Federal Reserve May Pause Quantitative Easing

Interest-Rates / Quantitative Easing Jan 09, 2013 - 05:55 AM GMTBy: BATR

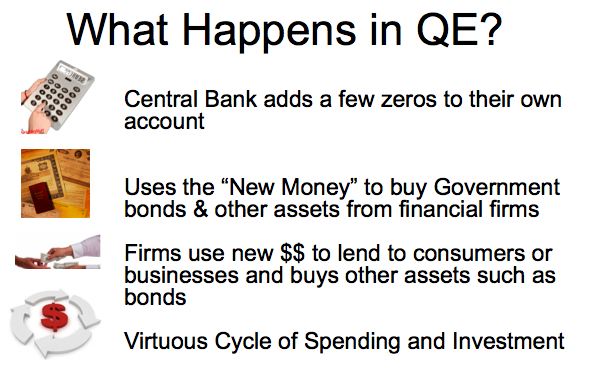

An obscure report that the Federal Reserve may suspend the monetization of purchasing Treasury Bonds has the smell of disinformation. The perennial efforts to lift economic spirits with the beginning of a New Year often are packed with wishful thinking. Quantitative Easing is being treated as a useful tool for turning on and off the spigot of liquidity infusion. In reality, the results of the massive origination of debt created monies fundamental purpose is to save the commercial banks from insolvency.

An obscure report that the Federal Reserve may suspend the monetization of purchasing Treasury Bonds has the smell of disinformation. The perennial efforts to lift economic spirits with the beginning of a New Year often are packed with wishful thinking. Quantitative Easing is being treated as a useful tool for turning on and off the spigot of liquidity infusion. In reality, the results of the massive origination of debt created monies fundamental purpose is to save the commercial banks from insolvency.

"St. Louis Fed President James Bullard, a voting member of the Fed's monetary policy panel this year, said a drop in the unemployment rate to 7.1 per cent would probably constitute the "substantial improvement" in the labor market that the central bank seeks.

"If the economy performs well in 2013, the Committee will be in a position to think about going on pause" with the asset buys.

Minutes from their December policy meeting showed that "several" top officials expected to slow or stop the so-called quantitative easing program, dubbed QE3, "well before" the end of the year - news that surprised some on Wall Street and prompted a drop in stocks and bonds, and a rise in the dollar."

The recent spike of equity prices after the sharp increase in taxes on high-end incomes just does not translate into improving the prospects of the beleaguered middle class. Temporary uncertainty relief does not make a healthy stock market alone. When the financiers of employment expansion must face the added costs of Obamacare and a drop in consumer disposable income, it simply does not follow that unemployment levels will drop in the near future.

Yet, segments of the Federal Reserve offers optimism, as the labor market may show "substantial improvement" in the coming months. Could this forecast imply some newfangled governmental make work new spending programs?

"AIG has just launched a two-week, multimedia campaign seeking to reintroduce itself after its role in sparking the Great Recession," MediaPost reported yesterday. "The company got an $85 billion bailout as the government took about an 80% stake."

The ballyhoo over paying back the loans steers clear of the real reason why AIG was "Too Important" to fail; namely, to salvage the incalculable derivative obligations. Rescuing the money center banks has always been the intent of the "Too Big to Fail" taxpayer salvage schemes.

But when will the limit of such gifts be reached? When the banks are satisfied or when the Treasury is emptied and looted, as the cost of extending the usury based financial system. Future generations do not have a chance for economic prosperity as long as the Federal Reserve continues the bond-buying thievery.

"The New York Fed’s primary dealers, the 21 banks with which it carries out transactions, expect quantitative easing to continue until 1Q 2014. This is according to a Dow Jones Business News report.

The recently released minutes of the December FOMC meeting revealed that several Fed governors were taking a more hawkish stance in regards to the bond-buying program."

Remember that the Fed is forecasting a slow modest recovery. What will the change in attitude become with a serious double-dip recession?

Do not believe for a New York minute that the Fed is looking to transition out of their gravy train financial backdrop for their bankster holders of the privately owned central bank.

The practical gauge of how long Quantitative Easing remains will be decided by the amount of debt that needs to be refinanced. Rolling over current debt is easy enough of a concept to understand. Should it not be just as comprehensible to recognize that continued increases in the national debt requires even greater appetites to buy government bonds?

"There’s a legal loophole allowing the Treasury to mint platinum coins in any denomination the secretary chooses . . . Yes, it was intended to allow commemorative collector’s items—but that’s not what the letter of the law says. And by minting a $1 trillion coin, then depositing it at the Fed, the Treasury could acquire enough cash to sidestep the debt ceiling—while doing no economic harm at all."

The obvious conclusion when the market refuses to support low interest T Bonds is that something has to give. Either interest rates need to rise significantly or the Fed must continue their Quantitative Easing.

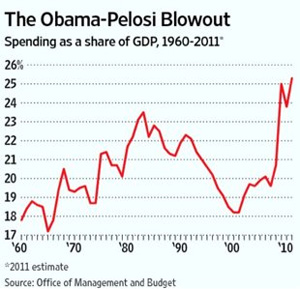

As long as the Obama administration maintains, We Do Not Have a Spending Problem, and stonewalls significant and meaningful reductions in the federal expenditures, the national debt will continue to be a drain on the financial bond markets.

Mr. Bullard’s optimistic projection of lower unemployment might simply be a signal that the methods for compiling the statistics may be in the works. The main street economy sees no benefit from a banking system that shuns loaning money to productive businesses.

Quantitative Easing in any form or machination is a euphemism for crony corporate welfare. The big money center banks are virtually financially immune from lawful accountability or criminal prosecution.

Slapping fines and penalties for violating statues and regulations, results in escaping trial by juries. This basic exclusive protection for the elites that run the counterfeit presses is the proof of true power. Inexhaustible Quantitative Easing is just another means to keep the spending financed with other peoples’ money.

James Hall – January 9, 2013

Source : http://www.batr.org/negotium/010913.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2012 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.