Is the Japanese Yen Doomed?

Currencies / Japanese Yen Nov 28, 2012 - 06:15 AM GMTBy: Axel_Merk

Because of Japan’s massive public debt burden, pundits have called for the demise of the Japanese yen for years. Are the yen’s fortunes finally changing? Our analysis shows that the days of the yen being perceived as a safe haven may soon be over. Let us elaborate.

Because of Japan’s massive public debt burden, pundits have called for the demise of the Japanese yen for years. Are the yen’s fortunes finally changing? Our analysis shows that the days of the yen being perceived as a safe haven may soon be over. Let us elaborate.

So many foreign exchange (“FX”) speculators have lost money shorting the yen that the currency earned the nickname the widow maker. Indeed, as the yen has had a weak patch as of late, some are already cautioning the trade might be crowded. But we don’t talk about a trade; we talk about a fundamental shift in the dynamics that might finally be unfolding.

To understand the yen, consider the earthquakes that hit New Zealand and Japan in early 2011: New Zealand’s shaker caused the New Zealand dollar to fall; Japan’s earthquake, in contrast, pushed the yen higher. In the short-term, earthquakes disrupt economic growth; conventional wisdom suggests less growth leads to a weaker currency. However, economic growth and currencies do not correlate as highly as one might expect. Indeed, everything appears backwards in Japan, and there’s a reason: historically, Japan has enjoyed a current account surplus. As a result, Japan does not rely on inflows from abroad to finance its budget deficit. Despite conventional wisdom, note that when there’s a shock to the economy, consumers save more/spend less, a positive to a currency all else being equal (i.e., in the absence of a current account deficit). In contrast, countries like the United States, or New Zealand for that matter, have a current account deficit; in the absence of growth, foreigners are less inclined to invest in the country, potentially depriving the country of inflows needed to finance budget deficits and, in the process, putting downward pressure on the currency. One reason why U.S. policy makers favor growth over austerity is to encourage inflows to finance the deficit. On that note, the lack of growth in the Eurozone, where the current account is roughly in balance, may be bad for employment, but the euro has managed to hold up reasonably well despite the crisis.

In some ways, when a country has a current account surplus, currency dynamics may be counter-intuitive: the more dysfunctional the Japanese government, the stronger the yen appears to have been in recent years. Since 2005, Japan has had seven prime ministers, with another change likely soon. A government with rotating heads suggests a government that doesn’t get anything done. Usually a government that “gets things done” is one that spends money, but Japan could not even get an expeditious rebuilding effort under way after the earthquake struck.

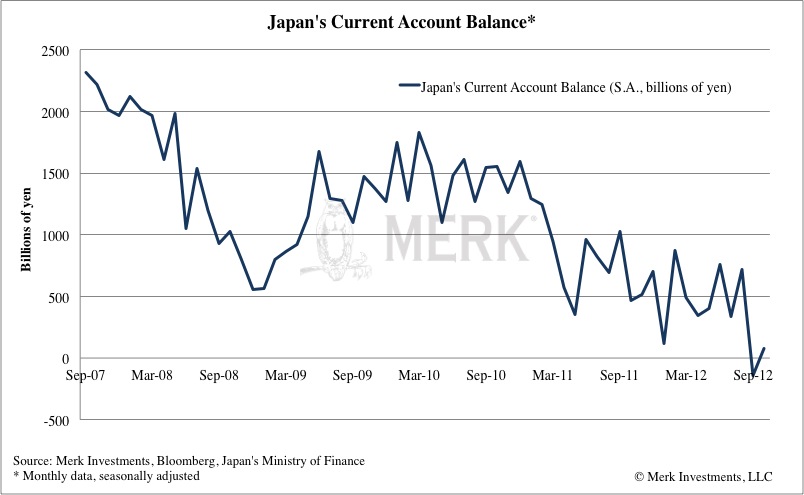

However, Japan's current account has been deteriorating in recent years. Consider Japan's seasonally adjusted monthly current account balance below:

Japan is doing its part to accelerate the demise of its current account:

•With one of the world’s highest life expectancies, almost no net immigration and falling birth rates, Japan’s aging population is often cited as the key-long term driver of the country’s deteriorating current account balance. The Japanese retire later than others in developed countries, cushioning the impact somewhat.

•The main “achievement” after the earthquake was announcing to abandon nuclear energy. Increasingly relying on imported energy is bad news for Japan's current account balance.

•Rising tensions with China don't bode we'll for trade. Shinzo Abe, Japan's likely prime minister to be is said to potentially escalate tensions further. If correct, we expect Japan's current account balance to suffer as a result.

Why does this all matter? After all, the US has had a massive current account deficit for years. The size of the current account deficit represents the amount foreigners need to buy in assets (local financial assets or real assets) to keep a currency from falling. With a current account deficit, Japan's debt to GDP ratio of over 200% may suddenly matter, as Japan may need to offer higher rates to attract foreigners to buy local assets (e.g., Japanese government bonds). The trouble is that Japan’s debt might be unsustainable at higher interest rates. To the extent that Japan has a current account surplus, it doesn't matter whether foreigners buy the yen, but those surpluses have fallen to deficits recently and that trend looks set to continue.

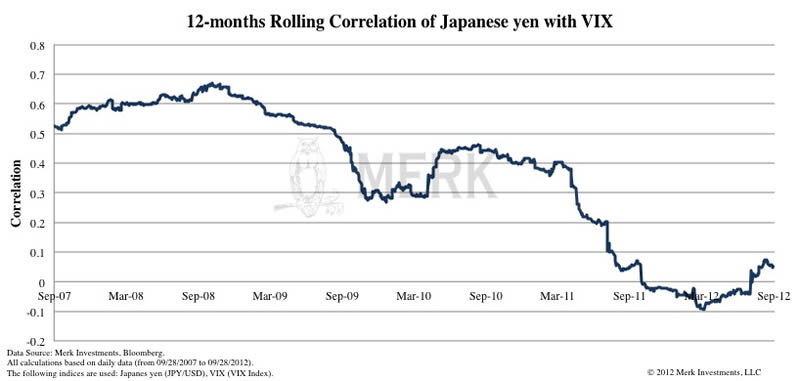

Some will argue that it still doesn't matter, as Japan is currently more concerned with negative rates. Our analysis, however, shows that the market does care: in recent years, the yen often appreciated when there was a "flight to safety;" if we use the VIX index, a popular measure of implied volatility of S&P 500 index options, as a proxy for the amount of fear in the market, then the yen should show a high correlation with the index. Below please see the 12-month rolling correlation of the yen versus the VIX index:

What the chart shows is that the yen isn't the safe haven it used to be. The yen no longer is the "go to" place when fear is elevated. There might be many reasons for this, but we like to look at it in the context of the current account balance, shown in the previous chart: as the current account has deteriorated, the yen's safe haven status appears to be eroding.

The one thing still going for the yen is that Japanese policy makers often don't execute on their talk. For example, Abe's election rhetoric suggests that the Bank of Japan (BOJ) will lose its independence as the government may force it to increase its inflation target of 1% (which it has failed to achieve) to 2 or 3 percent. But the BOJ has failed over and over again to live up to its promises. A side effect of that is that in recent years the BOJ's balance sheet has barely grown (the BOJ has "printed" very little money as one might colloquially say); Japan did its money printing in the 90s.

However, it may matter little what the BOJ is up to once the current account deteriorates further. We don't look at these trends as academic exercises, but rather consider the risk of acting versus not acting. At this stage, we assess the risk of not acting to be high and are putting our money where our mouth is.

We have a Webinar coming up on Thursday, December 13, 2012. Please register to learn more how we look at currencies to determine the strategic and tactical outlook for currencies such as the yen and the dollar. Please also sign up for our newsletter to be informed as we discuss global dynamics and their impact on gold and currencies.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.