You make most of your money in a bear market, you just don't realize it at the time

Stock-Markets / Stocks Bear Market Jul 12, 2012 - 02:13 PM GMTBy: Submissions

Kerry Balenthiran writes: "You make most of your money in a bear market, you just don't realize it at the time."

The above quote from Shelby Cullom Davis is particularly applicable to stock markets at present, bear markets inevitably lead to investors losing faith with the stock market. However, as values stagnate prices become better value, providing that earnings are increasing. As a long term investor, providing that we have cash to put to work, the ability to buy good quality stocks cheaply should be welcomed. The reality though is that investors in the stock market, just like homeowners, prefer prices to go up after they have bought as this confirms that they made a good decision in buying.

It should be obvious to us that the less we pay initially, the more we will make in the end – the old mantra of buy low, sell high. However during a market correction or general sideways action it often doesn’t feel like that.

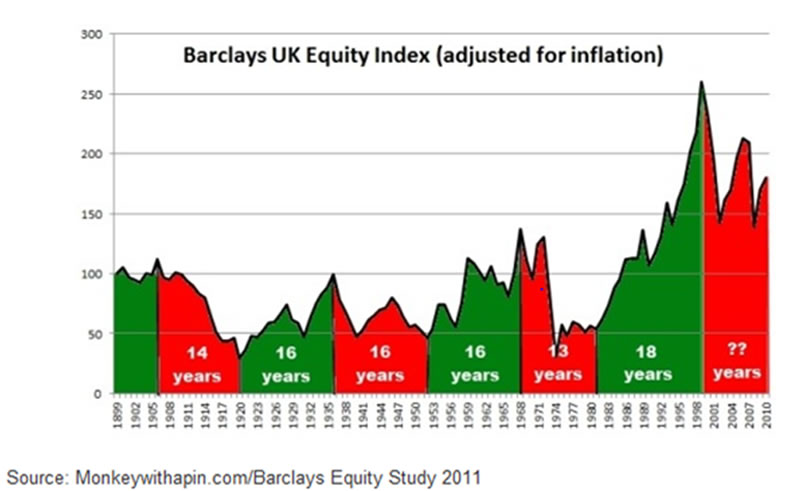

The graph below illustrates the regular bull and bear phases that occur in the stock market and it is important to recognize these phases and adapt our investment approaches, along with our expectations, to fit the stock market conditions.

The bull markets last for 16-18 years and the bear markets last for 13-16 years based on the above chart. The implications of this are that we are currently in 12 years into a bear market which may last between 13 and 16 years if history is anything to go by.

It is possible to dispute when the current cycle began and whether a new bull market started in 2009 but this misses the point. Investors should act consistently and seek out quality stocks regardless of what the market is doing. If the market goes down and target stocks decrease to a desired level then we should buy.

Experienced investors know, and new investors quickly find out, that investing is difficult psychologically because real money is on the line. No one knows what's going to happen tomorrow or the next day/week/month/year, the FTSE 100 could go to 7000 or 4000. Warren Buffet has referred to Mr Market as being temperamental and market volatility can be used to buy at better prices.

Having said all of that, only invest in quality stocks that can survive the turmoil that created the bear market - in the current case excessive leverage during the boom times and the banks now restricting lending in order to increase their capital ratios. The ValuableGrowth portfolio deliberately consists of stocks that are highly cash generative with low levels of debt. These companies do not have to sing to the tune of dysfunctional banks and are free to thrive even under a harsh economic environment.

Long term investors need to have the cash to put to work during the bear market and also have the confidence in their approach to continue to buy despite the market falls.

Kerry Balenthiran writes the ValuableGrowth blog in which he documents the trades and methods of his ValuableGrowth portfolio. ValuableGrowth aims to beat the market by taking a quantitative (numerical analysis) and qualitative (subjective analysis) approach to seeking out superior value growth stock opportunities.

© 2012 Copyright Kerry Balenthiran – All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.