Surmounting Government Confiscatory Policies & Bogus Official Economic Data

Economics / Economic Statistics Dec 29, 2012 - 05:17 AM GMTBy: DeepCaster_LLC

January, 2013

January, 2013

“As the miscreants in Washington negotiate solutions to the [various –Ed.] crises, trial balloons have been floated that agreement has been reached to use a new CPI measure—the C-CPI-U, which tends to understate inflation even more than the CPI-U—as way of deceptively reducing cost-of-living adjustments to Social Security, etc. Not too surprisingly, public reaction appears to be turning increasingly negative, as the concept gets broader exposure in the popular press.

Public Furor Mounts Over Proposed Use of the C-CPI-U to Short-Change Social Security Recipients on Their Cost of Living Adjustments. The chain-weighted CPI-U (C-CPI-U) is the fully substitution-based inflation series that is under serious consideration by those in Congress and the White House as a replacement for the CPI, with the goal of cutting Social Security cost-of-living adjustments (COLA) by stealth. A fully-substitution-based inflation index used in COLA calculations would reflect lower inflation than would the CPI-U or CPI-W (used for Social Security), resulting in fraudulently- and artificially-reduced cost-of-living adjustments to social programs, retirement funds, etc.

If the people controlling the U.S. government were honest, they simply would tell the COLA recipients that payments were being cut as part of the effort to balance the budget. Yet, no one in Washington has the political courage to suggest such a thing, openly, hence the regular deception that so often surfaces in the headline budget bargaining.

Reducing COLA by artificially reducing CPI reporting is not new. Had the politicians not pursued similar policies successfully in the 1980s and 1990s, Social Security payments would be more than double current levels… annual SGS – CPI Inflation… (using) the 1980-based measure came in at 9.4% in November …” (emphasis added)

November CPI, Industrial Production”, Shadowstats.com, 12/14/12

The proposed forced Investment of Present and Prospective Retirees 401(K) Assets in U.S. Treasury Paper about which we earlier wrote, is now followed by yet another prospective attack on Retirees’ Security, and indeed on the Wealth Security of those who hold $US Denominated Assets.

The Prospective Rigging of the CPI Calculation Protocol would , yet again, make the “Official” CPI even further removed from The Inflation Reality.

The Reality is that the current U.S. Inflation Rate, 9.82%, is already Threshold Hyperinflationary (see below).

And, of course, Official Numbers-Rigging is not limited to the U.S. We note Chinese and Eurozone Numbers-Rigging as well.

“A fake Libor rate, the scandal involving global benchmark interest rates that has raised the level of distrust in major banks and markets, is nothing compared to the damage that could be done if China’s true economic growth figures were revealed, according to Larry McDonald’s newsletter.

“Is Chinese GDP the new Libor? …More and more investors are starting to question the Chinese math on GDP.

“Annual gross domestic product came in at 7.6 percent in the second quarter, according to China’s government on July 13th. The report was better than investors expected…

“But slowing imports and industrial production, as well as harder-to-fudge electricity usage data, points to much slower growth, according to McDonald and other investors. Barclays believes the number should have been more like 7.15 percent.

“What worries McDonald… is that lying by governments and banks — be it Libor rates or GDP statistics — raises the systemic risk to the markets, which is much worse than just economic risk.”

“Lying Libor Is Nothing Compared to China’s Fake GDP: Report”

John Melloy, CNBC, 7/22/2012

Indeed, if one considers all the salient Chinese data together, one concludes that the Barclays estimate of Chinese GDP at 7.15% is still high.

In order to obtain a realistic view of economic performance it is necessary to look beyond the Official Data to data that are more difficult to manipulate. For China, for example, consider:

China’s shipbuilding industry has suffered a 60% decline in gross tonnage of orders; some builders may go bankrupt. China has vast stockpiles of as-of-yet-unused coal, iron ore, and copper. In the first half of 2012, Shanghai land sales fell close to 60%. The June 2012 Chinese electrical grid usage was flat. Prices in some Asian sectors sank an incredible 25% in June because of collapsing demand. China’s neighbor Singapore reported that its GDP growth fell 1.1% during the second quarter of 2012 following a 9.4% gain during the first quarter.

Australia has been losing jobs – Australian employers surprised the market after reporting payrolls were trimmed by 27,000 in June 2012; pushing the unemployment rate up to 5.2% from 5.1% in May, due primarily to redirection in growth of Chinese demand. And the two major customers of China’s exports – the Eurozone and the US continue to weaken.

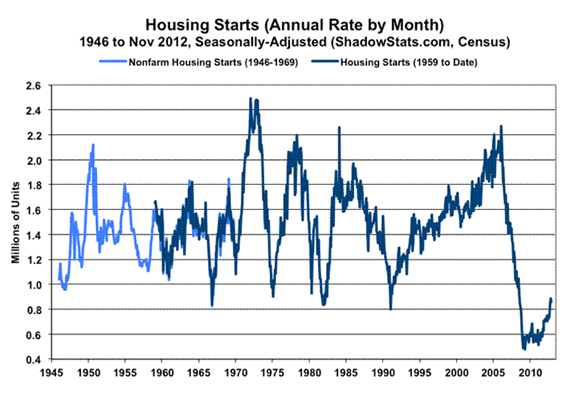

Switching focus to the U.S. we recently see that some Mainstream Media are claiming that the Housing Market has bottomed and is recovering. It is not.

“With minimal levels of consumer confidence and sentiment, and without positive real (inflation-adjusted) income growth and available credit, consumers generally cannot support real growth in broad consumption, let alone fuel a renewed housing boom. The financially-impaired banking system still largely is sitting on the sidelines, despite four-plus years of systemic-liquefaction efforts by the Federal Reserve.

Nonetheless, insurance payments on hurricane-damaged properties should help provide at least some temporary boost to the home construction industry in the next quarter or so.

November housing starts fell month-to-month by a statistically-insignificant 3.0%, likely reflecting mixed pressures from storm disruptions and rebuilding. The November loss, however, was in the context of downside revisions to reported activity of the last several months, in this highly volatile series.”

“November Durable Goods, Housing Starts, GDP Revision, #490”

John Williams, shadowstats.com, 12/21/2012

And most important, consider Williams on Real Current U.S. Inflation.

“Set by Uncontained Fiscal Malfeasance, and Exacerbated by Still-Unfolding Effects of the 2008 Systemic Panic and Near-Collapse, U.S. Hyperinflation Looms by End of 2014. After decades of U.S. government fiscal mismanagement, by 2004, the U.S. budget deficit was so out of control that it had become both unsustainable and uncontainable. Using generally accepted accounting principles (GAAP-accounting), the deficit for just the fiscal-year 2004 exploded to $11.0 trillion…

“Adjusted for distortions from one-time accounting changes, the actual, or GAAP-based, federal deficit has run roughly $5 trillion per year since 2004, and it likely topped $7 trillion in 2012, with total federal debt and the net present value of federal-government obligations approaching $90 trillion. No amount of spending cuts, outside of the politically-untouchable social programs, and no amount of tax increases, can bring the GAAP-based annual U.S. budget deficit into balance.

“Faced with structural impairments to individual income growth, the Federal Reserve (under Chairman Alan Greenspan) actively encouraged the excessive growth of consumer debt as a way to support economic activity, continuously borrowing economic growth from the future.

“With an inevitable day of reckoning, the U.S. financial and banking systems came literally to the brink of collapse in September 2008. To prevent the unthinkable, the Federal Reserve and the U.S. government created, spent, loaned, guaranteed, and gave away whatever money was necessary, and otherwise bailed out or acquired a number of failing large corporations…

“Those actions forestalled a systemic collapse, but they did not resolve the fundamental underlying difficulties. Contrary to official GDP reporting, there has been no subsequent economic recovery.

“The ultimate costs for saving the system in 2008 and beyond, comes down to inflation, which will be reflected eventually in the complete debasement of the U.S. dollar. Accordingly, actions taken during the crisis-containment of 2008, and later, brought the outside timing for the hyperinflation forecast of 2018, into 2014.

“…the U.S. dollar, as we know it, is not likely to survive until the next congressional election in 2014…”

“Special Commentary: Review of Economic, Systemic-Solvency, Inflation, U.S. Dollar and Gold Circumstances, #485”

John Williams, shadowstats.com, 11/27/2012

Official Data Purveyors would have you believe that U.S. inflation is “contained,” GDP is growing healthily, and Sovereign Debt is sustainable. Not true! The U.S. for example is already Threshold Hyperinflationary at 9.82% and GDP growth is a negative 2.10% and the net present value of downstream Federal as-yet-unfunded government obligations is nearly $90 trillion.

Bogus Official Statistics mask a wide variety of Negative Effects of ongoing Q.E. to Infinity and related Actions. Shadowstats.com calculates Key Statistics the way they were calculated in the 1980s and 1990s before Official Data Manipulation began in earnest. Consider:

Shadowstats Forecast of Impending Hyperinflation beginning no later than the end of 2014, is quite significant.

“I have been warning of a hyperinflation for at least seven years, but those warnings have been about a hyperinflation that was sometime in the future, generally in 2018 or 2014 timeframes mentioned above. Now, however, along with the passage of time, circumstances have evolved and are aligned for the hyperinflation to develop in the near future, specifically, within the next two years or so, by the end of 2014. Key developments, such as global loss of confidence in the U.S. dollar, and the dollar losing its safe-haven status, fell into place during 2011.

“Why 2014? While inflation is far from being out of control at the moment, the U.S. dollar is relatively strong, due to the euro crisis, that can change rapidly as global markets and domestic holders of the U.S. currency begin to flee the dollar, along with dumping dollar-denominated assets. Fiscal, systemic-solvency and economic conditions are deteriorating markedly, with a confluence of unstable circumstances likely to come to a head within the next year or so, placing extremely heavy selling pressure on the U.S. dollar and, before 2014, setting the stage for hyperinflation.

“The damage to the U.S. financial system and to U.S. dollar credibility have been so severe in recent years…

“The U.S. economy is far weaker than commonly viewed—it never recovered from the 2006/2007-to-2009 plunge in activity—and has begun to show renewed deterioration in terms of already moribund consumer income growth.

“Fundamental effects of the crises already have been seen in deteriorating funding conditions for Social Security and the annual budget deficit in general.

“Reflecting the impact of the recession, Social Security cash flows began turning negative in 2010, seven or eight years ahead of schedule. Also reflecting the effects of the recession and the crises responses of the Fed and federal government, the annual cash-based federal deficit exploded, hitting $1.3 trillion or above for each of the last three years, with annual GAAP-based deficits running at $5 trillion or more.

“Pending the results of court challenges, the Affordable Care Act (ACA) healthcare legislation likely will add more than $10 trillion in unfunded liabilities (net present value) to the government’s 2012 GAAP-based accounting, due for release in December 2012. That, plus consideration of accounting for Freddie Mac and Fannie Mae and otherwise normal annual transactions, could push the reporting of total GAAP-Based U.S. obligations—including gross federal debt and net present value of unfunded liabilities—from $80 trillion in 2011, into the $120 trillion range for 2012, or roughly eight-times the level of U.S. GDP.” (emphasis added)

“Review of Economic, Systemic-Solvency, Inflation, U.S. Dollar and Gold Circumstances, #445”

John Williams, shadowstats.com, 7/17/2012

Of Great Significance is the fact that Degradation of the U.S. Dollar’s status as World Reserve Currency is already well under way.

China has already entered into bilateral Currency Deals with several nations including Russia, Iran, Brazil, and (soon to be former) financial allies Japan and Australia. Consequently, the Purchasing Power of the $US will suffer a huge hit in the next very few years. Given the Real Numbers (per Shadowstats and Deepcaster, et al.) it is no wonder Economist Nouriel Roubini characterizes U.S. Recovery as a “Fairy Tale.”

“…the first-half growth rate looks set to come in closer to 1.5 percent at best, even below 2011’s dismal 1.7 percent. And now, after getting the first half of 2012 wrong, many are repeating the fairy tale that a combination of lower oil prices, rising auto sales, recovering house prices and a resurgence of U.S. manufacturing will boost growth in the second half of the year and fuel above-potential growth by 2013.

“…the gravity of weaker growth will most likely overcome the levitational effect on equity prices from more quantitative easing, particularly given that equity valuations today are not as depressed as they were in 2009 or 2010. Indeed, growth in earnings and profits is now running out of steam…”

“We’re Not Even Close to a Robust Recovery”

Nouriel Roubini, Project Syndicate, 7/22/2012

And it is not just Doctor Doom Roubini who sees beyond the Bogus Official Data. Former Reagan Budget Director, David Stockman sees the Real Data, the Consequences, and the Challenges clearly.

“I don't think we are at the beginning of the recovery. I think we are at the end of a disastrous debt supercycle that has gone on for the last thirty or forty years, really. It started when Nixon defaulted on our obligations under Bretton Woods and closed the gold window. Incrementally, year after year since then, we have been going in a direction of extremely unsound money, of massive borrowing in both the private and the public sector. We now have an economy that is saturated with debt: $54 trillion or $53 trillion – 3.5 times the GDP – way off the charts from where it was for a hundred years prior to the beginning of this. The idea that somehow all of that debt is irrelevant, as the Keynesians would tell us, is fundamentally wrong – and the reason why the economy can't get up off the mat.

“We're doing all the wrong things. We're adding to the problem, not subtracting. We are not allowing the debt to be worked down and liquidated. We're not asking people to save more and consume less, which is what we really need to do. And so therefore I think policy is just making it worse, and any day now we will have another recurrence of the kind of economic crisis we had a few years ago.”

“Austerity Is Not Discretionary,” Interviewed by Alex Daley, Casey Research

David Stockman, Congressman and former Reagan Budget Director, 7/20/2012

Official data sources have Powerful Interests to protect and Truth is often sacrificed. Thus it is essential to rely on other entities and persons such as Shadowstats, Deepcaster, Stockman, Paul Craig Roberts, and Roubini for Genuine Data and Honest Analyses. Given the aforementioned, to Protect and Profit from confiscatory polices and Bogus Numbers it is essential to Invest in the Precious Monetary metals, Gold and Silver, (but see Note 1) and Inflation-Resistant Assets such as Food Commodities. For Deepcaster’s specific recommendations aimed at Profit and Protection despite Bogus Official data and Confiscating Policies see Notes 2, 3, and 4 below.

Necessary also, is having Courage to see the Truth, because the Truth is not always Pretty.

Finally, important to note is the fact that, absent manipulation, Gold and Silver would be the monetary “Canaries” of the Financial World, whose prices would long ago have warned of Excessive Monetary and Credit Creation. Well, in the past decade their price appreciation certainly has “warned” of that, but not in the past few months. Gold and Silver prices are subject of ongoing Price Suppression by a Fed-led Cartel as described in Note 1 below. But Gold and Silver Price Suppression, cannot last forever.

Best regards,

www.deepcaster.com

DEEPCASTER FORTRESS ASSETS LETTER

DEEPCASTER HIGH POTENTIAL SPECULATOR

Wealth Preservation Wealth Enhancement

© 2012 Copyright DeepCaster LLC - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

DEEPCASTER LLC Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.