days

The current stockpiles could supply up to 75 days of net petroleum imports, based on EIA data of 9.70 million barrels per day for 2009. Average price paid for oil in the Reserve is $29.76 per barrel for a total cost of around $21.6 billion. The total value of the crude in the SPR is approximately $81.4 billion, using $112 per barrel as the market pricing point. The maximum drawdown capability is about 4.4 million barrels per day, and would take 13 days from Presidential decision to enter the U.S. market.

Two Major SPR Sales in U.S. History

However, major sales from the SPR have occurred only twice since the inception of SPR in 1975--post Hurricane Katrina under then-President George W. Bush, and former President George H. W. Bush sold it after Iraq's 1990 to 1991 invasion of Kuwait.

WTI at 30-month High, $4 Gas Imminent

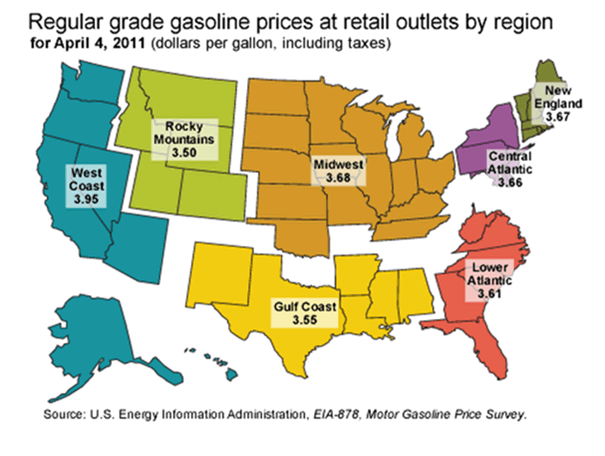

WTI (West Texas Intermediate) oil was trading around just below $107 a barrel when President Obama had that press conference on March 11. But price has since spiked to $112.79, while Brent Crude broke above $125 settling at 126.65 per barrel on April 8, up 6.70% on the week. Meanwhile, DOE data showed the national average price of retail unleaded gasoline reached $3.684 per gallon on April 1, up 30% from a year ago (see DOE price map).

WTI, Brent or Gas?

So, here is an intriguing question --What is the price point that’s been “teed up” as indicated by President Obama? Since the discussion seemed to have been centered on oil prices, it is logical to think the trigger point should have an oil price reference, either WTI or Brent, among other considerations.

On the other hand, U.S. consumers (and voters) seem to have a price tolerance threshold of $4 a gallon at the pump, so perhaps the retail gasoline price would be that trigger point for an SPR release?

Is Speculation-Driven Price Spike An Emergency?

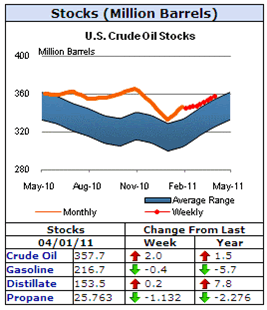

SPR is an emergency supply of crude oil intended to be the nation's first line of defense against an interruption in petroleum supplies. Nonetheless, the recent spikes of crude oil prices have very little to do with real physical supply shortages as the U.S. crude oil and petroleum products are well stocked (see DOE chart). Saudi Arabia also has pledged and pumped more oil, and created new light sweet blends to make up for Libya's lost barrels, but that has had little effect on oil prices.

Now, amid skyrocketing oil prices since the civil war erupted in Libya, and the gasoline prices moving closer to $4 a gallon at the pump, Democrats want President Obama to tap the SPR, but GOP leaders have so far rejected the proposal.

Although many have concluded that trading activities have very little effect on the prices of oil, this current crude market is a textbook case of excessive speculation overruns the supply demand fundamentals, where the conflict in MENA (Middle East and North Africa) has only added jet fuel to the speculation fire.

So that begs the another line of questions--Should the QE2-fueled speculation-driven price spikes in oil and gasoline be considered as a national energy emergency? Should the SPR be used to as a market price intervention tool?

Thin Line – Pricing in Risk & Speculation

Some have suggested that the high oil prices are just market pricing in risk premium of possible future supply disruption due to the political volatility in Libya, and MENA region. However, there’s a thin line between pricing in proper risk premium vs. pure speculation.

In the current crude market, massive speculation, juiced-up by the excess liquidity from Fed’s QE2, taking advantage of the oil geopolitics, is the prime suspect behind these irrational price levels, which are largely, if not entirely, detached from the physical and fundamental market.

Mere Intimation Will Do

From the current vantage point, it looks like the bull-charged oil market could ram through whatever price point the White House has in mind, and the possibility that the SPR could play a role as the market price moderator certainly adds an entirely different dimension to the crude oil prices.

Although it is still under debate whether the nation even needs to keep an SPR, one thing for sure is that oil would drop $5 in one day, and probably up to $20 in a month, with the mere intimation from the Administration that the SPR is scheduled to flood the market…without even an actual physical crude drawdown.

Breaking The Trend Trading

This will most likely break the momentum of trend trading, reversing the funds flow, putting downward pressure on prices, thus recreating a two-sided market, instead of the current one-sided long. Commodity markets tend to be more technically-driven than equities, and crude is deep in a bull trend trading mode. Unless something happens, such as the government stepping in with an SPR release announcement, or peace on earth, for example, to crash the speculative upward momentum, very little would faze oil.

WTI Could Be Misleading

Since we have not seen any Executive action with Brent breaking above $125, it seems to suggest President Obama is looking at WTI as the gauge for SPR release. WTI has been trading at a discount to ICE Brent primarily due to the inventory glut at Cushing, Oklahoma, the delivery point of NYMEX, pressuring the WTI price, while U.S. gasoline RBOB futures are moving in tandem with Brent, far outpacing WTI. So using WTI as a reference point for SPR related dedisions is a bit misleading and could result in a case of "too little too late" in regards to the runaway oil and gasoline prices.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://www.econmatters.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.