Credit Crisis Bailouts Benefitting Gold, Silver, Uranium And Rare Earth Miners

Commodities / Commodities Trading Feb 22, 2012 - 02:36 AM GMTBy: Jeb_Handwerger

The Chinese Ideographs for crisis is a two edged sword. One blade is pointed upward to forecast opportunity, the other symbol is pointed downward to signify danger. The short term deflationary crisis in 2011 provided a unique opportunity to buy undervalued miners at historic bargain basement prices.

The Chinese Ideographs for crisis is a two edged sword. One blade is pointed upward to forecast opportunity, the other symbol is pointed downward to signify danger. The short term deflationary crisis in 2011 provided a unique opportunity to buy undervalued miners at historic bargain basement prices.

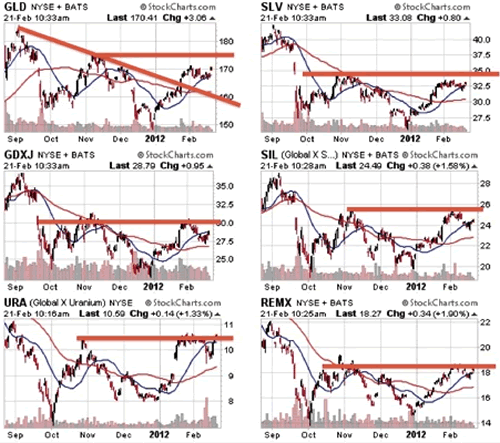

In 2012 the market metrics have been directed upwards for gold (GDX), silver(SIL), uranium(URA) and rare earth miners(REMX) as the 20 and 50 day moving averages turn upward. There is an old truism that fighting the tape can be dangerous for your financial health. It is suspected that the Europeans will try to assuage fears on a Greek bailout to the tune of $172 billon to solidify a global market reversal...for the time being.

This event will be coinciding with the general equity markets breaking through key resistance levels and previous 52 week highs. This powerful move in the S&P 500 (SPY) and Dow Industrials (DIA) makes a strong case that this recent 20% correction and our October 4th buy signal provided an excellent buying opportunity. It appears the equity markets have begun a new uptrend in response to Central Banks worldwide printing money and choosing some degree of inflation. Remember the Japanese, Chinese, English, Americans and Europeans have all instituted accommodative measures and are taking the inflationary path.

With this in mind, we have called for over four months, a powerful a risk on rally despite the naysayers as key resistance levels have been broken to the upside.

In any difference of opinion concerning the marketplace there are always criteria to buttress the bearish sentiment. However, capitalism is not yet ready to head for the hills. Our readers have looked ahead to a surprisingly strong rally in our sectors in 2012. Especially so the rare earths (REMX), uraniums (URA) and of course high quality junior gold (GDXJ) and silver stocks(SIL).

Specifically, subscriber attention should be directed in reviewing our articles on uranium written since the Fukushima disaster. Suffice it to say, for many months we have said it is only a matter of time before the world becomes aware of the strategic importance of uranium in the production of global electricity. Everyday brings additional items of interest that substantiates our position.

The public has chosen to ignore the new day that is dawning for nuclear energy. Rarely do we read of the AP-1000 reactor, which is safer and more economical and being approved right here in the United States for the first time in three decades!

The rare earth sector has been pummeled to the mat to the point where they represent dynamic buys at these cheap levels. Not only are they essential for American national security but the Chinese might be interested in purchasing positions to control their already quasi-monopoly, particularly in such "heavies" as dysprosium and terbium. It is noted with interest that the Chinese have halted production of these metals in order to fine tune prices in response to a weak global economy in 2011. Now that we have seen this revival in industrial metals, prices of these critical elements should continue on their secular long term upward path far outpacing 2011 declines.

Recently, Caterpillar announced record earnings based on the need for them to supply equipment for what they state is rising demand for precious and industrial metals production. Caterpillar said, "We expect producers will continue to struggle to meet this demand, and most commodity prices should average higher than in 2011." This may indicate that while all the attention has been diverted to the travails of the Eurozone, the rest of the world has been increasingly active in mining growth and development. The gold miners have experienced a volatile Jekyll and Hyde 2011. According to this pattern it was oversold and has been ready for this upward reversal in 2012.

We feel that it is only a matter of time before the precious metal miners themselves participate in reflecting this burgeoning mining bull market. Many miners are reporting earning surprises beating analyst estimates, while other companies have taken write downs in a powerful gold bull market. The majors are desperate for resource growth at a time when new discoveries are at an all time low. The majors are becoming less picky and some of the undervalued juniors sitting on developing mines may attract the hungry giants who may pay exciting premiums. Do not forget many of these majors are sitting on large holdings of U.S. dollars, which is increasingly losing value. They must work speedily to transfer that capital into resource growth.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

© 2012 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.