Changes in Monetary Policy Could Hit Gold Price

Commodities / Gold and Silver 2011 Apr 12, 2011 - 04:53 AM GMTBy: The_Gold_Report

How has the increase in government in the last 150 years driven precious metal prices? In this exclusive interview with The Gold Report, Leonard Melman, editor of The Melman Report newsletter and the author of Reverse the Way In, discusses why he recommends precious metal stocks, but advocates changes in monetary policy that could diminish the price of gold.

How has the increase in government in the last 150 years driven precious metal prices? In this exclusive interview with The Gold Report, Leonard Melman, editor of The Melman Report newsletter and the author of Reverse the Way In, discusses why he recommends precious metal stocks, but advocates changes in monetary policy that could diminish the price of gold.

The Gold Report: Your report is a hot commodity in the mining space. You also recently published a book, Reversing the Way In. Can you tell me about it?

Leonard Melman: It amounts to this: I believe the world has too much government. I don't think too many people would argue about that, except the dedicated leftists. Two phases have occurred in the last 300 years to create our present situation. The first, from 1700 to 1850, was immensely positive because the principles of real liberty became established. Authors like John Stuart Mill wrote about the tremendous benefits of economic liberty combined with individual liberty. Freedom became dominant and life improved dramatically.

But then people like Charles Marx came in and provided the social justification for increased government intervention. Politicians began to try to create happiness through laws and regulations aimed at improving peoples' lives. Woodrow Wilson almost singlehandedly transformed the U.S. government from free enterprise into government controlled. John Maynard Keynes gave the economic justification for larger government. Franklin Roosevelt took Keynes' philosophies and translated them into political action to enlarge government.

For the last 150 years, we have been enlarging government. I believe the solution to the problem is to reverse that way in, to start diminishing government and reduce its stranglehold over commerce.

TGR: You obviously see this as a major problem. Is that what prompted you to write the book?

LM: The biggest passion in my life is individual liberty. I don't think a person is free when his whole life can be dominated by government. We are subject to government laws in so many directions. All of these laws require money to enforce and operate. The government has to extract more taxes. It's creating tremendous economic difficulties because government has no way to tax people sufficiently to support itself. That's why debt levels around the world, for governments in country after country, are exploding. It's an unhealthy environment. I think we need a restoration of freedom. That was the purpose of writing the book.

TGR: One theme you discuss is that our freedom will continue to erode if U.S. monetary policy continues down its current path. But that path is ultimately good for gold and other precious metals. How do you on one hand recommend gold and precious metal stocks in your newsletter, and on the other hand advocate change in monetary policy that, if successful, would diminish the price of gold?

LM: It's an unfortunate reality. A precious metal investor who expects the price of gold and silver to go up should also be expecting an increase in social and economic problems.

The investment side of me says, "Yes, gold and silver prices will go up because the trends moving in that direction are so powerful." The libertarian, freedom-loving side of me says, "I would rather have a world of freedom if it's possible to achieve it." There is a direct contradiction in those two statements and I'm aware of that.

Just think back to the Ronald Reagan era. In 1980, the world was headed into ultimate calamity. Gold shot up from $106/oz. in 1976 to more than $800/oz. in 1980. Reagan came along and tried to crunch down, limit the growth of government, reduce inflation and reduce monetary growth. He was relatively successful, and a period of stability was obtained. Of course, gold and silver did horribly during that time, even though the country was generally becoming a better place to live.

There is a contradiction between the two. But I am advocating gold and silver because the forces behind monetary expansion are so strong that they're going to continue. The forces for expansion of government still remain powerful because of its ability to create money. The public believes that we can keep adding social programs to the list and the government will find a way to finance them as long as it can print more money. As long as that mentality remains in effect, gold and silver are going to achieve great heights.

TGR: Last spring, Greece needed a bailout from other eurozone countries. It created panic that sent global markets into volatility. Now, Ireland requires an extra $34 billion in bailout cash from the European Union. Portugal seems headed for a bailout, too. But this time, there's little panic. What's your view on what's happening there?

LM: The European monetary crisis is in its early stages. Portugal is headed toward a calamity. Italy is also very weak. Spain is showing real signs of deterioration. In fact, its bonds were downgraded by both Standard & Poor's and Moody's. There is no question there is a growing crisis.

There have been many panic calls from the media and mining investment gurus saying, "This crisis is the end, head for the hills!" None of those calamities have ensued. It's going to take one of these calamities to actually evolve into a catastrophe before people will really pay attention.

Underlying it all is this residual faith that the government can still handle calamities as they come along by some legislative manipulation or by monetary creation. Until that underlying faith is broken, I don't think we'll see the worldwide panic some are predicting.

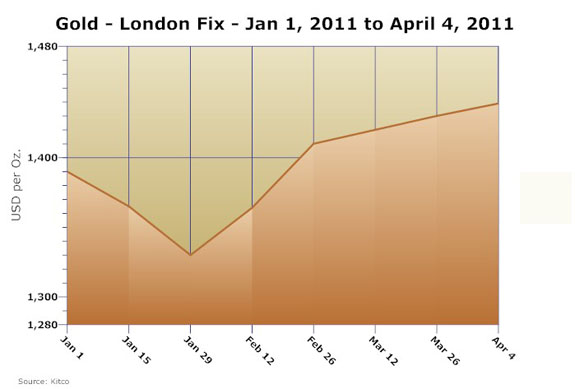

TGR: The June COMEX gold chart says there's support for gold at $1,411/oz., but there's technical resistance above $1,450/oz. Do you put much faith in the technical charts?

LM: Absolutely. Charts tell what people are doing. I'm always much more interested in what they're doing than what they're saying. If there is a rush to buy something, it's going to show up on the charts. Charts create a clear determination of what real action is taking place. Of course, I choose my investments through thorough fundamental analysis, but charts are a tremendous aid in my investment strategies.

TGR: Do you agree with COMEX's forecast?

LM: In my annual forecast, I actually call for gold to be relatively static during the first half of the year, but to move toward $1,850/oz. by the second half of the year. I think faith in government is starting to deteriorate. It's evident in the tremendous gulf between unionists and anti-unionists, the failure of QE1 and QE2 to produce prosperity, the tremendous tower of debt that's growing around the world. However, it hasn't yet reached the tipping point. In the second half, there is going to be a breakout and it's going to be a powerful one. Gold could move toward $1,800 to $2,000/oz. by the end of the year.

TGR: What's your range for silver over the same period?

LM: The range is between $35.50 and $38/oz. Silver may trade with a little more volatility on a percentage basis than gold. In the second half, silver could move towards $45 to $50/oz..

TGR: Faith in government may be deteriorating, but there were 216,000 new jobs in the U.S. in March—the sixth straight month of increases. It seems like the recovery continues to gain momentum.

LM: I don't know how much I trust government figures. They keep changing the parameters and adding special factors, so the figures get a little mushy. Since 2008, the U.S. government has undergone stimulative programs far beyond the scope of anything that has ever occurred. Frankly, if this is the only result from literally trillions of dollars of stimulus, then it's not much of an achievement.

The government has not yet proven the effectiveness of its programs. I will certainly acknowledge that the results that have come in the last six months are better than what went before. But the world is still vulnerable to a sudden downturn in the economic picture. I think that's going to happen. And that's what is going to break the faith.

TGR: In a recent edition of The Melman Report, you recommended investors take flight to the safety of precious metals if such an economic downturn occurs. What percentage of an investment portfolio do you recommend ought to be in precious metals?

LM: It depends entirely on a person's objective. If an investor is interested in preserving wealth in case of a catastrophe, they want physical gold, and silver and copper coins hidden in a secret place that only their family knows. They might want to leave gold coins on deposit in a bank or another secure facility. They might simply want to buy and sell gold futures and get a dollar-for-dollar play through non-leveraged investments. It just depends on how much risk an investor is willing to accept, and there's always the reality that the greater the profit, the greater potential for risk.

For myself, I enjoy trading long term in the money call options on stocks, which appear to have a sound future. I think that gives the best bang for the buck, while still maintaining a good degree of safety.

TGR: The Melman Report focuses a lot on mining equities, mainly in the small-cap space. Could you talk about some of your favorite small-cap names in precious metals?

LM: I like companies that have already moved projects toward productivity. For example, there are two companies operating side by side in Guanajuato, Central Mexico: Great Panther Silver Ltd. (TSX:GPR; NYSE.A:GPL) and Endeavour Silver Corp. (NYSE:EXK; TSX:EDR).

Both of these companies acquired projects between five and seven years ago. They explored them. They developed the resources. They built production facilities. Now both are in actual production. With the price of silver exploding upwards, they are bringing in substantial cash flow. That cash flow is financing additional exploration and they are building reserves.

At the same time, they're producing positive cash flow and profits. That's a wonderful combination. That can take a company from tiny to midsize and advance it towards a large size. The stocks of both companies have been exceptionally rewarded.

TGR: Since Great Panther listed on the NYSE Amex, its market cap has doubled to almost a half-billion dollars.

LM: At the bottom of the 2008 markets disturbance, Great Panther shares dropped to as low as about $0.25. It's trading this morning at $4.02. That's a multiple of 16 times over. At the same time, Endeavour Silver shares have moved from similar low levels to $9.53.

TGR: Endeavour has another project in the pipeline as well.

LM: It also has the Guanacevi Mines project in Northern Mexico. It's also a good cash flow provider and a significant profit contributor.

TGR: What about the management of Endeavour and Great Panther?

LM: I visited both companies, and I was very impressed with the caliber of the management. Both have years of experience. And not just a small amount of previous success. Everything I could see told me these are quality operations.

TGR: Any other interesting companies?

LM: Kent Exploration Inc. (TSX.V:KEX; OTCPK:KXPLF) has a multi-faceted story and projected cash flow is coming into the picture. Kent has three properties. Its barite project in Washington State is only about two months from production. It has a silver project in waiting in British Columbia. It also has a New Zealand gold mine that is under exploration.

The company also owns the rights to an Australian project. Kent spun out a new company called Archean Star Resources Inc. (TSX.V:ASP) that just started trading about a week ago at around $0.15 per share. Its project has great potential. It's just getting underway with new rounds of exploration.

The barite project will provide it with a cash flow to continue exploring in New Zealand and to start developing the British Columbian silver project. It may spill over into the Archean Star project in Australia as well. The barite project will enable Kent to advance its other projects as quickly as possible without undue dilution.

TGR: The project that they have in New Zealand is near Reefton, a former producing gold mining district. Something like 10 million ounces have come out of the ground.

LM: Exactly.

TGR: Any other promising opportunities?

LM: I've grown very familiar with Commerce Resources Corp. (TSX.V:CCE; Fkft:D7H; OTCQX:CMRZF) through the years. Commerce's main project was almost strictly limited to tantalum and niobium development in Blue River, British Columbia. However, the company has also advanced the Eldor Property in Québec as a rare earth elements project in the past year. The popularity of rare earth elements has generated a great deal of new interest in Commerce. The shares have advanced from about $0.25 to as high as $1 during the past year.

The Eldor Property is under the supervision of geologist Jody Dahrouge. I met Jody on a trip to Blue River. He strikes me as a serious, well-grounded geologist. I think the glowing reports that he signs can be trusted.

TGR: Commerce got some decent early results from Eldor. In the Ashram zone, which is part of it, it hosts an inferred resource of 117 million tons grading 1.74% total rare earth oxides. That's a pretty good start.

LM: From the reading I have done on other projects, both the extensive amount of material and the grades are very high compared to other North American projects. The most attractive feature to me about rare earth elements is that China has been the great provider of these elements to the world market for the past several decades. China just said it is going to being reducing exports, which is going to leave several important industrial applications short in North America. Companies are going to be looking for supplies from North America. That should bring in purchase commitments and excellent financing to advance these projects as fast as possible.

TGR: Another advantage Eldor has is that it's not nearly as remote as some other rare earth projects. Hydro-Québec infrastructure could limit costs compared to other players.

LM: Absolutely. The company is also ideally positioned near the St. Lawrence Seaway, so its products can be immediately shipped around the world. We're only talking a few hundred kilometers between its site and cities such as Saginaw on the St. Lawrence River. Commerce is also very close to the huge industrial markets of Ontario, Québec, and the northeastern U.S. There are inherent advantages in the Eldor Property.

TGR: Do you know David Hodge, Commerce's president?

LM: I've known Dave Hodge and several of his assistants, particularly Chris Grove, for going on 10 years. I meet with them regularly. Dave is a very enthusiastic supporter of mining. He is putting together a quality company that will be around for some time to come.

TGR: Could you give us a forecast of what you see happening in the precious metals and mining commodities spaces over the next four to six months?

LM: I have never seen a period of time in which there have been so many cross turns. The fires of inflation are starting to rise. I chart all the major grains, such as wheat, corn and soybeans. Those charts have headed higher over the last two years. Increased ethanol production is monopolizing huge acres of corn and leaving the rest of the world short of basic corn supplies. Because so much acreage is going to corn, it's diminishing the acreage of soybeans and wheat, sending those commodity prices higher.

There's also petroleum price inflation. The world uses 85 million barrels of petroleum per day. We are depleting the resource. The Ghawar Field in Saudi Arabia supplies about 6% of the world's petroleum. It's only still in production because water is being floated under the oil to raise it up. That can't go on forever. Plus, there are the problems of debt around the world. The U.S. national debt is $14.2 trillion. It's all very unstable. It's coming closer to a point at which government simply will not be able to resolve these problems. We could have a truly chaotic situation. For that reason alone, I believe investors should be in gold and silver, not only for insurance, but for potential profits.

TGR: Thanks, Leonard.

Leonard Melman has been writing about precious and base metals for more than two decades as monthly columnist for California-based ICMJ's Prospecting and Mining Journal and Vancouver's Resource World Magazine. He focuses on how political and financial considerations impact the world of mining and the prices of the metals. Melman has also contributed commentary and corporate studies to other publications, including the Aspermont group of publications in Australia and DEL Communications in Winnipeg. Leonard is a speaker at Cambridge House conferences across Canada. He has visited and reported on mining operations on four continents, and his articles appear on numerous mining company websites. Previously, Melman was a manager of multi-million dollar consumer lending operations and a securities and commodity broker. Melman recently wrote his first book Reversing the Way In. He lives in Nanoose Bay with his wife, Thama.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

DISCLOSURE:

1) Brian Sylvester of The Gold Report conducted this interview. He personally and/or his family own the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Timmins.

3) Ian Gordon: I personally and/or my family own shares of the following companies mentioned in this interview:Timmins Gold, Golden Goliath, Millrock and Lincoln. My company, Long Wave Analytics is receiving payment from the following companies mentioned in this interview, for receiving mention on my website, Golden Goliath, Millrock and Lincoln Gold.

The GOLD Report is Copyright © 2011 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.