China Downgrades U.S. Treasury Bonds to A+, Is Anybody Listening?

Interest-Rates / US Bonds Aug 11, 2011 - 02:53 AM GMTBy: Gary_Dorsch

Of the big-3 credit rating agencies, only the S&P rating agency had the courage and fortitude to speak the truth, about the severe deterioration of America’s financial status. S&P shocked the political establishment in Washington, by following through with its threat to downgrade US Treasury debt to AA+ on the evening of August 5th. S&P added that the US Treasury debt could be downgraded further, if the crooked and inept politicians in Washington haven’t taken any meaningful moves to cut the size of its mounting debt.

Of the big-3 credit rating agencies, only the S&P rating agency had the courage and fortitude to speak the truth, about the severe deterioration of America’s financial status. S&P shocked the political establishment in Washington, by following through with its threat to downgrade US Treasury debt to AA+ on the evening of August 5th. S&P added that the US Treasury debt could be downgraded further, if the crooked and inept politicians in Washington haven’t taken any meaningful moves to cut the size of its mounting debt.

Yet the most important voice in the debate about the credit worthiness of America’s debt, is not the twisted opinions of the US-credit rating agencies, but rather, that of China’s credit rating agency - Dagong Global Credit Rating, which downgraded US-Treasury’s debt from A+ to single-A last week. “The US decision to raise the borrowing ceiling will not change the fact that the growth of its debt has outpaced its overall economic growth and fiscal revenue. “It may further erode the country’s debt paying ability in the coming years,” Dagong Global said. It also issued a negative outlook. “The rise of the US-debt ceiling helped temporarily avoid a debt default but has not improved its solvency and the increasing government debt burden will deteriorate the US sovereign debt crisis.”

Beijing has earned the right to criticize the US-government’s addiction to debt, since it’s the biggest foreign holder of US Treasury notes, and it’s much better at managing state finances. China posted a fiscal surplus of 1.25-trillion yuan ($193-billion) in the first half of the year as steady economic growth lifted government revenues, the Ministry of Finance said on July 14th. The budget surplus, equal to about 6.1% of China’s gross domestic product from January to June, is well above Beijing’s target for a full-year fiscal deficit of 2% of GDP.

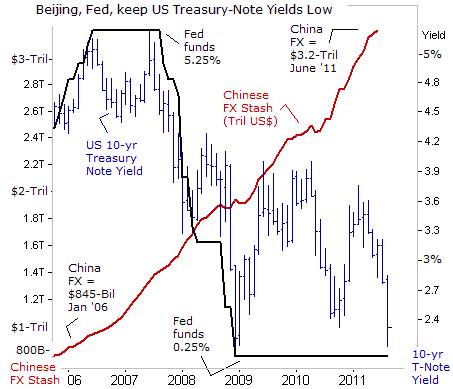

For most of the past decade, Beijing has been a loyal creditor of the US Treasury, recycling more than $2-trillion of its foreign currency holding into US-dollar denominated bonds, thus helping to keep US-interest rates artificially low. For the most part, US Treasuries represent the only destination large enough to accommodate China’s vast holdings, and that can absorb a trade in the tens of billions of dollars of T-notes, without moving prices too far. However, in a shocking development, Beijing has suddenly decided to take a very hard-line with the US Treasury, and is openly calling upon Washington to “cure its addiction to debts and learn to live within its means,” before it resumes lending to the US-Treasury.

In a commentary published by the China News Agency on the evening of August 7th, the technocrats in the Politburo dropped the equivalent of a nuclear bombshell that ignited a worldwide meltdown in global stock markets and sent gold soaring above $1,700 /oz. “China, the largest creditor of the world’s sole superpower, has every right to demand the US to address its structural debt problems and insure the safety of China’s dollar assets. If no substantial cuts were made to the US’s gigantic military expenditure and bloated social welfare costs, the latest credit downgrade would prove to be only a prelude to more devastating credit rating cuts, which will further roil the global financial markets all along the way,” it said.

That report followed by another editorial published by the China News Agency on August 6th. “Dagong Global degraded the US Treasury bonds late last year, yet its move was met then with a sense of arrogance and cynicism from some Western commentators,” the New China News Agency’s Saturday editorial said. “Now S&P has proved what its Chinese counterpart has done is nothing but telling the global investors the ugly truth.”

On August 8th, Beijing shocked the markets again, in a stinging commentary carried by the official Xinhua news agency. “China has every right to demand the US address its structural debt problems and safeguard China’s dollar assets. Washington needs to come to terms with the painful fact that the good old days when it could just borrow its way out of messes of its own making are finally gone. To cure its addiction to debts, the US has to re-establish the commonsense principle that one should live within one’s means,” Xinhua said.

Fears that Beijing is preparing for a confrontation with Washington sparked widespread selling in Asian stock markets on August 8th, and sent the price of Gold soaring above $1,700 /oz for the first time ever. A former top official of the National People’s Congress, Cheng Siwei said in an interview that Beijing should use future foreign reserves to buy bonds of other countries, instead of buying US Treasuries. “In my opinion, in regards to US Treasuries, the best strategy is no buy, no sell. I think maybe that’s the best strategy,” Cheng said.

The S&P rating agency was attacked in the media by the US Treasury chief and several mutual fund managers who were caught with their pants down, and left holding large positions in the stock market. When panic selling set in, the Dow Jones Industrials plunged -634 points on August 8th, its sixth worst point loss in history. That followed on the heels of the Dow’s eighth worst daily decline on August 4th. S&P-500 stocks lost -15% of their value in just two and a half weeks, while the Russell 2000 Index fell into bear market, down -25% from its April 29th high. The finger of blame for the market turmoil should be pointed at the crooked politicians in Washington that have buried America deep in debt. Nobody should be surprised, that the US’s #1 lender - Beijing, would threaten to cut-off the credit lines.

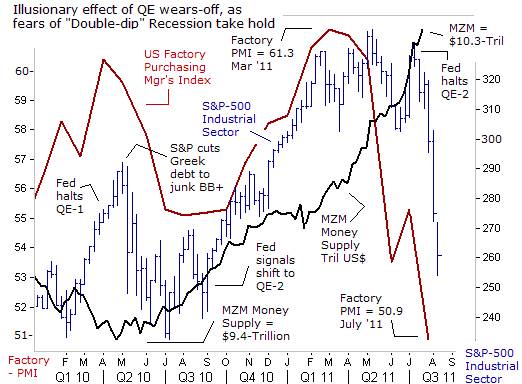

There were early warning signals of big trouble for the US stock market, that were ignored by the snake oil salesmen on Wall Street, who continue to tout investing in the stock market. However, contrary to bullish expectations, US-factory activity began to contract sharply in the month of May. The stock market bulls said the drop was temporary, - related to Japan’s tsunami. There was an explosive stock market rally in the last week of June, with bullish traders intoxicated under the influence of QE. Yet the last gasp rally was a bull trap, - the completion of a classic a “Head & Shoulders” topping pattern. Once the S&P-500 Industrials collapsed below the “neckline,” – panic selling ensued.

Stock market bulls are heavily addicted to the Fed’s hallucinogenic QE-drug, and soon after the Fed stopped injecting the heroin on July 1st, severe withdrawal symptoms began to take effect. Undoubtedly, the Wall Street Oligarchs, and their clients - the 10% of the wealthiest Americans who own 80% of the US-stock market, will be calling on “Bubbles” Bernanke to exercise the infamous “Bernanke Put” – that is to say, flooding the system with another tidal wave of cheap money in order to bailout gamblers when risky bets that go sour.

QE is nothing more than a “bargain with the devil.” The problem is that cheap borrowing costs also make a fertile environment for bubbles, which eventually will burst. Speculators borrow cheaply and make even bigger bets in the stock market. “The effort to help the economy sets up another more dangerous bubble,” warned Jeremy Grantham, chief investment strategist at Grantham Mayo Van Otterloo on October 27th, 2010. “It seems certain that the Fed is aware that low rates and moral hazard encourage higher asset prices and increased speculation, and that higher asset prices have a beneficial short-term impact on the economy, mainly through the wealth effect. It’s also probable that the Fed knows that the other direct effects of monetary policy on the economy are negligible,” he said.

“In almost every respect, adhering to a policy of low rates, employing quantitative easing, deliberately stimulating asset prices, ignoring the consequences of bubbles breaking, and displaying a complete refusal to learn from experience has left Fed policy as a large net negative to the production of a healthy, stable economy with strong employment,” Grantham wrote in a report titled “Night of the Living Fed.”

Fed policy has resulted in “extraordinary destructiveness and ruinous cost. I would force the Fed to swear off manipulating asset prices through artificially low rates and asymmetric promises of help in tough times,” - the Greenspan/Bernanke Put. “It would be a better, simpler, and less dangerous world, although one much less exciting for us students of bubbles,” Grantham added. Indeed, for the past decade, stimulating the US-economy has based upon blowing one bubble after another. Once the Fed stopped the daily injections of QE on July 1st, the QE-2 bubble on Wall Street began to burst spectacularly, and led to the loss of $3.8-trillion of paper wealth worldwide.

It’s only been five weeks since the Fed finished its $600-billion QE-2 scheme, and already, jittery mutual fund managers on Wall Street are crying for help. However, on August 7th, China’s Foreign Minister Yang Jiechi, warned US President Obama that the Fed mustn’t be allowed to launch another round of money printing that could crush the value of the US-dollar. “We also hope the United States can adopt measures to insure the safety of assets in the US held by other countries. The economic trend in the US has a significant impact on the global economy. A stable value of the US-dollar, as a major global reserve currency, is very significant to global economic and financial conditions,” he said.

Over 60% of China’s foreign currency stash is believed to be in US-dollar assets. Apart from Treasury bonds, China holds hundreds of billions in mortgage-backed securities issued by Freddie Mac and Fannie Mae, and corporate equities and bonds. The dollar assets held by China are now believed to total $2-trillion. It is estimated that in the first four months of 2011, China’s invested three-quarters of its foreign currency surplus in non-US dollar assets. As a result, China is vulnerable to the demise of the US-dollar, but also the European debt crisis that threatens the existence of the Euro as a unified currency.

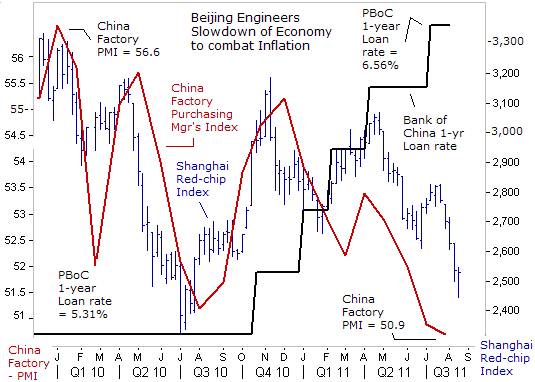

The People’s Bank of China (PBoC) still hasn’t been able to get the country’s inflationary spiral under control. The consumer price index was reported +6.5% higher in July from a year ago, it’s fastest in three years. Beijing is laying the groundwork for another quarter-point rate hike in the weeks ahead, by guiding China’s 1-year T-bill rate to 3.80%. Another round of QE-3 in the US would force Beijing to print vast quantities of yuan in order to prevent a collapse of the US-dollar, which in turn, could fuel even faster inflation in the Chinese economy. In that case, the PBoC would be forced to hike short-term interest rates much more aggressively, - thus risking the chance of toppling the world’s economic locomotive into a “hard landing.” Already, there are signals that China’s vast factory sector is stalling out, and the Shanghai red-chips have tumbled into bear market territory.

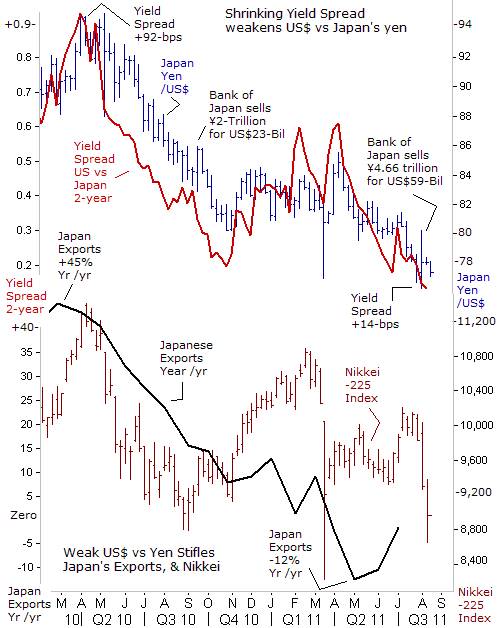

Japan is the second largest creditor to the US-Treasury, and Tokyo is also strongly opposed to another blast of QE, since its wobbly economy would be crushed by a further weakening of the US-dollar versus the yen. Last week, the US-dollar fell to as low as ¥76.50, as the interest rate spread between the US Treasury’s and Japan’s 2-year note shrank to a record low of just ×basis points. The yield spread has been shrinking as the Fed has ruled out any increase in the US-federal funds rate for as far as the eye can see.

The weaker US-dollar is dealing a crushing blow to the profits of Japanese Multi-Nationals listed on the Tokyo Stock Exchange. The Nikkei-225 index briefly fell below the 9,000-level this week, - threatening the capital adequacy ratios of some of Japan’s largest banks. To stop the US-dollar’s slide into oblivion, Tokyo launched its largest-ever single-day currency-market intervention, and Japan’s financial warlords say they stand ready to act again to cap the yen’s rise. The Bank of Japan injected about ¥4.66-trillion, into the currency markets, in exchange for $59.4-billion. It is widely believed that Tokyo would recycle the US-dollars that it acquires through foreign currency intervention, into US Treasury bonds, thus helping to picking up the slack, if Beijing decides to cut-off further credit to the US.

“Confidence in US-Treasuries has not been shaken. They remain an attractive investment,” said Japan’s Finance chief Yoshihiko Noda on August 7th. Japan held $912-billion in US Treasuries as of May 2011, and that number could go well over $1-trillion, if Tokyo ramps up its intervention operations, to defend the beleaguered US-dollar. Yet Tokyo was jolted on August 8th, when Moody's Investors Service suddenly warned that its efforts to weaken the yen could result in a downgrade of its AA- sovereign ratings.

Still, Tokyo might be on the verge of a massive yen selling spree that could rival its historic intervention operations of 2003 thru Q’1 of 2004, when Japan’s financial warlords injected 35-trillion yen into the markets. Tokyo could end-up monetizing a huge block of US Treasury bonds. Yet the effort to reverse the dollar’s downtrend would probably fail, now that the Bernanke Fed has vowed not to lift the fed funds rate for the next two years.

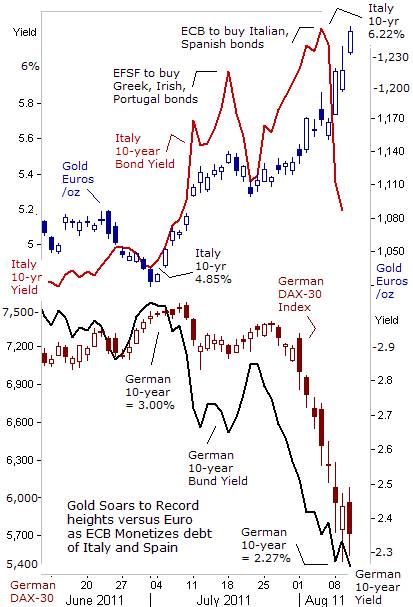

ECB Engages in QE, Printing Euros for Bailouts, - Gold soared to record heights in Frankfurt above €1,250 /oz on August 10th, following news that the European Central Bank (ECB) has finally crossed the Rubicon into the hallucinogenic world of QE. The ECB has agreed to print Euros in order to monetize the debts of Italy and Spain, and there are rumors that the size of the ECB’s money printing operation could reach €100-billion in the months ahead. “We are in the secondary market. I will not tell you moreover what we are buying or the amount, but the amounts are known of course and in that sense we are totally transparent,” said ECB chide Jean “Tricky” Trichet on August 9th.

Right now, the European banking system and the bond markets of five Euro-zone nations are hooked on the artificial life support systems put into place by the ECB, and backstopped by the taxpayers of France, Germany, and the Netherlands. On August 7th, just hours before the opening of the Asian stock markets, the ECB tried to head-off a stock market collapse, by saying it “would intervene in a very significant and cohesive way,” to halt financial market contagion. The ECB stepped into the markets on August 8th to buy Italian and Spanish bonds, and was able to knock Italy’s 10-year bond yield 1% lower to around 5.20%.

German Chancellor Angela Merkel’s decision to let the Euro zone’s bailout rescue fund buy the bonds of Greece, Ireland, Italy, Spain, and Portugal on the open market is meeting resistance from German taxpayers who are forced to subsidize the debts of others. More worrying is that the ECB’s purchases of Italian and Spanish debt is the latest step in a dangerous shift towards the disintegration of the Euro, and risks irreparable damage to the ECB’s inflation-fighting credibility. Just 42% of Merkel’s conservative ruling party approves of bailout packages for Greece, Ireland and Portugal, so there is no guarantee that the Euro-zone’s bailout fund would be expanded in October to cover the debts of Italy and Spain. The Bundesbank hawks would never have agreed to enter the Euro if they knew what it is happening now.

A Cyclical Top in Germany’s DAX? Although the ECB’s purchases triggered a sharp rebound in Italian and Spanish bonds, it couldn’t prevent the mighty German DAX Index from spiraling lower into bear market territory. On August 9th, the German DAX tumbled to an intra-day low of 5,425, - falling as much as -28% from its July 4th highs. Shell shocked investors sought the safety of German Bunds. While equity investors in Germany’s DAX multi-nationals are starting to suffer renewed losses, investors in Gold are profiting beyond their wildest imaginations.

Equity markets in Greece, Ireland and Portugal have already fallen below their March 2009 lows, under the duress of destructively high bond yields in their economies, Germany’s DAX-however, was able to sail through the crisis relatively unscathed, as its big multi-nationals posted bumper exports and profits and the German jobless rate sank to its lowest level since 1992. However, with the DAX Index tanking, it’s a signal that traders are starting to worry that slowing economies in Italy, Spain, France, China and the US could weaken demand for German exports. In June, German exports fell -1.1% to €88.3-billion, or +3.1% higher from a year earlier, the smallest yearly increase in 16-months.

For investors in the German DAX, - the Euro-zone’s top performing stock market, it’s been a decade of lost growth, locked within the confines of a secular bear market, and wild gyrations that have led to nowhere. However, when measured against the price of Gold, the DAX is still caught in the grips of a grizzly bear market. Today, 1-share of the DAX can only fetch 5 ounces of Gold, compared with 26 oz’s of Gold eleven years ago, and there is no bottom in sight. Worse yet for DAX bulls, the cyclical bull-run, intact for the past 26-months, might have reached its zenith, and could soon begin a bearish phase.

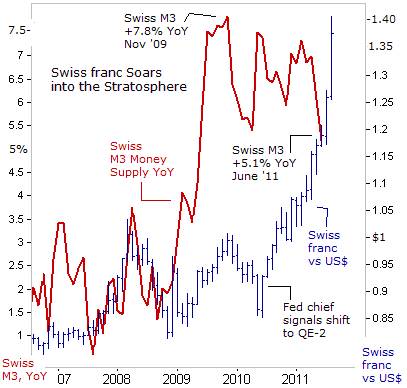

In Zurich, the Swiss National Bank (SNB) hasn’t unleashed an effective way of countering the strength of its currency. The Swiss franc rose spectacularly on August 9th, gaining +5% in a single day, and soaring far beyond the imagination of the average trader. The Swiss franc briefly soared above $1.400, soon after Fed chief Bubbles Bernanke said the fed funds rate would be locked at zero-percent, until his helm at the Fed expires. The franc is up about +65% against the US-dollar from a year ago, and is sending a signal that the US-dollar’s status as the world’s reserve currency is rapidly eroding. The IMF said the US-dollar accounted for only 60.7% of global currency reserves in the first quarter, down from 73% a decade ago. The Euro’s share also fell slightly to 26.6% from a peak of 28% in 2009.

In 2010, some 6.4% of all foreign exchange transaction involved the Swiss franc, making it the fifth most traded currency in the world, according to the BIS. Yet the Swiss franc only accounted for 0.1% of all currency reserves held by central banks. But this still makes it the fifth most popular reserve currency in the world. The Swiss franc is a so-called “safe haven” currency that means that investors and speculators buy it when other reserve currencies, including the Euro and the United States dollar, are under pressure.

It’s estimated that 28% of all funds held outside the country of origin are kept in Swiss banks. For this reason, the SNB has generally maintained a “hands-off” policy towards the Swiss franc, and has kept a relatively tight grip on the local money supply. Since the beginning of 2011, the growth rate of the Swiss M3 money supply has decelerated to +5.1% in June, compared with as high as +7.1% at the beginning of the year. However, given the upward explosion in the value of the Swiss franc’s exchange rate with both the Euro and the US-dollar, the SNB is under enormous pressure to expand the local money supply, while the government might consider slapping a tax on foreign monies held in Swiss banks, to weaken the franc.

Therefore, if the SNB begins its own version of QE to halt the rise of the Swiss franc, traders would be better off owning Gold, as a hedge against the threat money printing, - not just from Zurich, but by the ECB, the Bank of Japan, the Fed, and the Bank of England.

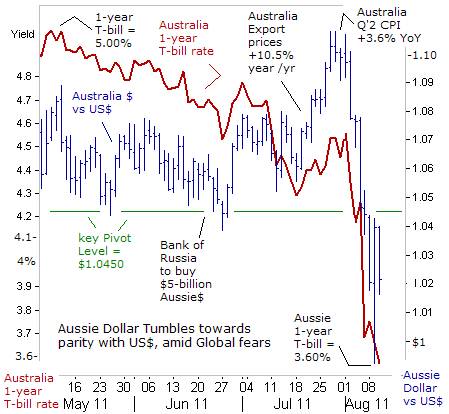

The Aussie dollar is the symbol of global risk taking. And with Japanese and US-interest rates pegged near zero; these central banks are in effect subsidizing risk-taking in the commodity and stock markets. Carry trades in the global bond markets has allowed the “too big to fail” banking Oligarchs to earn billions in profits. The amount of paper currency circulating in the global economy is at its highest level ever. This vast wave of hot money can find no profitable outlet in production, so it’s used for speculation in commodities and currencies, such as the Aussie dollar, which hit a high of $1.100 in July, up sharply from a low of around 60-cents at the depths of the 2008 global financial crisis.

Just a little over 2-weeks ago, the Australian dollar briefly climbed above $1.10 for the first time since it became a free floating currency. Since then, the Aussie dollar made a sharp U-turn, tumbling towards parity with the US-dollar at $1.00. Yield hungry buyers were lying in wait, ready to scoop up the Aussie, which suddenly looked like a real bargain. Tracking a last hour recovery rally on Wall Street, - the Dow Jones Industrials jumped +620-points off the low of the day, the Aussie dollar rebounded in lockstep, surging 5-US-cents off its low of the day to hit a high of $1.0435 in New York.

Sky-high commodity prices have helped lift Australia’s terms of trade, or the ratio of export to import prices, to the highest since records began in 1870 and double the average for the whole of the 1990’s. The Reserve Bank of Australia (RBA) has estimated that for every year the terms of trade stays at such stratospheric levels, it is worth a staggering 12 to 15% of the country's A$1.3-trillion of annual economic output. Still, amid the sudden meltdown in global stock markets, and the sharp downturn in key industrial metals and coking coal prices, the Aussie dollar suddenly finds itself on the defensive.

A key anchor of support for the Aussie dollar, its relatively high interest rates has suddenly been undermined by the a sharp slide in Australia’s 1-year T-bill rate, which has plunged by 150-basis points since mid-May, to around 3.50% today. The sharp slide in Aussie T-bill rates suggests the RBA would be in a position to lower its cash rate in the months ahead, if the Australian economy gets caught up in the global contagion. The slide in China’s factory activity is also a worry for the Aussie dollar, although Chinese imports from Australia rose +15% in June, from the previous month, to $7.6-billion, among the highest on record. This meant a China ran a deficit with Australia of $4.6-billion in July alone.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2011 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.