Standard & Poor's U.S. Sovereign Debt Downgrade Watershed Event

Interest-Rates / US Debt Apr 19, 2011 - 01:19 AM GMTBy: Richard_Mills

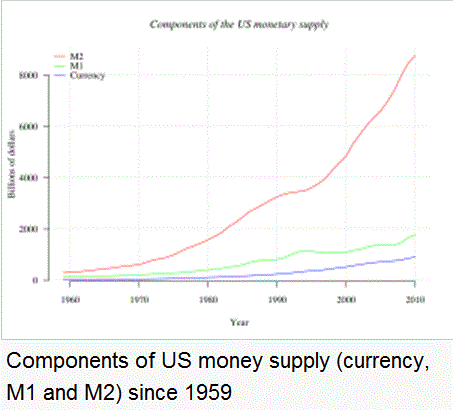

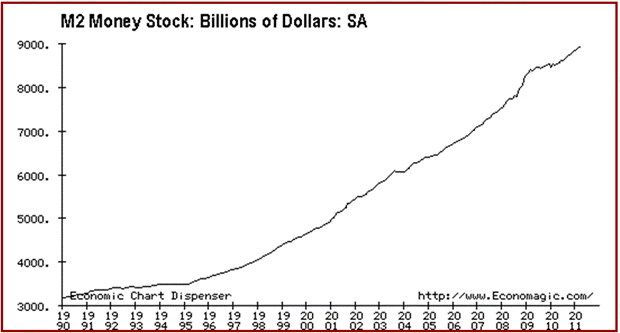

"Common sense tells us that a government central bank creating new money out of thin air depreciates the value of each dollar in circulation." ~ Congressman Ron Paul (R-TX)

"Common sense tells us that a government central bank creating new money out of thin air depreciates the value of each dollar in circulation." ~ Congressman Ron Paul (R-TX)

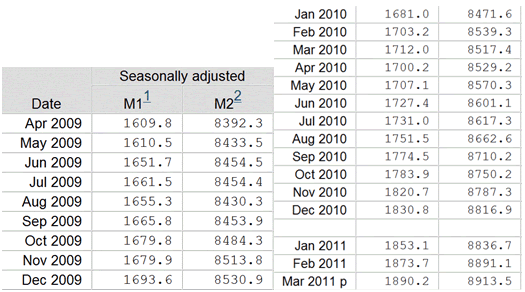

Billions of Dollars

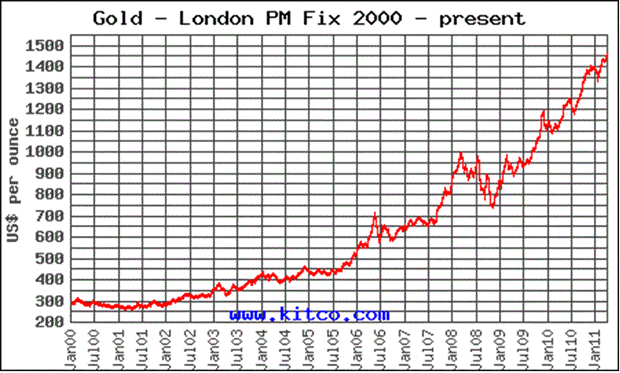

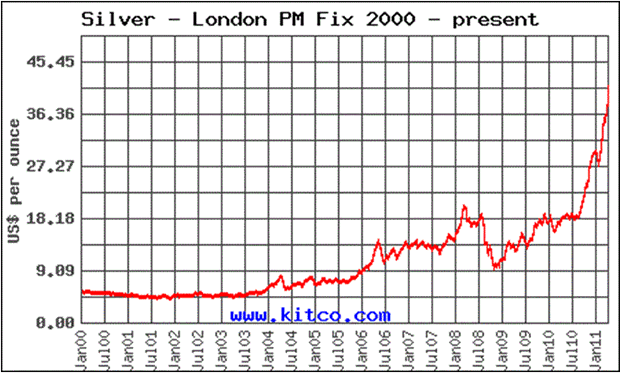

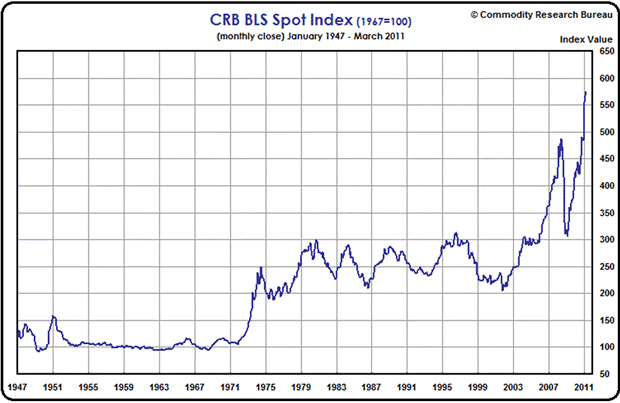

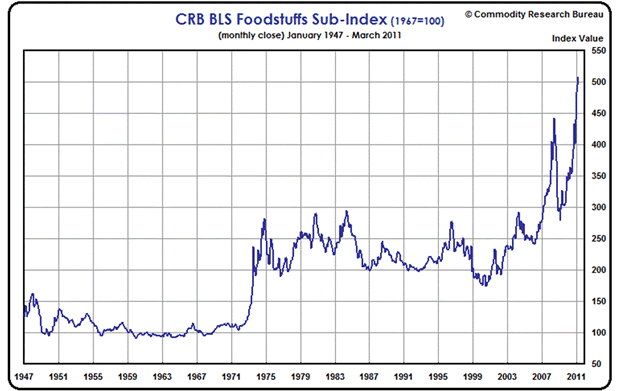

Declining confidence in paper money is pushing gold and silver from the shadows to center stage.

"The surge in commodity prices over the past year appears to be largely attributable to a combination of rising global demand and disruptions in global supply. These developments seem unlikely to have persistent effects on consumer inflation or to derail the economic recovery and hence do not, in my view, warrant any substantial shift in the stance of monetary policy." ~ Federal Reserve Vice Chairman Janet Yellen

"There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen... the bad economist pursues a small present good that will be followed by a great evil to come, while the good economist pursues a great good to come, at the risk of a small present evil." ~ Frederic Bastiat (1801-1850)

The federal deficit this year is a record $1.6 trillion -- a number that requires the government to borrow 43 cents out of every dollar it spends. The US government's total debt will mushroom from $14.2 trillion now to almost $21 trillion by 2016.

Obama's projected $1.6 trillion deficit for the current year would be the highest dollar amount ever. It represents 10.8 percent of the total economy, the highest level since 1945 when the deficit was 21.5 percent of GDP and reflected heavy borrowing to fight the Second World War.

The president's 2012 budget projects that the deficits total $7.2 trillion over the next 10 years with the shortfalls never coming in below $607 billion.

Professor Peter Bernholz, from the University of Basel, examined 12 of the 29 hyperinflationary episodes where significant data exists.

"Hyperinflations are always caused by public budget deficits which are largely financed by money creation...The figures demonstrate clearly that deficits amounting to 40 percent or more of expenditures cannot be maintained. They lead to high inflation and hyperinflations."

Most analysts quote government deficits as a percentage of GDP:

"The president's projected $1.6 trillion deficit for the current year...would also represent 10.8 percent of the total economy."

This reporting is misrepresenting the true size of the problem because it doesn't say how big the deficit is relative to expenditures.

On February 14, 2011, President Obama released his 2012 Federal Budget. The report updated the projected 2011 deficit to $1.645 trillion. This is based on estimated revenues of $2.173 trillion and expenditures of $3.818 trillion.

He then unveiled a $3.73 trillion budget for 2012 with a projected deficit of $1.1 trillion - a lot of savings/cuts and revenue assumptions in the 2012 budget appeared to this author, to put it politely, to be pie in the sky. The savings and revenue projections have more to do with the 2012 election than reality - Obama is trying to appear fiscally responsible to the voters. It also doesn't look like either party can agree to any cuts except to those in someone else's (somebody from the other party) back yard.

The US government cannot sell enough of its debt to its own citizens and foreigners to finance its deficit and pay the interest on its existing debt.

"Yes, we are monetizing debt. You buy bonds and you monetize debt. Right now, a lot of that is going into excess reserves so it is not having an immediate effect on inflation. It will initiate inflationary impulses. It takes time." ~ Thomas Hoenig, President, Federal Reserve Bank of Kansas City, early March 2011

The US government is already buying its own debt - this is the most inflationary thing a country can do - and it looks like we can expect this trend to continue and probably increase.

The Event

April 18th 2011 - Standard & Poor's Ratings Service lowered its long term outlook for the United States sovereign debt to Negative from Stable.

Moody's issued a warning earlier in 2011 saying that its rating could be downgraded if progress isn't made soon on the $1.5 trillion US budget deficit.

Conclusion

Are any countries in the world going to enter into a hyperinflationary episode anytime soon? This writer doesn't know - I do know we are experiencing inflation, I think it's going to get to much higher levels than today's and I've been saying so for quite a while.

Gold and silver shine brightest in inflationary times - when your cash is trash your gold and silver are shining - and history proves the greatest leverage to rising precious metal prices are junior companies involved in the discovery and development of precious metal projects.

Junior precious metal companies should be on every investors radar screen. Are they on yours?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2011 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.