Huge Problem With Bernanke's 2% Inflation Target Explained in Graphs

Economics / Inflation Mar 02, 2012 - 03:00 AM GMTBy: Mike_Shedlock

Ben Bernanke wants prices to rise 2%. There are numerous problems with such a proposal, the first being increases in money supply sometimes lead to asset bubbles and not increases in prices of consumer goods.

Ben Bernanke wants prices to rise 2%. There are numerous problems with such a proposal, the first being increases in money supply sometimes lead to asset bubbles and not increases in prices of consumer goods.

Indeed the Fed completely ignored (if not encouraged) the housing bubble because home prices are not in the CPI. A housing bubble and a housing crash was the result.

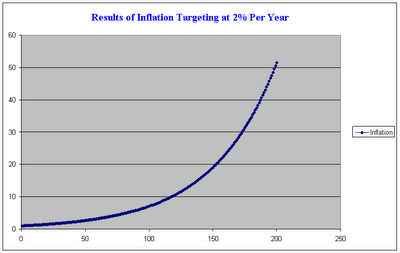

The second major problem with inflation targeting is prices may go up, but wages may not necessarily follow. Indeed they haven't. Let's start with a graph of 2% price inflation over time.

Inflation Targeting at 2% a Year

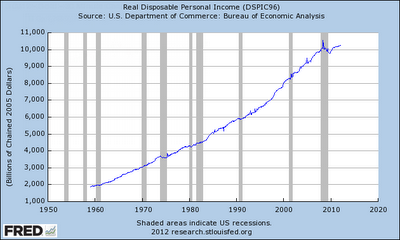

Real Disposable Personal Income

That chart nicely shows a slight parabolic pattern similar to the start of the first chart. However, that growth is a mirage based on population changes. Let's factor out population increases.

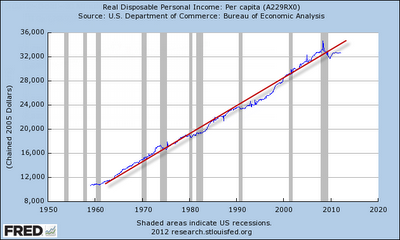

Real Disposable Personal Income Per Capita

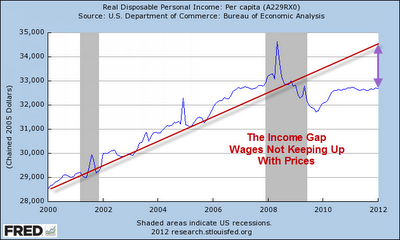

Real Disposable Personal Income Per Capita Detail

Income Gap Discussion

That "Income Gap" is not the only problem. One must also consider "skew". As a result of Fed policies, there have been some income gains, but only at the top end.

"Per Capita", by definition, averages out those gains.

In reality, a select few percent have done exceptionally well as a result of Bernanke's tremendously misguided policies. Another few percent have simply done well, and another perhaps slightly larger group have barely kept up.

The bottom 80 percent or so have fallen much further behind than the per capita charts suggest.

Except for the banks, brokers and bondholders, and everyone else bailed out by the Fed, most have been clobbered by Fed policies.

Ironically, many of those bailed out have the unmitigated gall to whine about their plight. Please See Unbelievable Stress of Making "Only" $200,000 After Taxes for details.

Mike "Mish" Shedlock

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.