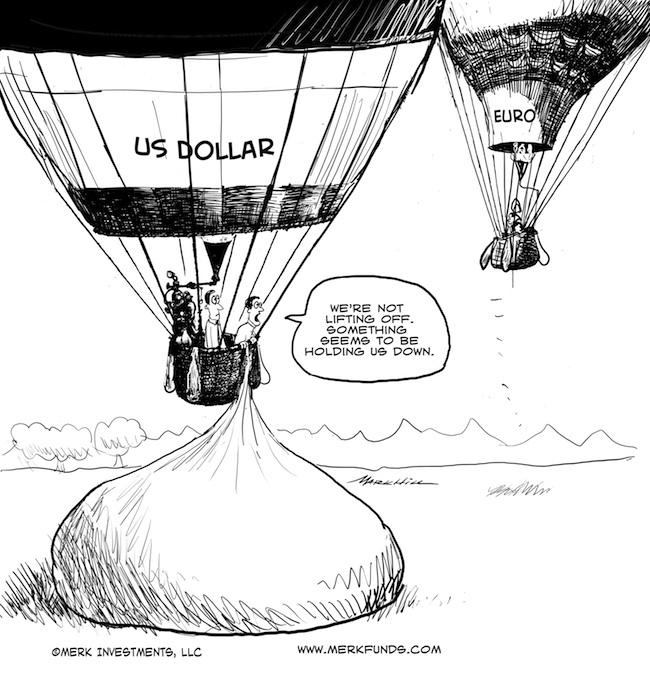

Is the Euro Safer than the U.S. Dollar?

Currencies / US Dollar Jun 21, 2011 - 02:32 PM GMTBy: Axel_Merk

Which one is safer: the euro or the U.S. dollar? Before jumping to a conclusion one way or the other, let's look at different sides of the respective coins. We have been warning for years that there may be no such thing anymore as a safe asset and investors may want to take a diversified approach to something as mundane as cash. We believe Greece has rather serious issues, but concerned investors may want to take a closer look at their dollar holdings for potential “contagion” risks. Let us explain…

Which one is safer: the euro or the U.S. dollar? Before jumping to a conclusion one way or the other, let's look at different sides of the respective coins. We have been warning for years that there may be no such thing anymore as a safe asset and investors may want to take a diversified approach to something as mundane as cash. We believe Greece has rather serious issues, but concerned investors may want to take a closer look at their dollar holdings for potential “contagion” risks. Let us explain…

|

Dollar risk…

The dollar risk hiding in plain sight are U.S. money market funds. Just like all investors, money market funds have been scrambling for yields. With yields on three month Treasuries at a rock bottom annualized 0.02% as of this writing, money market funds have had to look for riskier investments to make ends meet. Part of the reason why T-Bills are trading at such minimal yields may be due to the bickering on the debt ceiling, ironically causing fears of T-Bill shortages in the market (see our analysis “ Debt Ceiling Jeopardizes Dollar's Reserve Status ”); but another reason may be a flight out of money market funds into T-Bills, as investors place increasing scrutiny on the underlying holdings of their money market funds.

So what are these riskier investments? We encourage everyone reading this analysis to download the latest published report of the money market funds they are invested in. As we fear the issue is a systemic one, we won't name any specific funds. Still, to illustrate the issue, two money market funds we recently analyzed had the following characteristics: the first was a large institutional money market fund with US$74 billion in assets. 4.6% of the fund is held in commercial paper issued by BNP Paribas. BNP Paribas is a French bank with €5 billion ($7.2 billion) in Greek bond holdings. In total, that fund had over 50% exposure to foreign banks, many of them European. The second was a retail money market fund with $1.4 billion in assets offered by a major brokerage firm. Approximately two thirds of its assets were invested in U.S. dollar denominated commercial paper and other short-term debt instruments issued by European banks.

European interbank lending has continued to have its ups and downs, so why not look for funding in U.S. markets? It reduces European Banks' dependency on the ECB. While liquidity has been mopped up in Europe, the Federal Reserve (Fed) has ensured that U.S. monetary policy is financing the rest of the world – quite literally in this case. There has been substantial backlash to the Fed's policy at the height of the financial crisis of providing liquidity to foreign banks. Still, the “moral hazard” so often talked about is alive and kicking: while we don't have a crystal ball, our best guess is that should European banks face challenges in the case of a Greek default, the Federal Reserve would step in to support U.S. money markets – and with it – European banks. Thomas Hoenig, the most vocal Kansas City Fed President to have dissented on Federal Open Market Committee (FOMC) decisions numerous times in 2010, is working to reform the system; amongst others, he writes in a recent Financial Times editorial: “Specifically, money market funds should be required to have floating net asset values, …”

Indeed, moving away from illusion-based accounting to market-based accounting (which includes floating net asset values for money market funds) would do more than any recent legislation passed to make the financial world more robust. It would mean financial institutions would need to be less leveraged because they need to take into account that their investments could temporarily show paper losses; isn't that exactly what we need? Incentives to use less leverage! And aren't incentives so much superior to regulation, as it is – in our humble opinion - impossible for the regulators to be ahead of the creativity of bankers?

"The language of the bond market is the only language policy makers understand." - Axel Merk

Euro risk…

Let's talk euro risk now. Just as when investors hold U.S. dollars, investors have choices when they hold euros. While the U.S. has a national Treasury market, each European country has its own short-term financing instruments. Even Greece continues to periodically issue short-term debt. The benchmark for European Treasuries are German issued Treasuries. By all means, there are plenty of opportunities to expose either U.S. dollar or euro denominated cash equivalents to all kinds of risk. It may be prudent for U.S. investors to re-evaluate their U.S. money market holdings should they be concerned about “Greek contagion.” But just as investors may flock to U.S. Treasuries in times of crisis, euro denominated investors may flock to German Treasuries in times of turmoil. The point here is: investors have a choice and should be conscious about the risks they are taking on. In practice, many investors embrace U.S. money market funds, but may shy away from the euro. Notably, of course, there is currency risk in choosing the euro. The Federal Reserve may be actively working to weaken the U.S. dollar in order to spur economic growth; in our analysis, Fed Chairman Ben Bernanke has done so in both word and action. But for those investors considering the euro, the choice is still one of providing a loan to a bank through a deposit, or other avenues such as lending money to the Greek or German government, amongst many other choices.

When the euro was approaching $1.18 last summer, we were one of the few arguing that the euro will strengthen, and substantially so. Our argument had been, and continues to be, that the issues in the Eurozone are serious, but that they should be expressed in the spreads in the bond markets. Meaning that it is perfectly compatible to have a strong euro with Greek debt selling off. It is precisely because less money is spent and printed in the Eurozone that the euro has been able to rally. Bernanke has testified that going off the gold standard during the Great Depression has helped the U.S. recover faster from the Great Depression than other countries; while such a policy is not compatible with the Fed's mandate of price stability, such a policy may indeed spur nominal growth (subject to various risks). What many don't realize is that someone is on the other side of the trade: currencies of countries, or the Eurozone in this case, that don't actively debase their currency may end up with a lot of pain, less economic growth, but potentially a very strong currency.

Pimco's CEO El Erian has argued that when there is a “debt overhang”, contracts get “renegotiated” -- be they personal, corporate, municipal, state or sovereign. The key is to be positioned to profit from the opportunities that may arise in that context. You may not want to hold Greek debt, but how about the euro through German Treasuries? There are other choices, such as the Swiss franc or gold, to name but two; what makes the euro different amongst these choices is that the euro appears out of favor with many investors; the euro may present a good value opportunity for those that believe the currency can thrive even with all the challenges going on in the Eurozone.

Contagion risk…

So what about this contagion risk? We tend to disagree with both camps: those that say that all will be fine don't respect the markets – an attitude that may be hazardous to one's wealth. On the other end of the spectrum we have policy makers such as Jean-Claude Junker, the prime minister of Luxembourg and “President of the Euro Group” (the head of Eurozone finance ministers), that warn of apocalyptic consequences potentially worse than those stemming from the Lehmann Brothers collapse.

First, it's not in Greece's interest to default at this stage . If Greece were to default now, the country may not be able to get financing at palatable terms, thus forcing an overnight adjustment of its primary deficit. As such, it's in Greece's interest to continue to lower its primary deficit; down the road, a restructuring of its debt (default) may make sense for Greece, as it allows the country to write off its debt, while being able to stomach the shock that comes with default. A default now, however, would only lead to a collapse of its banking system, without having addressed its structural issues. A Greek default now would mostly be a Greek tragedy, as the country might fall into chaos. Greece's problem is not one of a strong currency (by being part of the euro), but an inability to collect taxes combined with too many promises made to its people, which will inevitably be broken. If Greece were to leave the euro, tourism may be the one industry to benefit, at the expense of a collapse of the financial system, the pension and social security system, as well as potential hyperinflation in due course.

Similarly, it's not prudent for the stronger Eurozone countries to cut their aid at this stage . German exports are booming, amongst others, because of the weaker euro caused by Greek debt worries. Germany wants peace in Europe – a key reason why the European project was initiated in the first place; Germans have always been paying for European institutions; they don't like it, complain about it, but will continue to subsidize them. It's also in the interest of the rest of Europe to keep subsidizing the peripheral countries to allow the financial system to strengthen and better stomach a default, which may very well occur further down the road.

In this context, the best incentive provided for reform is the pressure of the bond market: the language of the bond market is the only language policy makers understand. Think about the reforms that have been implemented in Greece, Portugal, Spain, Ireland, often with rather weak governments. And when the opposition sweeps to power, such as in Portugal now or possibly in Spain next year, guess what: the bond markets, not the politicians, will continue to be in the drivers' seat. In the U.S., we believe it may play out the same way: policy makers may only come to their senses once the bond market forces them to; except that because of the current account deficit in the U.S., the U.S. dollar may be far more vulnerable than the euro. In the Eurozone, the current account is roughly in balance, making it possible to have lackluster economic growth combined with a strong currency.

Ireland appears to be following through in imposing losses on unsecured debt holders of Irish banks; but because the country's entire business model is based on serving the Eurozone, an exit from the euro is in our view most unlikely. Indeed, we are more concerned about potential fallout stemming from any Irish crisis to the pound sterling because of exposure of the British banking system to Ireland. Portugal is a small country that rose to the challenge rather late; its banking system is in decent shape; we won't speculate about Portugal's fate here, but shall note that we believe any shock stemming from the country can be absorbed. Spain is a different story: it's a big country with a big economy that went through a housing bust; Spain's total debt to GDP ratio is low for advanced economies, even if the budget deficit and unemployment are currently high; Spain started to address issues in its banking system well before stress tests became fashionable and is moving about as fast as possible given Spain's history and culture. Countries have gone through housing busts before – they are painful, but we do not believe Spain is at risk. Italy survived the financial crisis well, and did not substantially ramp up expenditure due to the crisis; Italy's Achilles' heel is its total debt to GDP ratio, not to mention an ailing government; still, most of Italy's debt is domestically owned, and the market places Italy – rightfully so in our opinion – in a more stable category than the small peripheral countries.

Finally, note that we believe an exit of, say, Germany, from the Eurozone is not in the cards. A ‘new Deutsche Mark' would kill Germany's export-driven economy. The departure of a strong country would suck money out from the Eurozone financial system, causing a collapse. And if Germany were to leave its obligations denominated in euro as some have suggested, it would be considered a partial default, causing irreparable damage to Germany's cost of capital. It simply makes no sense. Rather, we believe Germany will continue to engage peripheral countries with a stick-and-carrot approach, just as it has been playing out.

One difference today, compared to the “Lehman moment” in 2008, is that we now know policy makers' playbook. We know that central banks can keep a banking system afloat, even an insolvent one (c.f. also Japan in the ‘90s). The markets have also been pinpointing the vulnerabilities. It's in that context that policy makers should spend at least as much effort in making the system more stable as they do in trying to convince the Greek to become German – something that obviously will not happen. As such,

- Policy makers should heed ECB President Trichet advice: “it is essential for banks to retain earnings, to turn to the market to strengthen further their capital bases or to take full advantage of government support measures for recapitalization. In particular, banks that currently have limited access to market financing urgently need to increase their capital and their efficiency.

- Policy makers must not only have credible stress tests in which sovereign defaults are factored in as possibilities. Long-term, regulations must move away from policies that coerce banks into holding sovereign debt. Such rules contribute to frozen inter-bank lending markets.

- Banks must be more transparent with their holdings, allowing investors to judge a bank's solvency on facts rather than rumors.

There are many other measures that can and should be taken. What is most unfortunate, though, is that the will to reform appears to wane the moment the markets quiet down. As such, the turmoil in the bond markets ought to be embraced as an opportunity. The U.S. was right in aggressively bolstering its banking system, as alternatives are orders of magnitude more expensive. Foremost, however, as Merk Senior Economic Adviser and former St. Louis Fed President Bill Poole has pointed out, sound institutional arrangements should be in place to make stressful periods less stressful.

There is no silver bullet to resolve the Greek debt crisis; indeed, it's not merely a Greek or “PIIGS” crisis, it's a global sovereign debt crisis where the debt-to-GDP ratio in developed countries is exceeding 100%. Rather, it will be a drawn-out process. In our assessment, it may be a painful process, but one in which the euro may substantially outperform the U.S. dollar in the medium to long-term. Is the euro safe? No – that notion better be reserved for a tale in the Wizard of Oz – but in our opinion, it's odds look better than that of the U.S. dollar.

To be updated as this discussion evolves, please make sure you sign up to our newsletter. We manage the Merk Absolute Return Currency Fund, the Merk Asian Currency Fund, and the Merk Hard Currency Fund; transparent no-load currency mutual funds that do not typically employ leverage. To learn more about the Funds, please visit www.merkfunds.com.

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.