Stock Market Where We've Been, and Where We're Going

Stock-Markets / Stock Markets 2012 Nov 10, 2012 - 10:53 AM GMTBy: EWI

After years of campaigning and billions of dollars spent, the U.S. Congress is virtually no different than before Election Day: a Republican-controlled House, a Democratic majority in the Senate and the same occupant in the White House.

After years of campaigning and billions of dollars spent, the U.S. Congress is virtually no different than before Election Day: a Republican-controlled House, a Democratic majority in the Senate and the same occupant in the White House.

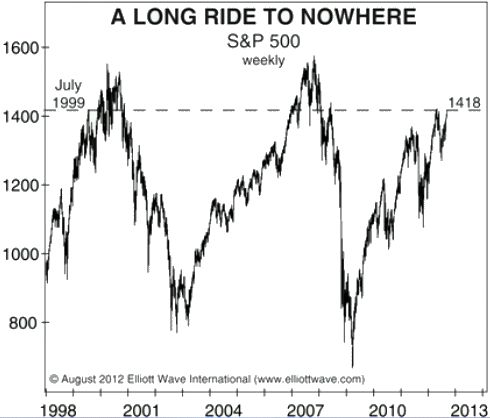

The same can be said for the S&P 500 -- and then some.

Investors who've been in an S&P index fund over the past 13 years would have been better off in a money market account! From July 1999 through August 2012, the S&P 500 was back to where it started.

We think this is the longest topping process in the history of the United States. -- Steve Hochberg, EWI Chief Market Analyst

Yet, the long ride to nowhere is likely headed somewhere very soon -- but not where most investors think. Moreover, the market's trend may unfold much faster than many observers suspect.

You see, according to recent sentiment indicators, the long ride to nowhere has lulled many investors into a sense of complacency.

But please know that we see abundant evidence that should create a sense of urgency in the mind of investors.

That's why the editors of EWI's Financial Forecast Service are hosting a limited-time, free event for U.S. investors.

They want you to see what they see in U.S. financial markets.

You will learn why the stock market top has occurred over a period of time, and why the resolution may be swift.

EWI's editors guide you through chart after chart, including a real eye-opener that shows the triple top in the Great Asset Mania. As you see the scope of this chart, Hochberg provides his insightful commentary.

Hochberg also describes what he means by "inter-market non-confirmation" and observes, "We've had broad swaths of the market peel away from the rally that started in March 2009."

Now learn what Hochberg sees unfolding next by accessing EWI's free Financial Forecast Service limited-time special event. This free rare event is available to you by joining Club EWI (membership is also free). Joining Club EWI only takes a few moments. Please follow this link to learn how >> |

This article was syndicated by Elliott Wave International and was originally published under the headline U.S. Stocks: Where We've Been, Where We Are and Where We're Going. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.