What Exactly is the Function of the Federal Reserve Bank?

Interest-Rates / Central Banks Apr 26, 2011 - 07:10 PM GMTBy: EWI

What exactly is the function of the Fed? If it's to help the U.S. economy grow steadily, then how come in 2007-2009 we had the biggest stock market crash in decades followed by "the Great Recession" and a worldwide financial crisis?

What exactly is the function of the Fed? If it's to help the U.S. economy grow steadily, then how come in 2007-2009 we had the biggest stock market crash in decades followed by "the Great Recession" and a worldwide financial crisis?

For answers, let's turn to someone who has spent a considerable amount of time studying the Fed and its functions: EWI's president Robert Prechter.

This is an excerpt from a free Club EWI eBook, "Understanding the Fed." Enjoy -- and for details on how to read this important 32-page eBook in full, free, look below.

The Fed’s Presumed Inflation Since 2008 Is Mostly a Mirage Excerpted from Prechter's December 2009 Elliott Wave Theorist

... We all know that the Fed created $1.4 trillion new dollars in 2008. It has told the world that it will inflate to save the monetary system. So that is the news that most people hear.

But the Fed’s dramatic money creation in 2008 only seems to force inflation because people focus on only one side of the Fed’s action. Even though the Fed created a lot of new money, it did not affect the total amount of money-plus-credit one bit... When the Fed buys a Treasury bond, net inflation occurs, because it simply monetizes the government’s brand-new IOU. But in 2008, in order for the Fed to add $1.4 trillion new dollars to the monetary system, it removed exactly the same value of IOU-dollars from the market. It has since retired some of this money, leaving a net of about $1.3 trillion.

So investors, who previously held $1.3t. worth of IOUs for dollars, now hold $1.3t. worth of dollars. They are no longer debt investors but money holders. The net change in the money-plus-credit supply is zero. The Fed simply retired (temporarily, it hopes) a certain amount of debt and replaced it with money.

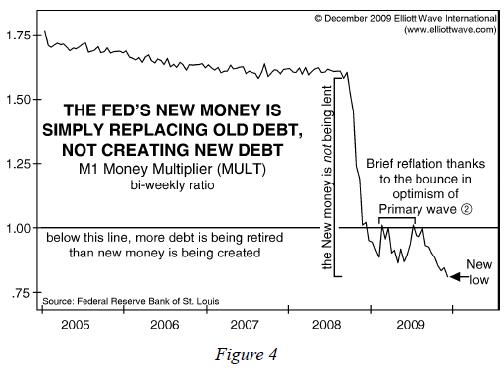

Evidence for this case is in Figure 4. Even though the Fed has swapped over a trillion dollars of new money for old debt, the banks aren’t lending it. The money multiplier is back in negative territory, which means that there is more debt being retired than there is new money being created. In other words, deflation is winning.

The bottom line is that the Fed hasn’t created much inflation over the past two years. The only reason that markets have been rallying recently is that the Elliott wave form required a rally. In other words, in March 2009 pessimism had reached a Primary-degree extreme, and it was time for a Primary-degree respite. The change in attitude from that time forward has, for a time, allowed credit to expand again.

But the Fed and the government didn’t force the change. They merely accommodated it, as they always have. They offered unlimited credit through the first quarter of 2009, and no one wanted it. In March, the social mood changed enough so that some people once again became willing to take these lenders up on their offer.

When credit collapses again during the wave 3 downtrend, we at Elliott Wave International will no longer have to keep “making the case” that the Fed is impotent. It will be clear once again, just as it was in 2008. (...continued)

Chapter 1: Money, Credit and the Federal Reserve Banking System

Chapter 2: What Makes Deflation Likely Today?

Chapter 3: Can the Fed Stop Deflation?

Chapter 4: Jaguar Inflation

Chapter 5: Can't Buy Enough...of That Junky Stuff, or, Why the Fed Will Not Stop Deflation

Chapter 6: The Fed's "Uncle" Point Is In View

Chapter 7: Government Thrashing

Chapter 8: The Coming Deflationary Pressure on the Government

This article was syndicated by Elliott Wave International and was originally published under the headline Understanding the Fed. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.