The Debt Ceiling Reality Show Must Go On

Interest-Rates / US Debt Jul 14, 2011 - 04:45 AM GMTBy: James_Quinn

The Debt Ceiling Reality Show is winding down to its dramatic conclusion on August 2. I think Fox should capitalize on the drama by gathering the American Idol judges to vote on the best performance by a political hack. We can have Ryan Seacrest announce on August 1 at 11:55 pm that the winner is – THE WALL STREET MONIED INTERESTS.

The Debt Ceiling Reality Show is winding down to its dramatic conclusion on August 2. I think Fox should capitalize on the drama by gathering the American Idol judges to vote on the best performance by a political hack. We can have Ryan Seacrest announce on August 1 at 11:55 pm that the winner is – THE WALL STREET MONIED INTERESTS.

The latest round of kabuki theatre performed by the corrupt lying thieves in Washington DC is being played out every night on the MSM. The volume of misinformation, lies, exaggerations, posturing, and propaganda is staggering. These vile excuses for leaders know that 80% of the American population wouldn’t know the difference between a debt ceiling and a drop ceiling. They use this ignorance to their advantage, as Obama warns that old people won’t get their social security checks and government drones won’t be paid.

The latest round of kabuki theatre performed by the corrupt lying thieves in Washington DC is being played out every night on the MSM. The volume of misinformation, lies, exaggerations, posturing, and propaganda is staggering. These vile excuses for leaders know that 80% of the American population wouldn’t know the difference between a debt ceiling and a drop ceiling. They use this ignorance to their advantage, as Obama warns that old people won’t get their social security checks and government drones won’t be paid.

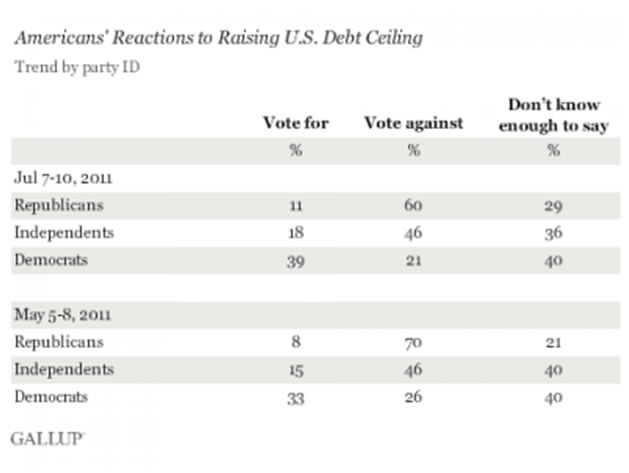

According to Gallup, Republicans and Independents don’t want the debt ceiling raised. The poll also indicates that at least one third of Americans don’t care. They are too outraged by the Casey Anthony verdict to focus on the economic future of our country.

I’ll let you in on a secret. The debt ceiling will be raised. Sorry to ruin the surprise, but this entire sordid episode has nothing to do with our dire economic situation. It is solely about the 2012 elections. Both parties are conducting overnight polling on which talking points are working best in convincing the sheeple that their party is less likely to be blamed. Posturing and polling are what passes for leadership in America. It is a disgusting display and will contribute to the ultimate collapse that is headed our way like a Japanese Bullet Train.

Here is a summary of where we stand according to the MSM and the political class in Washington DC:

- The supposedly grand compromise that would have “cut” $4 trillion from future deficits fell apart last week. The Democarats wouldn’t “cut” entitlements and the Republicans wouldn’t “raise” taxes.

- The latest proposal was down to $2 trillion of future “cuts”, but neither side would agree to what and when.

- Now in the ultimate Washington kick the can move, Mitch “Turtle Face” McConnell has proposed that Obama increase the debt limit in three stages, while requiring him to propose offsetting spending cuts, offering a potential path out of the impasse. Harry Reid loves the idea. I’m sure that gives you a nice warm feeling, like piss running down your leg.

This “solution” cuts nothing. Neither party wants to get blamed for shutting down the government. The Republicans blinked first. Honor, truth, and reality based solutions are non-existent in Washington DC. Weasels can never be trusted around the chicken coop.

The humorous part of this whole disgusting episode is that the $2 trillion or $4 trillion of supposed cuts in spending were not cuts at all. They were nothing but lower increases in future spending. They didn’t cut the national debt. Neither party has come close to presenting a plan to cut the national debt. Mike Shedlock presented a comparison of Obama’s ten year budget versus Paul Ryan’s ten year budget back in April. Take a a gander:

Even using ridiculously optimistic assumptions like interest rates staying low, no new wars, ending existing wars, no recessions, and no new programs, both of the corrupt political parties show ongoing deficits of $500 billion to $1 trillion per year forever. Does that sound like cuts in spending? The proposed reductions in spending increases are like pissing in the Atlantic Ocean of debt.

And here is where the rubber meets the road. Both the Democrat and Republican budget plans insure economic collapse within the next ten years. Again, using ridiculously optimistic assumptions, our National Debt would rise from $14.3 trillion today to between $23 and $26 trillion in ten years. Does that sound like cuts in spending to you?

Luckily, we’ll never reach those levels. We will hit $20 trillion in debt by 2015. That is a lock. Total Federal government revenue today is $2.175 trillion. We spend approximately $1 trillion per year on our military related adventures, or 46% of our total revenue. If interest rates are 5% in 2015, we will spend $1 trillion on interest. If rates are 10%, we will spend $2 trillion on interest.

Do you get the picture? An unsustainable trend will not be sustained. We have two choices. We can proactively address the problem or just wait for the collapse of our economic system. This debt ceiling reality show is all the proof I need. Our leaders will choose to wait. It won’t be long.

Since no one in Washington DC can be depended upon to do the right thing, the only solution is to pass a Balanced Budget Amendment to the Constitution. Special interests across the land would mobilize all their forces to fight this idea. Deficit spending of $1.5 trillion per year enriches bankers, bomb makers, the AARP, mega-corporations, chain stores, restaurants, insurance companies, drug makers, etc. They will fight for their right to suck the country dry.

No matter how you cut it, H.L. Mencken understood our form of governing:

”Democracy is the theory that the common people know what they want, and deserve to get it good and hard.”

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2011 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.