Stock Market Flashing A Buy Signal?

Stock-Markets / Stock Markets 2011 Jun 20, 2011 - 02:39 AM GMTBy: Chris_Vermeulen

Since the first trading session in May we have seen the stock market sell off. The old saying “sell in May and go away” was dead on again this year. Here we are 7 weeks later with the stock market continuing to lose ground. This extended sell off has everyone all worked up that this is the beginning of another market collapse.

Since the first trading session in May we have seen the stock market sell off. The old saying “sell in May and go away” was dead on again this year. Here we are 7 weeks later with the stock market continuing to lose ground. This extended sell off has everyone all worked up that this is the beginning of another market collapse.

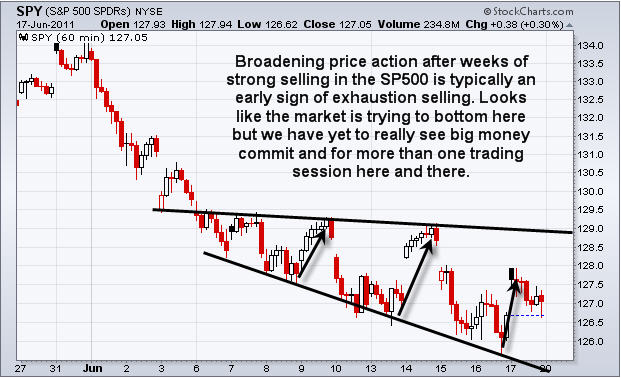

Let’s take a quick look at the SP500 hourly chart covering the month of June.

As you can see, price is still falling but every couple of trading sessions we get some big money players nibbling on stocks accumulating shares and running the market higher. This type of price action is typically an early signal that the market is trying to bottom.

There are two key ingredients for a higher stock market and both have been missing from the mix for a couple months. The two key sectors which have a significant weighting in terms of the broader market are the financial and technology stocks.

Let’s take a look at the financial sector:

As you can see on the bottom of this chart, financials started to lag the market in late January. Ever since then this sector has been in a strong downtrend pulling the broad market averages lower with it. The good news is that this sector has just reached a major support zone and is looking ripe for a bounce and possible rally.

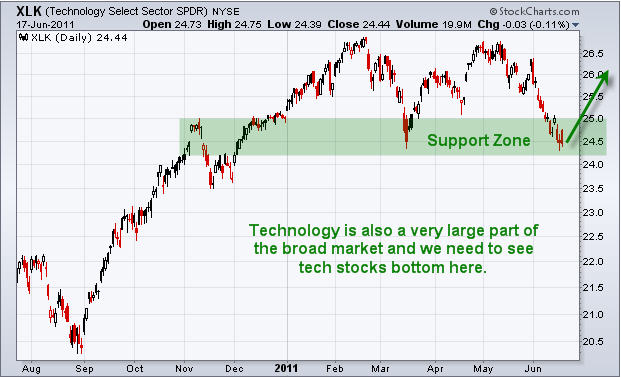

The other main ingredient to a higher stock market is the technology sector.

Looking at the technology sector:

Here we can see technology stocks have been pulling back for several weeks. Tech stocks are now trading down at a major support zone and they look oversold. A bounce from this level is very likely in the coming week.

Weekend Trading Conclusion:

In short, I continue to feel the market is trying to bottom here and we are at the tipping point when things get volatile and choppy just before we get a trend reversal in the S&P 500. Keep an eye on the short term charts of financials and technology sectors. Once they start making higher highs and higher lows on the 60 minute charts I believe it will be the start of a nice bounce and possible rally.

If you would like to get more of my daily analysis to join my newsletter at www.GoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.