Yellen is Supportive of Additional Fed Action to Support U.S. Economic Activity

Economics / US Economy Nov 30, 2011 - 03:18 AM GMTBy: Asha_Bangalore

The Fed's Vice Chair Janet Yellen presented a case for additional Fed action to support economic activity in the United States. These two excerpts (emphasis added) from her speech indicate her opinion about the necessity for Fed action

The Fed's Vice Chair Janet Yellen presented a case for additional Fed action to support economic activity in the United States. These two excerpts (emphasis added) from her speech indicate her opinion about the necessity for Fed action

"The Federal Reserve continues to provide highly accommodative monetary conditions to foster a stronger economic recovery in a context of price stability. Moreover, the scope remains to provide additional accommodation through enhanced guidance on the path of the federal funds rate or through additional purchases of longer-term financial assets."

More generally, I see a strong case for additional policies to foster more-rapid recovery in the housing sector. Indeed, to provide greater support for mortgage markets, the Federal Reserve recently adjusted its program for reinvesting its securities holdings.

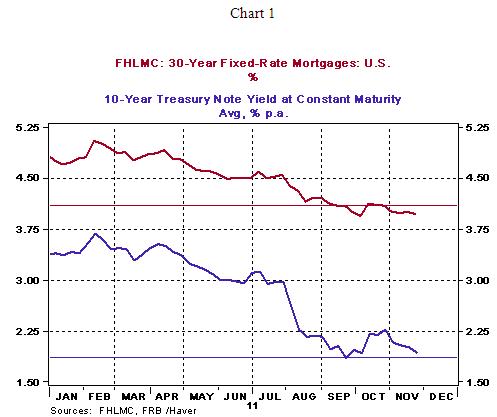

Essentially, another round of quantitative easing made up of largely mortgage-backed securities is the likely course of Fed action in the first quarter of 2012. The Fed commenced implementation of the maturity extension program, or what is widely known as "Operation Twist," as of September 21. The program includes purchases of $400 billion of longer-term Treasury securities to replace shorter-term Treasury securities. The program has succeeded in bringing about a small reduction in mortgage rates (see Chart 1). It is expected that additional purchases should bring about a further reduction in mortgage rates. Janet Yellen’s remarks suggest that Bernanke has her vote for further Fed action, but it may take a few more weak economic reports to reduce the number of dissents that prevailed at both the August and September 2011 FOMC meetings.

Outlook of Consumers Improves in November

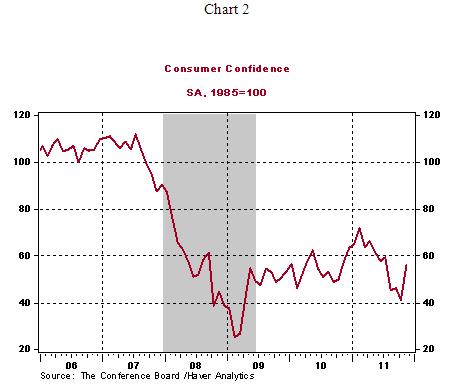

The Conference Board's Consumer Confidence Index increased to 56.0 in November from 40.9 in the prior month. The sharp increase reflects gains in the Present Situation (38.3 vs. 27.1 in October) and Expectations Indexes (67.8 vs. 50.0).

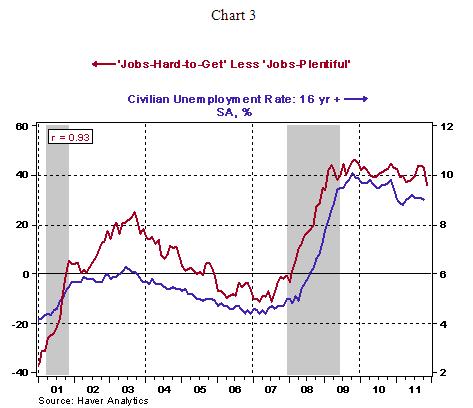

Households were more optimistic about the labor market when the November survey was conducted compared with their assessment in October. The number of respondents indicating that "jobs are plentiful" increased to 5.8% from 3.6% in October and fewer respondents held the opinion that "jobs are hard to get" (42.1% vs. 46.9% in October). The net of these two indexes (36.3 vs. 43.3 in October) has a strong positive correlation with the unemployment rate (see Chart 3). Based on this relationship, it should not be surprising to see to a lower unemployment rate for November when the employment report is published on Friday, December 2.

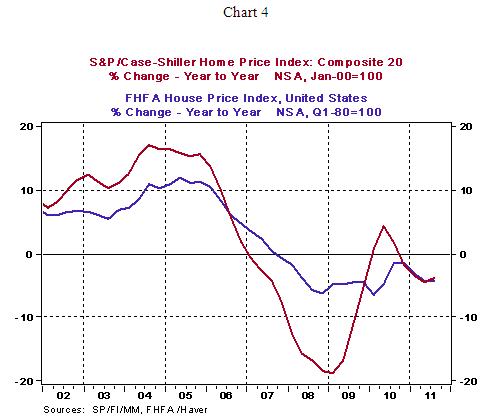

Home Prices in September Show a Small Improvement

The Case-Shiller Home Price Index fell 3.6% in September from a year ago, which represents a small improvement from August (-3.8%). In the third quarter, the Case-Shiller Home Price Index fell 3.8% vs. a 4.4% drop in the second quarter. The FHFA House Price Index declined 4.3% in third quarter vs. 4.2% in the second quarter. The good news is that home prices have stopped falling at a rapid pace. Also, the metro-level Case-Shiller Home Price Indexes show that nine metros (Chicago, Cleveland, Dallas, Detroit, Denver, Minneapolis, Portland Washington, and New York) show year-to-year gains in September.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.