What Hyperinflation Looks Like

Economics / HyperInflation May 06, 2011 - 02:11 AM GMTBy: Washingtons_Blog

Sweeping up pengő banknotes. Hungary, 1946.

Sweeping up pengő banknotes. Hungary, 1946.

100 Billion Dollars buys eggs in Zimbabwe.

500 Billion Dinar note from Yugoslavia.

Burning marks as fuel to keep warm. Germany, 1913.

As I've previously noted, hyperinflationists are too focused on Weimar Germany:

You've heard how bad things were in the Weimar Republic, when people would rush straight to stores to buy food after receiving a pay check because their money would buy much less the next day.

But it turns out that Germany's hyperinflation in 1923 was nothing compared to that experienced by Hungary, Zimbabwe and Yugoslavia.

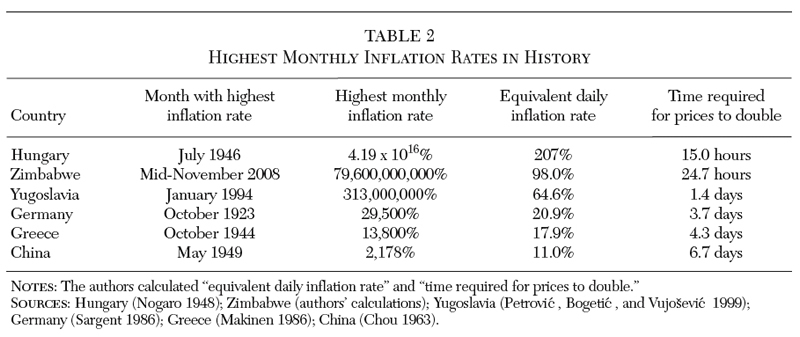

In a new paper published by the Cato Institute, economics professor Steve Hanke lists the all-time worst episodes of hyperinflation:

Note that Hungary's daily inflation rate was ten times greater than that in Weimar Germany, and prices doubled almost six times faster in Hungary than in the Weimar Republic.

Life in Weimar Germany was extremely difficult. But Hungary in 1946 was a lot worse.

Note: While the commonly accepted explanation for hyperinflation is government printing too much money, Ellen Brown argues that the real explanation is a concerted attack on a country's currency by foreign speculators and/or foreign governments.

Postscript: This post is not implying that I think we'll necessarily get hyperinflation. It is only trying to put historical cases of hyperinflation in context.

Global Research Articles by Washington's Blog

© Copyright Washingtons Blog, Global Research, 2011

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.