Uranium Stocks Frustrating Trend

Commodities / Uranium Feb 28, 2008 - 01:27 PM GMTBy: Merv_Burak

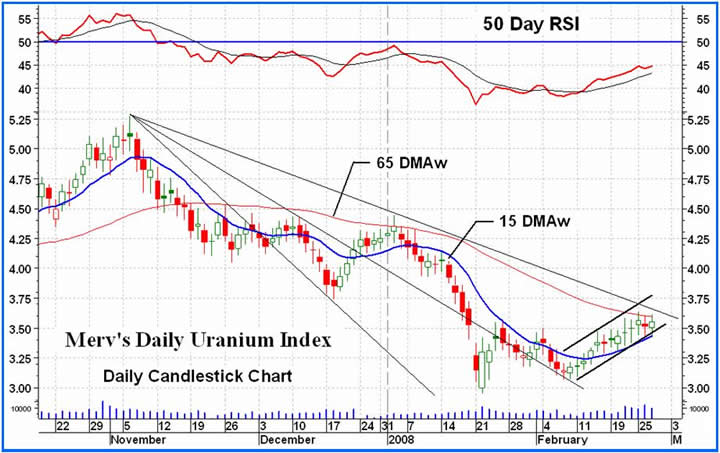

1% here and 1% there but still we're not getting anywhere. It's a little frustrating waiting for some significant action but all we get is nibble, nibble. The Merv's Daily Uranium Index was up another 0.037 points or 1.05%. Looking at the chart that still hasn't gotten us where I would like to see the Index, that is, decisively through those resistance levels and on into new rally highs. But no, it's nibble, nibble. There were 25 winners on the day and 24 losers with one unchanged. You can't get much closer to a neutral day than that. Still no run-away winners (or losers).

1% here and 1% there but still we're not getting anywhere. It's a little frustrating waiting for some significant action but all we get is nibble, nibble. The Merv's Daily Uranium Index was up another 0.037 points or 1.05%. Looking at the chart that still hasn't gotten us where I would like to see the Index, that is, decisively through those resistance levels and on into new rally highs. But no, it's nibble, nibble. There were 25 winners on the day and 24 losers with one unchanged. You can't get much closer to a neutral day than that. Still no run-away winners (or losers).

Of the five largest stocks it was another mixed day. Cameco lost 1.8%, Denison gained 0.5%, First Uranium lost 1.3%, Paladin gained 1.9% and Uranium One gained 9.0%. The best daily performer was a WOW. Hathor Exploration gained 128.0% on the day. Must have been something they said. The worst performer, on the other hand, was not so bad. Magnum Uranium was the loser with a loss of 6.9%.

The intermediate term is still failing to reverse its indicators. Now, the moving average seems closer to a breach than the momentum indicator. The Index remains below a negative moving average line but the line now is turning more and more into a horizontal, although not quite into a positive slope yet. The momentum remains in a somewhat lateral trend but still inside its negative zone. It is still above its trigger line so that the basic direction remains in a positive direction. The intermediate term rating remains BEARISH .

On the short term the Index remains above its positive moving average line and the momentum indicator remains in its positive zone. The Index remains trapped inside that upward sloping channel but is at the low level and looks like it may want to break below the lower support trend line. As for the more aggressive Stochastic Oscillator, it remains in a lateral trend but still well inside its positive zone. It has not indicated any preference for a positive or negative Index move for over a week now. The short term rating remains BULLISH .

With the short term bullish and the intermediate term bearish something's gotta give. Either the short term turns back into the bearish camp or it continues to advance turning the intermediate term into a bull. It's the waiting at this point that is so frustrating.

By Merv Burak, CMT

Hudson Aero/Systems Inc.

Technical Information Group

for Technically Uranium with Merv

Web: http://techuranium.blogspot.com/

e-mail: merv@themarkettraders.com

During the day Merv practices his engineering profession as a Consulting Aerospace Engineer. Once the sun goes down and night descends upon the earth Merv dons his other hat as a Chartered Market Technician ( CMT ) and tries to decipher what's going on in the securities markets. As an underground surveyor in the gold mines of Canada 's Northwest Territories in his youth, Merv has a soft spot for the gold industry and has developed several Gold Indices reflecting different aspects of the industry. As a basically lazy individual Merv's driving focus is to KEEP IT SIMPLE .

This Blog is - A periodic review of the daily or weekly market action in uranium stocks. The review is strictly from the technical perspective. Merv is a pure market technician. Weekly, one will find a table of technical information and ratings of the 50 component stocks of the Merv's Uranium Index as well as a weekly summary of the uranium stock activity. Daily (most days), one will find a daily review of the market action of the Merv's Daily Uranium Index as well as technical analysis of one or more uranium stocks of interest.

Disclaimer - Technical analysis is not perfect. Should you expect perfection this is not the site for you.

Technical analysis IS a very sound technique to assess the daily or weekly trading activities in securities and to assess appropriate timing of investment activities. This blog provides such technical analysis of the trading activity in uranium stocks for your information. Any use made of this information is strictly at the users risk. No guarantees are made for the accuracy or potential for the information provided herein. Use at your own risk. You are strongly advised to check with your broker or investment adviser before activating any investment desisions.

Merv Burak Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.