Banks Doubling Down on Bad Debts As Merrill Lynch Writes Down $15billion

Stock-Markets / Financial Markets Jan 12, 2008 - 08:14 PM GMT

Merrill Lynch, the third largest U.S. securities firm, is expected to write down $15 billion in the fourth quarter, nearly twice as much as previously announced. Analysts had recently been expecting a $12 billion loss for the same period. Citigroup may face another $14 billion of losses, according to J.P. Morgan Chase and Bank of America may announce $5 billion of write-downs in collateralized debt obligations.

Merrill Lynch, the third largest U.S. securities firm, is expected to write down $15 billion in the fourth quarter, nearly twice as much as previously announced. Analysts had recently been expecting a $12 billion loss for the same period. Citigroup may face another $14 billion of losses, according to J.P. Morgan Chase and Bank of America may announce $5 billion of write-downs in collateralized debt obligations.

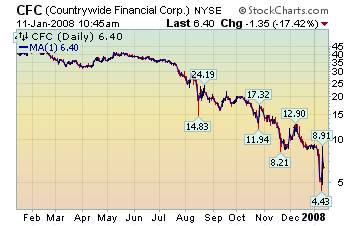

In the meantime, Bank of America, already stung by its $2 billion investment in Countrywide Home Loans in August, is raising the stakes twice again by betting another $4 billion in an all-out purchase of Countrywide. Their original $2 billion is now worth approximately $640 million. I believe that this is an error in judgement that will come back to haunt them in the future. In normal times, the potential payoff from buying a down-and-out company like Countrywide would be outstanding. However, the expected number of mortgage resets in 2008 are expected to exceed those seen in 2007. Maybe that is why the purchase may not close until the third quarter of 2008, if the company is still in business.

In the meantime, Bank of America, already stung by its $2 billion investment in Countrywide Home Loans in August, is raising the stakes twice again by betting another $4 billion in an all-out purchase of Countrywide. Their original $2 billion is now worth approximately $640 million. I believe that this is an error in judgement that will come back to haunt them in the future. In normal times, the potential payoff from buying a down-and-out company like Countrywide would be outstanding. However, the expected number of mortgage resets in 2008 are expected to exceed those seen in 2007. Maybe that is why the purchase may not close until the third quarter of 2008, if the company is still in business.

Erratum: In last weeks article, I mentioned that customer deposits were bank assets. That was incorrect. They are bank liabilities . From these liabilities, banks fund loans and investments, which are income-producing assets of the bank. If the bank were to simply keep the money in a vault, it would earn no income and worse, incur the ordinary expenses of running the bank.

No confidence.

Consumer confidence fell to a record low in January. People are worried about jobs, energy bills, foreclosures and just a general angst about the economy. Consumer gloominess translates into less willingness to spend money. If the country isn't already in a recession, a continued lack of confidence will certainly raise the chances of one.

Weak holiday sales spark concerns for the market.

As if the banks didn't have enough trouble, the retailers are reporting weak Christmas sales as last minute shopping and gift card purchases turned out to be a non-event. “ Concerns about higher gasoline prices and food costs as well as declines in the credit and housing markets have reduced shoppers' mall trips and made them tighten their purse strings, analysts said.”

As if the banks didn't have enough trouble, the retailers are reporting weak Christmas sales as last minute shopping and gift card purchases turned out to be a non-event. “ Concerns about higher gasoline prices and food costs as well as declines in the credit and housing markets have reduced shoppers' mall trips and made them tighten their purse strings, analysts said.”

In addition, the technical pattern is still not complete. Should the S&P 500 decline below the August low, further selling may ensue.

Treasury bonds may participate in a general decline.

Treasury bonds were lower yesterday. This flies in the face of the argument that a Bernanke rate cut should stimulate bonds. That has the potential of removing bonds from the safe haven list in a general decline. Please note the expanding triangle formation in the chart. Should treasury bonds decline below 113, the entire rally from June may be wiped out. Be aware…the risk in long bonds may be higher than anticipated.

Treasury bonds were lower yesterday. This flies in the face of the argument that a Bernanke rate cut should stimulate bonds. That has the potential of removing bonds from the safe haven list in a general decline. Please note the expanding triangle formation in the chart. Should treasury bonds decline below 113, the entire rally from June may be wiped out. Be aware…the risk in long bonds may be higher than anticipated.

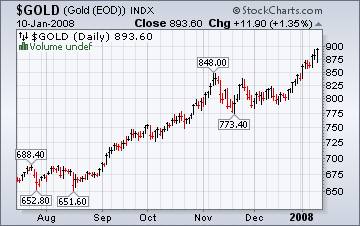

Gold at $900?

Well, folks, it looks like I have egg on my face. I suggested last week when the bullish sentiment is so prevalent, that it's time to look for a change of trend. The problem is, sentiment is not the most precise timing tool, as many analysts know well. Gold hit $900 today.

Well, folks, it looks like I have egg on my face. I suggested last week when the bullish sentiment is so prevalent, that it's time to look for a change of trend. The problem is, sentiment is not the most precise timing tool, as many analysts know well. Gold hit $900 today.

“The funds are really heavily at play ... The momentum with gold is almost like mania . We keep wondering how high it will go," said Jon Nadler, an analyst with Kitco Bullion Dealers in Montreal .

The Nikkei at lowest since 2005

The Nikkei 225 Index keeps going lower, as subprime woes and a poor retail outlook also hit Japan . Japan 's economy is so tied to the U.S. that, as the saying goes, “When the U.S. sneezes, Japan catches pneumonia.” The problem with the chart pattern is that the Nikkei has run out of near-term support levels. Unless it can rally here, we may see the decline get much more serious.

The Nikkei 225 Index keeps going lower, as subprime woes and a poor retail outlook also hit Japan . Japan 's economy is so tied to the U.S. that, as the saying goes, “When the U.S. sneezes, Japan catches pneumonia.” The problem with the chart pattern is that the Nikkei has run out of near-term support levels. Unless it can rally here, we may see the decline get much more serious.

The Shanghai Index is running into round number resistance.

SHANGHAI (XFN-ASIA) - China A-shares finished the morning session mixed amid some consolidation after the main index hit key resistance at 5,500 points, dealers said.

SHANGHAI (XFN-ASIA) - China A-shares finished the morning session mixed amid some consolidation after the main index hit key resistance at 5,500 points, dealers said.

We saw it on the Dow Jones Industrials at 10,000. This is a psychological barrier with round numbers where people tend to take profits and await the outcome. Note how The Shanghai index was stopped right at 6000 when it attempted to re-test the recent high.

The point is, the market has a memory of where it has been and may behave differently when it arrives at those levels again. This could be a good place for a failure for the Chinese market.

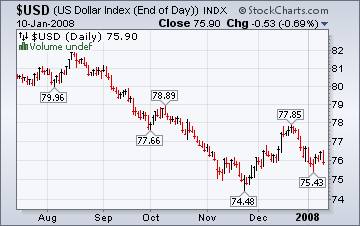

The Loonie loses parity with the dollar.

Jan. 11 (Bloomberg) -- Canada's dollar fell for a sixth day, its longest slide since March, as the economy's unexpected loss of jobs in December bolstered speculation the U.S. slump is hurting Canada.

Jan. 11 (Bloomberg) -- Canada's dollar fell for a sixth day, its longest slide since March, as the economy's unexpected loss of jobs in December bolstered speculation the U.S. slump is hurting Canada.

The currency, the second-best performer against the U.S. dollar last year after Brazil 's real, has declined 2.1 percent this month, the most among the 16 most-actively traded currencies.

Does this look like a slow-motion train wreck?

The Boston Federal Reserve Governor, Eric Rosengren warned that the housing market could get uglier if the economy slows. The fact is, economists have been worried that the economy may slow down substantially more, adding to the housing woes.

The Boston Federal Reserve Governor, Eric Rosengren warned that the housing market could get uglier if the economy slows. The fact is, economists have been worried that the economy may slow down substantially more, adding to the housing woes.

Meanwhile, late payments and foreclosures hit their highest level ever recorded in December.

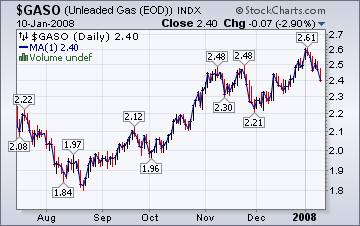

How far will gasoline prices go?

The Energy Information's Weekly Report claims that non-OPEC oil production is on the rise and should add another 1.6 billion barrels of oil per day to worldwide production in 2008-2009. This should ease the strain of costly imports on our economy going forward. Because of this, the EIA sees moderating oil prices in the future. It is hard to say whether this news had any effect on the price of gasoline, but, coincidental or not, gasoline prices are moderating.

The Energy Information's Weekly Report claims that non-OPEC oil production is on the rise and should add another 1.6 billion barrels of oil per day to worldwide production in 2008-2009. This should ease the strain of costly imports on our economy going forward. Because of this, the EIA sees moderating oil prices in the future. It is hard to say whether this news had any effect on the price of gasoline, but, coincidental or not, gasoline prices are moderating.

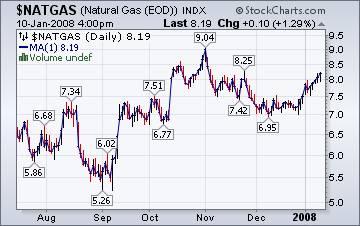

Prices for natural gas remain flat.

The Natural Gas Weekly Update again reiterates that prices are weather-dependent. The stormy weather in the west has brought with it higher prices, while prices in the rest of the country were moderate. Natural gas in storage remains above the 5-year average and suggests that prices may be range-bound rather than spikey. The chart suggests the possibility of moderating prices in the near term.

The Natural Gas Weekly Update again reiterates that prices are weather-dependent. The stormy weather in the west has brought with it higher prices, while prices in the rest of the country were moderate. Natural gas in storage remains above the 5-year average and suggests that prices may be range-bound rather than spikey. The chart suggests the possibility of moderating prices in the near term.

Just what we need…the world's cheapest car.

NEW DELHI - For millions of people in the developing world, Tata Motors' new $2,500 four-door subcompact — the world's cheapest car — may yield a transportation revolution as big as Henry Ford's Model T.

"I think there is immense unmet demand for a vehicle of this type, because it effectively eliminates the great leap currently required to go from a two-wheel to a four-wheel vehicle," Casesa said. "They are creating something that has never existed before, the utility of a car with the affordability of a motorcycle."

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I back at it with our running commentary on the markets. You will be able to access the interview by clicking here .

Happy New Year!

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.