Euro Dollar Debt Crisis Dance Doesn’t Fool Gold And Silver Bulls

Commodities / Gold and Silver 2011 May 24, 2011 - 01:34 AM GMTBy: Jeb_Handwerger

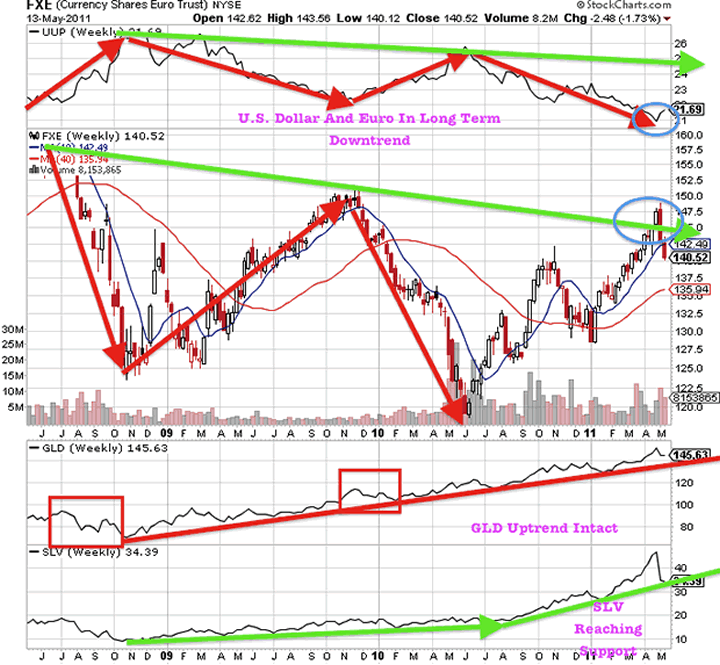

The euro (FXE) slid compared to the U.S. dollar (UUP) after meeting and reversing at its long term down-trend resistance line two weeks ago. About four weeks prior to that, I alerted readers that the Euro could reverse lower supporting precious metal prices. In my March 28th article I wrote, “Watch for a move out of the euro to support precious metals prices as the euro reaches its descending upper resistance level. For the past two years the euro and the dollar have done this inverted dance wherein one goes up and the other goes down. But one thing I am not fooled about is the fact that they are both in secular long-term downtrends.”

The euro (FXE) slid compared to the U.S. dollar (UUP) after meeting and reversing at its long term down-trend resistance line two weeks ago. About four weeks prior to that, I alerted readers that the Euro could reverse lower supporting precious metal prices. In my March 28th article I wrote, “Watch for a move out of the euro to support precious metals prices as the euro reaches its descending upper resistance level. For the past two years the euro and the dollar have done this inverted dance wherein one goes up and the other goes down. But one thing I am not fooled about is the fact that they are both in secular long-term downtrends.”

The Euro continued to press higher on the hopes of a recovery from July of 2010 until May of 2011. The decline in the Euro is due to expectations of further bailouts in Europe and the European Central Bank taking a very dovish position by not raising interest rates. Greece is on the brink of default and Portugal may receive additional assistance. We are witnessing pressure put on the Euro and capital flowing into the U.S. dollar which has forced some U.S. dollar (UDN) bears to cover their aggressive short position. This short covering rally in the U.S. dollar has caused a commodity (DBC) de-leveraging forcing hedge funds to raise cash reducing their exposure to commodity related equities.

Don’t forget that the U.S. is dealing with its own domestic economic issues combined with a renewed commitment to democratize the Middle East, which will require additional borrowing. Investors and traders are asking where will this money come from? The U.S. has already hit its debt limit and has been warned of a credit downgrade.

Many are concerned by the reported end of QE2. However, noises are being made about the possibility of the imposition of QE3, which could possibly be tonic for gold and silver prices.

At present gold (GLD) and silver (SLV) may be basically pricing in the possibility of sovereign default risk. Witness the pleas of Greece for immediate aid. Other members of PIIGS nations may not be far behind. The biggest threat to our thinking is a continuing dip in risk appetite initiated by the end of QE2 or as stated a heightening in the Euro-zone debt crisis. This may be causing this U.S. dollar spike as capital flows to safe-haven and investors close their short-dollar wagers.

We feel that such a move would possibly be transitory in nature. Should QE3 not be instituted, Bernanke has a whole bunch of other arrows in his quiver. Monetary printing by any other name may be just as effective as it is surreptitiously instituted. There is a strong possibility that the Fed will remain faithfully wedded to aggressive monetary policy in order to lower unemployment and extricate the nation from its economic mess. A black swan may be steaming toward us. As remote as it may seem, the possibility of a U.S. financial default, may be in the cards. But then isn’t that what black swans are always about?

Be assured that we are keeping a weary eye on these constantly evolving developments. Partake in a free trial of my daily intelligence report by clicking here.

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.