Peak Oil is here, Crude Oil price to reach $150 by 2012 Year End

Commodities / Crude Oil Feb 24, 2012 - 03:21 AM GMTBy: Sam_Chee_Kong

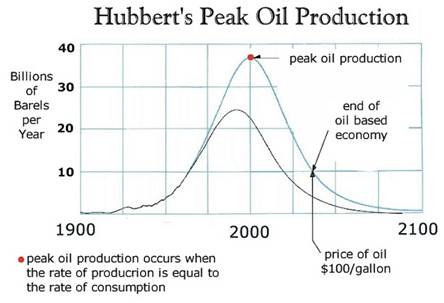

The ‘Peak Oil’ or ‘Hubbert Peak’ theory refers to the peak in global oil production. Oil is finite and non renewable resource and once half of its reserve is depleted then it will go into a terminal decline as shown on the above figure.

The ‘Peak Oil’ or ‘Hubbert Peak’ theory refers to the peak in global oil production. Oil is finite and non renewable resource and once half of its reserve is depleted then it will go into a terminal decline as shown on the above figure.

Hubbert Curve

The theory is named after M.King Hubbert (former Shell geologist) who created a method of modeling the production of oil. Of the 65 oil producing countries 54 already past its peak and is now declining.

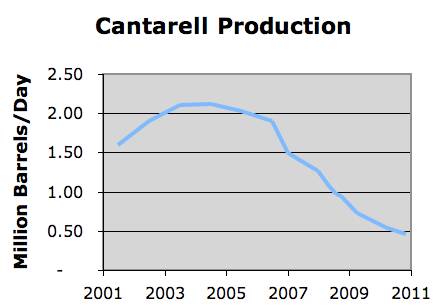

Oil production in the US is down 11% since 1971, UK North Sea down 27% since 1999, Australia down 26% since 2001. Cantarell oilfield Mexico’s largest, has its output falling from 2.1 MBD in 2004 to less than 0.5 MBD today and Saudi’s Ghawar ,the world’s largest oilfield has been declining at about 5% per year.

Even King Abdullah realizes the effects of Peak Oil and had been quoted on a new oil find. “Leave it in the ground …. Our children need it”

According to two researchers at the University of California, world oil supply will peak between 2010-2030 and any renewable replacement technologies will only be viable at around 2140. So, there is an existing gap of 130 years.

US Military findings

The US Military issued a 2010 Joint Operating Environment analysis early this year on Peak Oil and the summary of their findings are:

#1 To sustain the energy needs by 2030 we need to find a fresh supply of 1.4 MBD (millions barrels per day) from now until then.

#2 By 2030 the total world oil consumption will be 118MBD but energy producers will only be able to supply 100MBD.

#3 By 2012 surplus oil production will disappear and as early as 2015, the shortfall between supply and demand will be 10MBD.

Very Bullish Technical Setup

Please take a look at the above 1 year chart for WTI light crude oil. Since making a low of $92.52 on Dec 16th 2011, oil had since been moving on an uptrend. Moreover, there has been a huge base building from early Nov 2011 towards the beginning of Feb 2012.This is indeed a very bullish signal, signaling very HUGE upward movement in crude oil prices in the coming months. After breaking out from the resistance at $103.74 which is recorded in 4th Jan 2012, we shall see crude oil price to break the 52 week high which is recorded in 2nd May 2011 at $114.83.

To calculate our target we take the low in December which is $92.52 and the high in 4th Jan 2012 which is $103.74. The spread between the high and low is $103.74 - $92.52 = $11.22. So, the next immediate target for 1st breakout will be $103.74 + $11.22 = $113.28, which is just a little bit short of the 52 week high of $113.83. Since most of the indicators are overbought, we shall expect a bit of correction before the 52 week high will be taken out on the next leg up, which we estimate to reach $113.28 + $11.22 = $124.50.

Why we still need oil?

It is very difficult for us to discard our dependence of oil overnight and here are some facts:

- Approximately 10 calories of fuel are needed to produce 1 calorie of food

- To produce a car you need 20 barrels of oil

- To produce a 32Mb Ram chip you need 3.5 pounds of fossil fuel

- Fertilizers are made from ammonia which is derive from natural gas

- The manufacturing of 1 ton of cement requires 45 gallons of oil

- Pesticides, agro-chemicals and plastics are made from oil

- The transportation of food, water and medicine requires oil

Peak Oil is here to stay. The Chinese are more prepared than any of us. China is now training 40,000 geologists a year to confront these challenges and they are scouring all over the globe to look for oil and joint energy partnerships. Whereas in the US, it is doing exactly the opposite, training 500 geologists and 40,000 lawyers !! So, it is obvious that both have different directions, one is training more lawyers for its Sub-Prime mess whereas the other is training more geologists to look for more energy sources!!

What can we expect in the near future as a consumer?

- Forget about cheap oil, its history. Oil is going to hit US200 in the next 5 years. Prepare to pay US 5 – 6 per litre for your oil.

- Car sales will be dominated by efficient hybrid and electric cars by 2025

- Prepare to pay more for food, medical, energy and etc due to price inflation.

- Prepare for more street demonstration and riots due to lack of food and higher cost of living.

- Prepare for a change in lifestyles and be more prudent

- Be self sufficient – if possible have a plot of land to grow your own food.

And what have our government done to alleviate our dependence and also our dwindling supply of oil? The warning signs have fallen on deaf ears and by the time when urgency is needed to confront the problem, it will be too late. Unfortunately, there is no easy fix and the clock is ticking!

Any government should be doing everything in its power to encourage the development of technologies in Wind, Sun ,Wave, Biofuel or Nuclear to lessen its dependency on oil.

This is a matter of National Security as demonstrated by Russian President Vladimir Putin, who use of the On/Off switch to control the flow of oil on its pipeline to Ukraine. People needs to WAKE UP to the urgency that is required before it is too late.

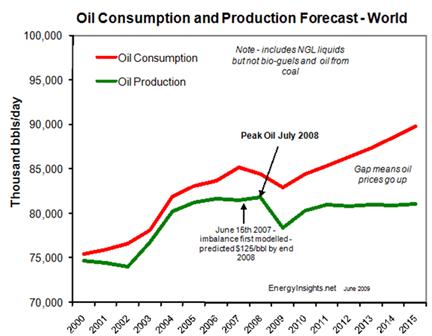

Another factor that need to be taken into consideration is that the expected increase in demand is going to outstripped the supply in a much faster way because we have not taken into consideration the demand of oil from China and India. As you know, historically the growth of oil demand is somewhat about 50% of economic growth but in recent years its growth had somewhat in excess of 60% and increasing as shown by the Oil Consumption Chart above.

Economic growth in China averages about 8-10% for the past two decades , while India’s about 6-8% for the past few years enables them to increase their middle class population. Hence, the demand for cars, motorcycles, industrial consumption on oil also increased proportionally. Currently, China’s car production stands at 18.5 million units per year as of 2011 and according to Reuters, its passenger car sales is expected to increase by as much as 10% next year.

Secondly, the combined population of BRIC nations accounted for more than 40% of the world’s population, we don’t need to be a rocket scientist to figure out where the direction of the demand for energy will be heading for the next decade or two.

In conclusion, we will expect the imminent energy crisis WILL BE WORSE than the current credit crunch!!

by Sam Chee Kong

samcheekong.blogspot.com

cheekongsam@yahoo.com

© 2012 Copyright Sam Chee Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.