Japanese Economy Slumps, Industrial Production Falls 2.6%

Economics / Japan Economy Dec 28, 2011 - 08:38 AM GMTBy: Mike_Shedlock

A torrent of bad news hit Japan in November. Please consider some details from the Bloomberg article Japan Factory Output Falls on Global Slump

A torrent of bad news hit Japan in November. Please consider some details from the Bloomberg article Japan Factory Output Falls on Global Slump

- Factory output fell 2.6 percent from October

- Exports fell for the second straight month

- Capital spending in the third quarter dropped 9.8 percent

- The Bank of Japan Tankan quarterly index of corporate sentiment fell to minus 4 this month. A negative figure indicates that pessimists outnumber optimists

Japan blames this mess on a strong Yen and Thailand’s worst flooding in almost 70 years. The flooding crippled the output in Southeast Asia of Japanese companies such as Sony Corp. and Honda Motor Co.

Japan created four separate "supplementary budgets" totaling of 20 trillion yen ($257 billion) to deal with the the earthquake and tsunami. In 2012, Japan will create a "separate budget" for reconstruction.

However, no matter how many piles spending is split into, Japanese deficit spending cannot be hidden.

Japan's problems don't stop there. Europe is Japan's third largest export market, and Europe is a basket case. Europe will remain a basket case if Eurozone austerity measures are even modestly implemented.

Land of the Rising Debt

Pater Tenebrarum had some excellent charts and commentary in his post Land of the Rising Debt

Government spending does not 'spur growth'. If it did, Japan would have been the world's growth engine for the past two decades. In reality, every cent the government spends must be taken from the private sector and therefore can no longer be spent or invested by it. We can see what the government's spending achieves (not much) – what we cannot see is what would have been achieved had the government left well enough alone and the private sector had saved, spent and invested instead. This is the 'broken window effect' – one must not only consider the obvious economic effects of a policy, but also the 'unseen' ones. Government spending is a burden, not a boon.

Like its counterparts in Europe, Japan's government tries to get its house in order not by reducing spending – apparently a completely taboo subject in Japan – but by raising taxes. This will predictably - just as it does in Europe - double the burden on the economy. Since these tax hikes are immensely unpopular in Japan, it is not necessarily likely that they will happen. Moreover, there may be no more time to take effective countermeasures against the growing debt load: the death spiral may well begin before such measures can be implemented and take effect.

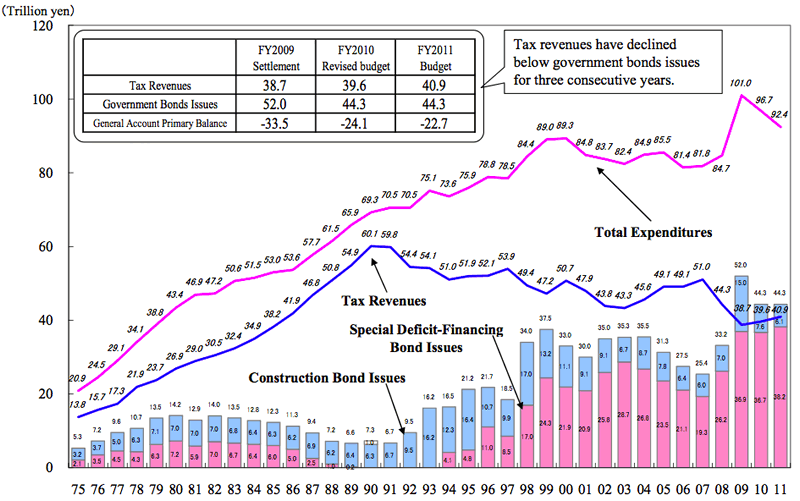

Not only is Japan's debt-to-GDP ratio uncomfortably high, its tax revenues continue to decline precipitously as a percentage of government spending.

In such a situation, the level of interest rates becomes an ever growing concern. Right now, Japan's interest rates remain among the very lowest in the world. And yet, in spite of near record low interest rates, the percentage of tax revenue the government must spend on interest expenses is increasing fast.Powder Keg Waiting for a Spark

The pertinent point is not the sorry state of affairs including a debt-to-GDP ratio of 220%, but rather when it matters. So far Japan has avoided printing on the scale of the Bernanke Fed, but one has to wonder how long that can continue in spite of Japan's dire worst in the industrialized-world demographics.

Tenebrarum points out "At the moment, JGB's trade like 'risk free' debt, in spite of the fact that Japan has lost its 'AAA' rating long ago and has been downgraded again this year, with further downgrades likely. Should the percentage of foreign ownership of JGB's rise significantly, the probability of a 'non-linear' debt market convulsion will rise commensurately. The Japanese government can 'financially repress' its own institutions, but not foreign investors."

"It seems rather like a powder keg waiting for a spark".

Indeed! Moreover, Japan's efforts to kick the can down the road perpetually issuing short-term debt that will need to be rolled over at some point insures the explosion will be massive once the debt-bomb finally ignites. Please see Japan Seeks to Market Record 145 Trillion Yen Bonds in 2012; Kicking the Can Japanese Style for a brief analysis.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.