Demand for Wealth Preservation Ensures Gold's Retreat is Temporary

Commodities / Gold and Silver 2011 Oct 06, 2011 - 04:14 AM GMTBy: Nick_Barisheff

Gold will continue rising in value over the coming years for one reason: The primary buyers are purchasing physical gold for wealth preservation, and there simply isn't enough physical gold to satisfy their appetites. The recent pullback was by no means the bursting of the gold bubble. Bubbles are characterized by months of extended exuberance and consistently higher highs -- not the two- and three- hundred-dollar corrections we've seen twice in the past few weeks. Such pullbacks are healthy as they indicate gold has much, much farther to go.

Gold will continue rising in value over the coming years for one reason: The primary buyers are purchasing physical gold for wealth preservation, and there simply isn't enough physical gold to satisfy their appetites. The recent pullback was by no means the bursting of the gold bubble. Bubbles are characterized by months of extended exuberance and consistently higher highs -- not the two- and three- hundred-dollar corrections we've seen twice in the past few weeks. Such pullbacks are healthy as they indicate gold has much, much farther to go.

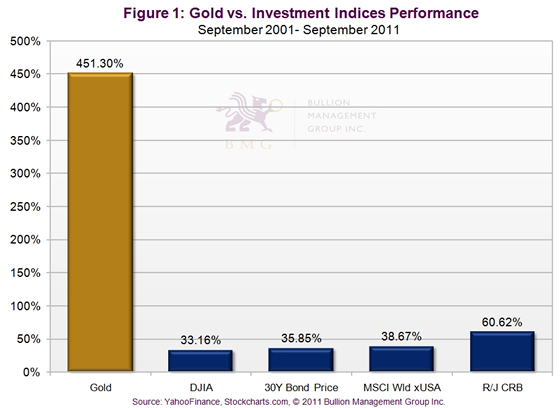

Those who buy gold for wealth preservation are happy. Gold has outperformed all other asset classes for most of the past decade (Figure 1). As other asset classes, such as bonds, currencies and stocks, become more positively correlated to each other, gold continues moving in the opposite direction and therefore continues serving its true purpose of wealth preservation effectively.

For the half of the world that will be responsible for gold's eventual five-digit destination -- the Chinese, Russian, Middle Eastern and Indian buyers -- gold is doing its job. They are far less concerned about short-term price swings. Their distrust of fiat currencies has not abated just because the US came up with yet another plan for extending the dollar's hegemony -- the latest being an attempt to flatten the yield curve between long- and short-term bonds through the Fed's "Operation Twist." Many of these people remember how currency debasement can destroy wealth. The world's largest gold buyers, the Chinese, experienced hyperinflation between 1947 and 1949. This is still fresh in their minds.

As the aging population, outsourcing and a variety of other irreversible trends converge, growth slows -- yet growth is essential to our current economic structure, and currency must be created to compensate for this slowing growth. Ultimately, Western central bankers have no other choice but to continue printing currency and, through this act, debasing its value.

Despite Federal Reserve Chairman Ben Bernanke's recent assurances that inflation will remain at two percent, real inflation, that which is determined by measuring the original basket of goods before they began substituting expensive items for cheaper ones, will continue growing. ShadowStats measures this original basket of goods and puts real inflation at about 11 percent. Inflation is caused by currency debasement. Gold is the best indicator of true inflation because there is a limited supply of it and more dollars/euros/pesos chasing the same limited supply makes gold appear to rise in price.

As the gold holders of the East probably realize, gold is not really rising in value. It is holding its purchasing power much as it has for the past 3,000 years. Currencies are falling in purchasing power against gold. This implies that gold can rise as far as currencies can fall and, since there is no alternative but to continue printing currency to compensate for slowing growth and rising entitlement payments, gold is destined to rise much higher for many years to come.

Gold will continue to rise until the economy is truly healthy again. Talk of deflationary pressures reversing the course of gold is a short-term, Western assessment. Of course, as we've recently seen, when the stock market crashes people sell their winners to cover margin, and lately the big winner has been gold. Last week the gold market saw stop losses, margin calls, raised margin requirements and a rising dollar, so the computers that do most of the trading these days sold on overdrive.

The Eastern buyers, as well as sophisticated Western investors, are happy with pullbacks as they allow them to buy more gold at attractive prices. The Chinese Central Bank has publicly stated that it plans to raise reserves from 1,100 to 6,000 tonnes of gold. Unofficially, they have stated 10,000 tonnes. They think in terms of decades, not nanoseconds like Western speculators. The Chinese government encourages its citizens to put five percent of their savings in gold. They are developing infrastructure to make gold ownership as easy as possible and to make the country the most gold-mining-friendly country in the world. In fact, they now lead the world in gold production. For those who like to compare our current gold market with that of the late 1970s it is well to remember that the Chinese, and most of today's developing countries, were not even participants at that time.

Perhaps the most significant development of the past decade, and one that has gone virtually unnoticed in the West, is the Pan Asian Gold Exchange (PAGE) to be hosted in Kunming City, Yunman Province - the gateway to all of Southeast Asia. This is a game-changing event that is part of China's five-year plan to change the entire face of the gold market. In the west, 100 ounces of paper gold are traded for every ounce of physical. The PAGE will be the polar opposite of this. It will have a 1:1 leverage rate between the renminbi and gold. This perhaps reflects the Chinese distrust of gold derivatives and paper currencies. In a recent Forbes article , titled "The Chinese Mean To Control The Global Gold Market," author Robert Lenzner makes the point that this is the plan.

Of course, gold has a long history of moving to where things are made and, like Western manufacturing jobs, gold is moving east. The PAGE is scheduled to open to the 320 million customers of the Chinese Agricultural Bank late this year and to the rest of the world in 2012. As it does, the PAGE will appeal to gold buyers who prefer to trade in a liquid physical market over a paper market. It will increase the demand for physical gold exponentially. Confidence in paper products is rapidly waning. Easterners are simply further ahead of the West on this as they have more recent memories of the destruction currency devaluations can cause.

At BMG we encourage our customers to think outside the box of this Western-centric fiat thinking and to assume the broader, value-based perspective that gold affords, one that many Easterners have already embraced. We encourage our customers to think in terms of ounces not dollars. This is of course much easier to do when you own physical bullion. Such a vantage point helps to put these pullbacks in perspective. When gold corrects, buy more. When it resumes its long multi-year ascent, be grateful you did.

By Nick Barisheff

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

© 2011 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.