Gold in Tight Trading Range

Commodities / Gold & Silver Dec 20, 2007 - 09:13 AM GMTBy: Gold_Investments

Gold was down $1.80 to $801.10 per ounce in New York yesterday and silver was up 4 cents to $14.07 per ounce. Gold traded sideways in Asia and Europe and the London AM Fix was at $799.50 (down from $801.50).

At the London AM Fix gold was trading at a new all time record in British pounds at £401.62 GBP (up from yesterday's London AM Fix at £399.35). Gold went up to €557.30 EUR (up from yesterday's London AM Fix at €556.83 ). Gold has again increased in sterling and in euros. Gold thus surpassed it's all time record high in british pounds at £400.47 and will likely do so in euros and dollars early in the New Year.

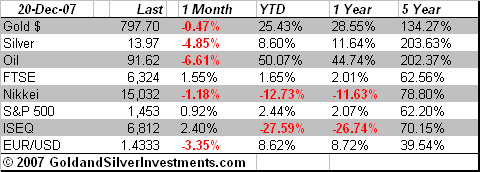

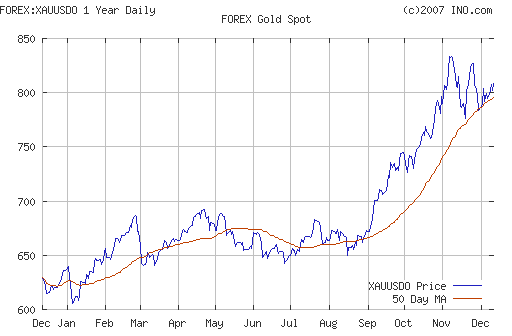

Gold in dollars remains confused and in a tight trading range with mixed signals coming from the bounce in the dollar and the still elevated oil price. Gold is up some 25% year to date and with inflation on the rise and with the printing presses in full effect gold will likely again outperform other asset classes in 2008.

Today's economic releases are on the second order in importance, but one should watch initial jobless claims and the Philly Fed Index for signs of weakness in the US economy. Weekly unemployment figures and revised third-quarter GDP are out at 1330 GMT, while November leading indicators are out at 1500 GMT. Bear Stearns fourth-quarter results could also be in focus since it is one of the first banks to take a major hit due to its involvement in the US subprime mortgage market.

Financial conditions are worsening by the day despite the best efforts of the central banks. News that Standard & Poor's had offered a grim assessment of bond insurers and had cut ACA Financial Guaranty Corp. to junk status is a further very serious development in the unfolding saga. S&P warned that the AAA rating of larger bond insurers that underpins so many fixed-income investments could come under pressure. Shares of bond insurers AMBAC Financial Group Inc and MBIA Inc tumbled after Standard & Poor's downgraded the outlook for both, indicating that their triple-A credit ratings are at risk.

Should a large bond insurer experience significant financial difficulties there will be financial systemic reverberations.

The New York Times reports that Morgan Stanley reported the first quarterly loss in its 72-year history Wednesday, heightening fears that the financial toll would keep mounting from the fast-spreading crisis in the subprime mortgage market. The company took a $9.4 billion charge on subprime-linked investments for the fourth quarter, bringing its cumulative charges for subprime mortgages to $10.8 billion. In a stark reflection of its diminished status it also said it would sell a $5 billion stake to a Chinese investment fund to shore up its capital.

Wall Street banks so far have reported more than $40 billion of losses as a result of the crisis in the mortgage market. Worst-case estimates put the eventual bill at $200 billion or more. The tally is likely to rise again Thursday when Bear Stearns is expected to report a quarterly loss. The developments on Wednesday were a stunning turn of events for Morgan Stanley, an offshoot of the Morgan banking dynasty that has counseled corporate America since the Depression.says that how reliant Morgan Stanley and Wall Street are on foreign funds and gives additional credence to the joke now circulating on trading floors: “Shanghai, Dubai, Mumbai or goodbye.”

This shows how western financial institutions and the western financial system is increasing reliant on their Middle Eastern and Asian creditors and shows how the balance of economic power and wealth is shifting eastwards. The unipolar world that emerged after the Cold War is being replaced by a multi polar world where Asian countries are no longer prepared to play second fiddle to the US and other western countries.

Le Metropole Cafe's William Murphy noted the news that "the Swiss National Bank sold 11.3 tonnes of gold in November follows their only having sold 12.3 tonnes in October, and means the formerly very regular c.1.5 tonnes a business day pace has decisively slowed. One wonders why. The October reduction was hypothesized to have been accommodating the 43 tonne sale by the ECB itself, an idea presumably undermined by the November report. If the SNB abides by its' public statements, they only have 112 tonnes left of the 250 tonnes they have said they will sell by September 2009: 5.1 tonnes a month."

Given the clear and present systemic risks facing the global economy it seems increasingly likely the western central banks who have been selling their gold (unlike the Federal Reserve) will slow down their gold sales in the coming months and may join their South American, South African, Russian, Chinese and other Asian central banks counterparts in becoming net buyers.

Silver

Silver is trading at $13.99/14.01 at 1200 GMT after yesterday's rally.

PGMs

Platinum was trading at $1511/1517 as per above (1200 GMT).

Spot palladium was trading at $354/358 an ounce (1200 GMT).

Oil

Oil remains at elevated levels above $90 per barrel and NYMEX light sweet crude oil was trading at over $91.70 a barrel creating gold buying interest from investors looking to hedge against surging inflation.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.