The Slippery Slope of Sliver

Commodities / Gold and Silver 2011 Oct 24, 2011 - 02:49 AM GMTBy: EconMatters

Silver has taken some serious beatings lately, but there seems to be a renewed optimism in the market place towards the white metal as Bloomberg reported that

Silver has taken some serious beatings lately, but there seems to be a renewed optimism in the market place towards the white metal as Bloomberg reported that

"Investors for now are getting more bullish. As well as adding to ETP [Exchange-Traded Product] holdings, they are also buying bullion coins, with the U.S. Mint selling 4.46 million ounces of American Eagles in September, the most since January.

....Combined assets in ETPs rose 4.8 percent to 17,515 metric tons since mid-July, equal to almost nine months of mine production, the data show.

Money managers raised bets on higher prices for the first time in more than a month in the week ended Oct. 11, Commodity Futures Trading Commission (CFTC) data show. The net-long position gained 1.3 percent to 11,573 futures and options contracts."

According to the median in a Bloomberg survey of 11 analysts, the metal may average $38 an ounce this quarter and rise to a record $42 by the final three months of 2012, which would imply about 18% and 33% gain respectively from the current price level. China industrial usage, and investment demand partly due to U.S. Fed's record low interest rates, are cited as the primary reasons to be bullish on sliver.

But not everyone buys the China growth story with silver. Morgan Stanley, for example, is pouring cold water by predicting output from mines will rise 1.4 percent this year, accelerating to 4.5 percent in 2012, and that the global oversupply of silver will persist until at least 2016. Barclays also echos a similar bearish outlook for silver believing "the fundamentals still look very weak,” and expects the metal to average only $27 in the fourth quarter of next year, implying a 1% loss from the current level.

Bloomberg further pointed out that historically, silver has not performed well during crisis as the metal slumped 24 percent during the 2008 financial crisis, the most in almost a quarter century, while gold rose 5.5 percent. So sliver, although considered as part of the precious metal family, may not preserve asset values as much as people tend to think if we head into a double dip recession or if some kind of crisis erupts.

Many investors, using gold as a benchmark, believe silver is an attractive alternative investment to gold as it is cheaply priced relatively to gold with the recent pullbacks. Moreover, silver could still benefit from China and investment demand.

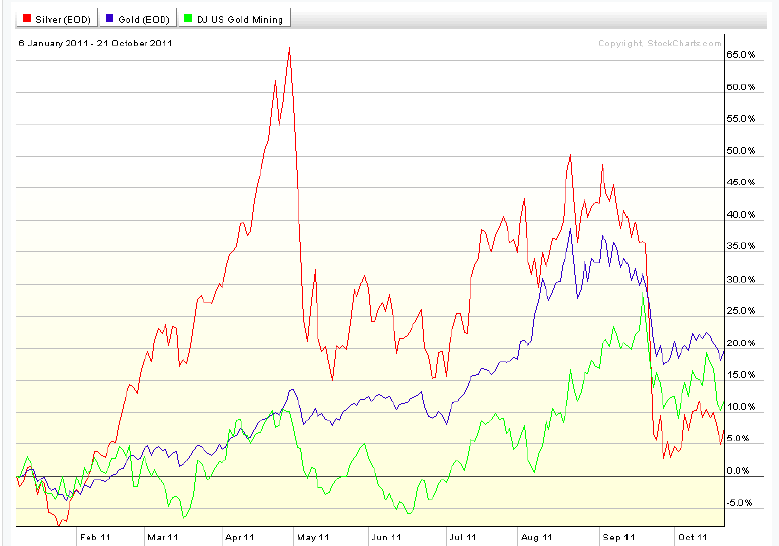

However, technically speaking, whenever you see two gigantic vertical Niagra-Falls-size drops, with several sizable mini drops in between--all within a 6-month time--on the price chart (below), without the justification of a far superior return, it is a sign that you would be much better off elsewhere in terms of risk / reward.

The chart below compares price performances of Gold, Silver and Dow Jones U.S. Gold Mining Index. As the chart illustrates, silver would give you a lot more sleepless nights (EMS probably needs to be on standby as well) than Gold or the stocks of gold miners..

|

| Chart Source: stockcharts.com |

Furthermore, based on market fundamentals, the recent data coming out of China suggest the world's growth engine is still fighting inflation and is definitely slowing down. While we see a very low probability of a China Crash Scenario, this downshift will most likely weaken the demand side of the investing thesis for silver

We got a lot of flak when we warned physical sliver investors in April that the metal was at the bubble stage, and the pitfall of following the futures market actions. At the time, based on the market condition and valuation, we concluded that,

"This is the epitome of a bad investment. You’re supposed to buy low and sell high, not the other way around. Remember, you are an investor not a trader if you’re buying the Physical Silver Coins. Thus you have to be a “Value Investor”. And I am here to tell you there are no ‘Values’ in the Physical Silver Market, or any other Silver Market for that matter."

Now fast-forward six months later, the price of silver has tanked almost 32%, whereas Gold has held up a lot better -- up 7.65% in the same period. Silver coins, which represent the physical market, were as high as around $52 in April, and now it's at the $32 range, a 58% plunge, even worse than the spot silver. So what that means is that some investors could be $20 underwater on each silver coin if they got in around the peak.

Currently, the valuation of silver may have improved from the bubble level six months ago; nonetheless, due to the uncertainty in the broader market and economy, the sector market specific thin liquidity, ridiculously high volatility and margin requirements, we maintain our rating that silver remains an ultra speculative / risky investment option that investors should stay away from.

We have written at length here, , regarding the pros and cons and potential pitfalls of investing in the silver market, and strongly caution investors against even engaging in that market -- Let's just say even if you were an Olympic skier, you would not want to ski on that slope.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.