US Interest Rate Cuts and Mortgage Bailout Will Avert US Recession in 2008

Interest-Rates / US Economy Dec 11, 2007 - 12:35 AM GMTBy: Nadeem_Walayat

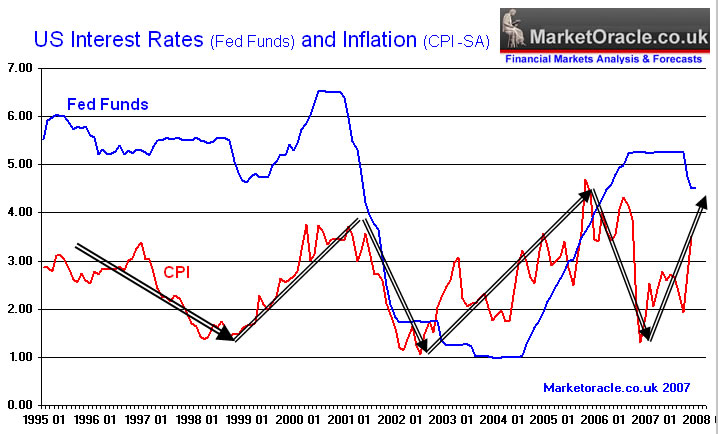

The US Fed's reaction to date to the housing bust and US subprime mortgage credit crisis is by making deep cuts in US interest rates that today will see at least a further 0.25% cut bringing the rate down to 4.25%, off 1% from the 5.25% high just 3 months ago.

The US Fed's reaction to date to the housing bust and US subprime mortgage credit crisis is by making deep cuts in US interest rates that today will see at least a further 0.25% cut bringing the rate down to 4.25%, off 1% from the 5.25% high just 3 months ago.

The US Fed is clearly in full blown panic mode, with the aim of the cuts to avert a potentially deep US recession.

The US Fed will continue cutting interest rates during 2008, regardless of the consequences to the US dollar and inflation (which has a little further to rise going into 2008). The cuts are ensured by the worst housing market conditions since the great depression which is a harbinger of a deep recession unless emergency preventative action is taken now. Therefore the primary observable goals of the interest rate cuts are to:

a. Stabalise the US housing market

b. Unfreeze the interbank money markets and for the credit markets to start operating normally.

Both a) and b) are linked, as you will not have an unfreezing of the credit markets until asset prices that mortgage backed securities are priced on stop falling in value. Both of the targets are so as to prevent a meltdown in consumer spending, which would ignite the recession.

The Feds actions to date and later today are signs of a emergency action and therefore suggests that the Fed will cut rates much deeper than current expectations.

Interbank Interest Rate Spread

The US 3 months interbank rate at 5.20%, suggesting strongly that the impact of the rate cuts is so far are not having the desired effect of easing liquidity. On the contrary the situation has increased flight to quality amongst investors and institutions. This again confirms the Fed will cut interest rates far more deeply so as to change sentiment in the credit markets.

Paulson's Mortgage Bailout Plan

Acknowledging the severity of the credit squeeze as a consequence of the falling housing market, the Treasury Secretary is attempting to take further action to support the mortgage market via a rescue plan and attempt to stem the tide of foreclosures forecast for 2008. At this point the plan is limited and aimed specifically at those home owners who at the time of adjustable rate mortgages reset are up to date with repayments AND will be able to demonstrate that they will not be able to afford the higher reset interest rate, thereby freezing the interest rate for 5 years.

Its highly likely that as the number of foreclosures continues to soar during 2008 and the housing market continues to decline, the bail out plan will be expanded to include more home owners at risk of foreclosure.

Whilst the plan will meet the target of supporting the housing market. It will also create an artificial market in housing that will lead to a protracted price depressed housing market than what may have otherwise transpired.

Can the US Fed Avert a Recession ?

The consensus commentary is clearly shifting in favour of a US recession during 2008. However apart from a recession in the housing sector and job losses expected in the financial sector. The stock market (Dow Jones) trading near its all time high seems to be suggesting that the worries are over stated.

The job losses expected are unlikely to result in a US recession, the housing market credit crunch will impact on growth but only to perhaps shaving 2% or so of GDP growth therefore 2008 looks set to achieve growth in the region of 1.5% to 3% and thus avoid a US Recession. Also, the falling dollar is already having a positive impact on exporters that looks set to continue to benefit from the on going dollar devaluation during 2008.

Implication for the Financial Markets

US Dollar - The dollar's bear market will persist during 2008, until signs emerge that the US housing market decline is coming to an end.

Global Stock markets - My expectation is that the worlds stock markets as measured by the main indices will rally strongly during 2008 on the premise that the US will avoid a recession as well as a consequence of the growth spiral. The global P/E ratio analysis of 18th Nov, suggested which markets looked more favourable in terms of price / earnings and growth prospects. Already the stock markets have rebounded strongly a midst an atmosphere of gloom and doom, analysis of the 12th of Nov, suggested an imminent low in advance of the resumption of the bull market into year end.

US Housing Market - As mentioned above, the rescue plans will ensure that the housing market will remain depressed for many years, much as Japan experienced during its bad debts crisis that was prolonged due to government intervention.

Financial Sector - Whilst the bad news and bad debt provisions is far from over, selective large banks with little exposure to the US housing mortgage market look good value, analysis of 19th Nov looked at several UK based banks that have since performed strongly.

In Summary

The US and much of the western world is going to go through a rough patch during 2008. The US in my opinion does look set to avoid a recession, and much of the funds that were flowing into the housing markets and now pouring into treasuries will seek higher returns elsewhere. Those higher returns look set to be found in the stock market as investors realise that the economic picture is not so bad, and that the stock market instead of falling as the growing consensus suggests, will continue to trend higher and attract more converts seeking higher returns.

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.