Post Bubble America Heading for Deepest Recession Since the Great Depression

Economics / Economic Depression Mar 08, 2008 - 03:13 AM GMTBy: Mike_Whitney

“Market conditions are the worst anyone in this industry can ever remember. I don't think anyone has a recollection of a total disappearance in liquidity...There are billion of dollars worth of assets out there for which there is just no market.” Alain Grisay, chief executive officer of London-based F&C Asset Management Plc; Bloomberg News

“Market conditions are the worst anyone in this industry can ever remember. I don't think anyone has a recollection of a total disappearance in liquidity...There are billion of dollars worth of assets out there for which there is just no market.” Alain Grisay, chief executive officer of London-based F&C Asset Management Plc; Bloomberg News

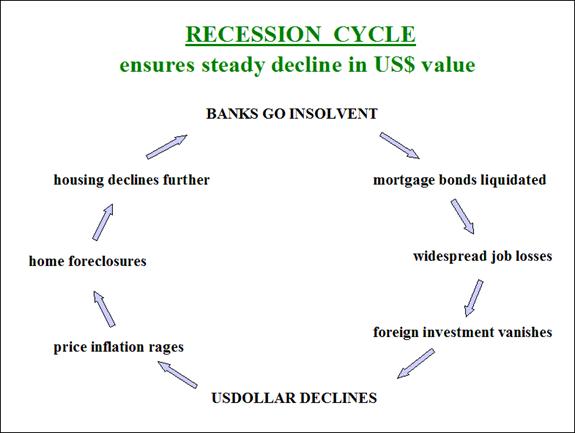

The hurricane that began with subprime mortgages, has swept through the credit markets wreaking havoc on municipal bonds, hedge funds, complex structured investments, and agency debt (Fannie Mae). Now the first gusts from the Force-5 gale are touching down in the real economy where the damage is expected to be widespread.

The Labor Department reported on Friday that US employers cut 63,000 jobs in February, the biggest monthly decline in five years. The cut in payrolls added to the 22,000 jobs that were lost in January. 52,000 jobs were cut in manufacturing, while 331,000 have been lost in construction since September 2006. The Labor Department also reported on Wednesday that worker productivity slowed significantly in the last quarter of 2007. When productivity is off; labor costs go up which adds to inflationary pressures. That makes it harder for the Fed to lower rates to stimulate the economy without inviting the dreaded “stagflation”---slow growth and rising prices.

The news on commercial construction is equally bleak. The Wall Street Journal reports: “For the second month in a row, the Commerce Department reported a decline in spending on nonresidential construction -- which includes everything from hospitals to office parks to shopping malls....Signs of trouble cropped up at the end of the year. As credit markets tightened, office space sold in the fourth quarter dropped 42% from a year earlier, and sales of large retail properties declined 31%, says Real Capital Analytics, a New York real-estate research group....If spending continues to slow, construction workers, who are reeling from the housing slowdown, face more layoffs.” (“Building Slowdown Goes Commercial”, Wall Street Journal)

Commercial real estate is the next shoe to drop. There's a tremendous oversupply of retail space nationwide and the bloodletting has just begun. Builders have continued to put up shopping malls and office buildings even though residential real estate has gone off a cliff. Now the battered banks will have to repossess thousands of empty buildings in strip malls with no chance of leasing them out in the near future. It's a disaster . From December 2007 to January 2008 spending on commercial construction took its steepest drop in 14 years. The sudden downturn is adding more and more people to the unemployment lines.

So, what does it all mean? Unemployment is up, productivity is down, inflation is increasing, the dollar is underwater, commercial real estate is in the tank and the country is sliding inexorably into recession.

THE DEEPEST AND MOST RAPID DOWNSWING SINCE THE GREAT DEPRESSION

As for the housing market:

“ Housing is in its "deepest, most rapid downswing since the Great Depression," the chief economist for the National Association of Home Builders said Tuesday, and the downward momentum on housing prices appears to be accelerating.

"Housing is in a major contraction mode and will be another major, heavy weight on the economy in the first quarter," said David Seiders, the NAHB's chief economist.” (“Rapid Deterioration”, MarketWatch)

Home sales are down 65% from their peak in 2005. Inventory is stacked a mile-high. Vacant homes now number about 2 million; an increase of 800,000 since 2005. Demand is weak and prices are plummeting. It's all bad. Meanwhile, the Federal Reserve and the Bush administration are scrambling to devise a plan that will keep homeowners from packing it in altogether and walking away from their mortgages. But what can they do? Will they really write-down the principle on the mortgages like Bernanke recommends and face years of litigation from bond holders who bought mortgage-backed securities under different terms? Or will they simply allow the market to clear and send 2 million homeowners into foreclosure in 2008 alone?

The deflating housing bubble is finally being felt in the broader economy. Home equity is vanishing which is putting downward pressure on consumer spending and shrinking GDP. Also, the dollar is at historic lows, and an intractable credit crunch has left the financial markets in disarray. Experts are now predicting that consumer spending won't rebound until housing prices stop falling which could be late into 2009. When Japan experienced a similar credit/real estate meltdown; it took more than a decade to recover. There's no reason to believe that the present crisis will unwind any faster.

On Friday, banking giant USB estimated that credit woes would end up costing financial institutions $600 billion, three times more than their original estimate of $200 billion. But USB's forecast does not take into account the $6 trillion of lost home equity if housing prices fall 30% in the next two years. (which is very likely) Nor does it account for the potential losses in the structured finance market where $7.8 trillion of loans (which are presently in “pooled securities”) have gone into a deep-freeze. There's no way of knowing how much capital will be drained from the system by the time all of this plays out, but if $7 trillion was lost in the dot.com bust, then it should greatly exceed that figure.

The housing bubble was entirely avoidable. It was the policies of the Federal Reserve which made it inevitable. By fixing interest rates below the rate of inflation for almost 3 years, Greenspan ignited speculation in housing and created a false perception of prosperity. In truth, it was nothing more than asset-inflation through the expansion of debt. The Fed's actions were complimented by repeal of regulatory legislation which prevented the commercial banks from dabbling in securities trading. Once the laws were changed, the banks were free to peddle their mortgage-backed securities to investors around the world. (A-rated mortgage-backed bonds are currently fetching just 13% of their face value!) Now, those sketchy bonds are blowing up everywhere leaving large parts of the financial system dysfunctional.

The housing bubble was entirely avoidable. It was the policies of the Federal Reserve which made it inevitable. By fixing interest rates below the rate of inflation for almost 3 years, Greenspan ignited speculation in housing and created a false perception of prosperity. In truth, it was nothing more than asset-inflation through the expansion of debt. The Fed's actions were complimented by repeal of regulatory legislation which prevented the commercial banks from dabbling in securities trading. Once the laws were changed, the banks were free to peddle their mortgage-backed securities to investors around the world. (A-rated mortgage-backed bonds are currently fetching just 13% of their face value!) Now, those sketchy bonds are blowing up everywhere leaving large parts of the financial system dysfunctional.

As investors continue to run away from anything remotely connected to mortgages; the price of risk, as measured by the spread on corporate bonds, has skyrocketed. In fact, investors are even shunning overextended GSEs like Fannie Mae and Freddie Mac. As the number of foreclosures continues to soar, the aversion to risk will intensify triggering a savage unwinding of leveraged bets in the hedge funds as well as a wider paralysis in the financial markets.

There's absolutely no doubt now that the storm that is currently ripping through the financials will soon bring Wall Street to its knees. It may be a good time to remember that on March 24, 2000, the NASDAQ peaked at 5048. On October 9, 2002 it bottomed-out at 1114; a loss of nearly 80%. Could it happen again?

You bet. Expect to see the Dow hugging 7,000 by year end.

The Wall Street Journal ran an article on Tuesday which outlined how the banks changed standards at the Basel meetings in Switzerland to give them greater autonomy in deciding issues that should have been governed by strict regulations:

“Some of the world's top bankers spent nearly a decade designing new rules to help global financial institutions stay out of trouble...Their primary tenet: Banks should be given more freedom to decide for themselves how much risk they should take on, since they are in a better position than regulators to make that call.” (“Mortgage Fallout Exposes Holes in New Bank-risk Rules”, Wall Street Journal)

It is a classic case of the foxes deciding they should oversee the hen-house.

The Basel Committee on Banking Supervision is an industry-led group comprised of the central bank governors from the G-10 countries; Belgium, Canada, France, Italy, Japan, the Netherlands, Sweden, Switzerland, Britain and the US. Basel is supposed to establish the rules for maintaining sufficient capitalization for banks so that depositors are protected. But it's a sham. It appears to be more focused on maintaining US and European dominance over the developing world and making sure the levers of financial power stay in the manicured paws of western banking mandarins.

Now that the financial system is in terminal distress; many people are questioning the wisdom of handing over so much power to organizations that don't operate in the publics interest. Thomas Jefferson anticipated this scenario and issued a warning about the perils of abdicating sovereignty to unelected, profit-oriented bankers. He said:

“If the American people ever allow private banks to control the issue of our currency, first by inflation, then by deflation, the banks and the corporations that will grow up will deprive the people of all property until their children wake up homeless on the continent their fathers conquered.”

Even though the nation is stumbling towards an economic hard-landing; the banks are still only interested in finding a way to save themselves. Last week, the New York Times revealed a “confidential proposal” from Bank of America to members of Congress asking the US government to guarantee $739 billion in mortgages that are at “moderate to high risk” of defaulting to save the banks from potential losses. Yesterday, Rep. Barney Frank--operating in the interests of his banking constituents--made an appeal in the House of Representatives on this very issue, saying that congress should consider buying up some of these sinking mortgages to help struggling homeowners. But why should the taxpayer pay for the mistakes of privately-owned banks; especially when those banks have been bilking the public out of billions of dollars through the sale of worthless subprime securities?

Even though the nation is stumbling towards an economic hard-landing; the banks are still only interested in finding a way to save themselves. Last week, the New York Times revealed a “confidential proposal” from Bank of America to members of Congress asking the US government to guarantee $739 billion in mortgages that are at “moderate to high risk” of defaulting to save the banks from potential losses. Yesterday, Rep. Barney Frank--operating in the interests of his banking constituents--made an appeal in the House of Representatives on this very issue, saying that congress should consider buying up some of these sinking mortgages to help struggling homeowners. But why should the taxpayer pay for the mistakes of privately-owned banks; especially when those banks have been bilking the public out of billions of dollars through the sale of worthless subprime securities?

The Fed has already lowered the Fed Funds rate by 2.25 basis points to 3% (more than a full-point below the current rate of inflation) to help the banks recoup some of their losses from their bad bets. Bernanke has also opened a Temporary Auction Facility (TAF), which allows the banks to use mortgage-backed securities (MBS) and other structured investments as collateral at 85% their face-value.(even though the bonds are only worth pennies on the dollar on the open market) So far, the TAF has secretly loaned out $75 billion to capital-depleted banks, which Bernanke thinks is a positive development. By why is the Fed chief encouraged by the fact that the country's largest investment banks need to borrow billions of dollars at bargain rates just to stay solvent? The truth is that many of the banks are just padding their flagging balance sheets so they can scour the planet looking for investors to buy parts of their franchises.

On Tuesday, Bernanke addressed the Independent Community of Bankers of America exhorting them to take whatever steps are required to keep homeowners with negative equity from walking away from their mortgages. Along with the proposed “rate freeze” on adjustable rate mortgages (ARMs); the Fed chief also suggested that the lenders lower the principle on the mortgages to entice homeowners to keep making nominal payments on their loans. But, clearly, foreclosure is the wisest choice for many homeowners who may otherwise be chained to an asset of steadily declining value for the rest of their lives. Homeowners should base their decisions on what is in their best long-term financial interests, just as the bankers would do. If that means walking-away, then that is what they should do. The homeowner is in no way responsible for the problems deriving from the subprime/securitization scam. That was entirely the work of the bankers.

On Tuesday, Bernanke addressed the Independent Community of Bankers of America exhorting them to take whatever steps are required to keep homeowners with negative equity from walking away from their mortgages. Along with the proposed “rate freeze” on adjustable rate mortgages (ARMs); the Fed chief also suggested that the lenders lower the principle on the mortgages to entice homeowners to keep making nominal payments on their loans. But, clearly, foreclosure is the wisest choice for many homeowners who may otherwise be chained to an asset of steadily declining value for the rest of their lives. Homeowners should base their decisions on what is in their best long-term financial interests, just as the bankers would do. If that means walking-away, then that is what they should do. The homeowner is in no way responsible for the problems deriving from the subprime/securitization scam. That was entirely the work of the bankers.

The FDIC has begun to increase staff at many of its regional offices to deal with the anticipated rash of bank failures in states hardest hit by the housing bust. California, Florida and parts of the southwest will definitely need the most attention. These states are undergoing a housing depression and many of the smaller banks which issued the mortgages and commercial real estate loans are bound to get hammered. They simply do not have the capital cushion to withstand the tsunami of defaults and foreclosures that are coming. Depositors should make sure that all their savings are covered under FDIC rules; no more than $100,000 per account. Money markets are not insured.

Also, the G-7 nations announced last week that if “irrational” price movements persist, they would “collectively take suitable measures to calm the financial markets”. The group added that they would conduct their activities secretively for maximum effect. Consider how desperate the situation must really be for G-7 finance ministers to issue a public warning that they are planning to intervene in the market to prevent a calamity. This is stunning. The group did not specify whether they were talking about propping up the stumbling greenback or buying up futures in the equities markets like a global Plunge Protection Team. Nevertheless, their comments add to the growing perception that things are out of control and deteriorating quickly.

INFLATION vs. DEFLATION

With oil, gold and food prices soaring, the Fed has been roundly criticized for cutting rates and risking further erosion to the value of the dollar. (This morning the dollar fell to $1.53 on the euro!) But Bernanke is right; the real danger is deflation. We are at the beginning of a consumer-led recession; characterized by weakening demand, lack of personal savings, declining asset-values (particularly homes) and over-indebtedness. The Fed's increases to the money supply via low interest rates will not effect the dramatic economic slowdown that will be evident within the year. Trillions of dollars of derivatives, over-leveraged subprime assets and otherwise bad bets are all unwinding at the same time draining an ocean of virtual capital from the economy. If credit keeps getting destroyed at the present pace, the country will be in the grips of a depression-like slump by 2009. The Wall Street Journal's Greg Ip puts it like this in his article “For the Fed, a Recession—Not Inflation—Poses Greater Threat”:

“So why is the Fed more worried about growth than inflation? First, it thinks run-ups in commodity prices explain the increases, not only in overall inflation but also in core inflation: higher energy costs have "passed through" to other goods and services. Core inflation rose and fell with energy inflation between early 2006 and mid-2007, and the Fed thinks the same thing is probably happening now. If energy and food prices stop rising -- they don't have to actually fall -- both overall and core inflation should recede.

Ip continues: “Fed officials don't think the latest jump (in food and energy) can be justified by fundamental supply and demand....A more likely explanation, investors perhaps alarmed by the Fed's dovish stance, are pouring money into commodity funds and foreign currencies as a hedge against inflation. ...But speculative price gains can't be sustained if the fundamentals don't support them. If the Fed and the futures markets are right, prices will be lower, not higher, a year from now.”

Bernanke is right on this point. Temporary price increases are not the result of shortages, increased production costs, or fundamentals, but speculation. In fact, demand for petroleum products has been down by 3.4% over the last four weeks compared to the same time last year, which means that prices will probably drop steeply once the commodities frenzy runs out of steam. Investors are simply looking for somewhere to put their money rather than in shaky corporate bonds or overpriced equities. Commodities are the logical alternative. But as soon as consumer spending stalls; all asset-classes will fall accordingly, including gold and oil. (And, yes, the dollar should recover some lost-ground, however temporary)

Many analysts believe oil's rally will be short-lived. Falling demand for overall petroleum products, which was down 3.4 percent over the last four weeks compared to the same time last year, suggest prices could drop steeply once the dollar-driven oil investment frenzy runs out of steam, analysts said.

THE RECESSION AHEAD: Cyclical downturn or post-bubble recession?

An article in the New York Times by Morgan Stanley's Asia chairman, Stephen Roach, states that the country is not in a cyclical downturn, but post-bubble recession. There is a big difference. The Fed's interest rate cuts and Bush's “Stimulus Plan” are unlikely to stop housing prices from continuing to fall nor will they miraculously fix the problems in the credit markets. The massive expansion of credit in the last 6 years has created a $45 trillion derivatives balloon that could implode or just partially unwind. No one really knows. And no one really knows how much damage it will cause to the global financial system. Stay tuned.

Roach notes that the recession of 2000 to 2001 was a collapse of business spending which only represented a 13% of GDP. Compare that to the current recession which “has been set off by the simultaneous bursting of property and credit bubbles.... Those two economic sectors collectively peaked at 78 percent of gross domestic product, or fully six times the share of the sector that pushed the country into recession seven years ago.”

Jim Willie - US Dollar-Gold: A Perfect Hyper-Stagflationary Storm

Not only will the impending recession be six times more severe; it will also be the death-knell for America's consumer-based society. Attitudes towards spending have already changed dramatically since prices on food and fuel have increased. That trend will only grow as hard times set in.

Roach adds: “For asset-dependent, bubble-prone economies, a cyclical recovery — even when assisted by aggressive monetary and fiscal accommodation — isn't a given....Washington policymakers may not be able to arrest this post-bubble downturn. Interest rate cuts are unlikely to halt the decline in nationwide home prices...Aggressive interest rate cuts have not done much to contain the lethal contagion spreading in credit and capital markets.

A more effective strategy would be to try to tilt the economy away from consumption and toward exports and long-needed investments in infrastructure...Fiscal initiatives should be directed at laying the groundwork for future growth, especially by upgrading the nation's antiquated highways, bridges and ports.” (“Double, Bubble Trouble” Stephen Roach, New York Times)

The Federal Reserve and Washington policymakers are still stuck in the past trying to revive consumer spending by creating another equity bubble with low interest rates and their $600 per person “stimulus” giveaways. This is the wrong approach and its bound to fail. The Greenspan era is over. Let's put it to rest once and for all. No more bubbles. No more phony debt-generated prosperity. No more over-leveraged, complex Ponzi-scams that end in tragedy. Roach points the way forward; invest in infrastructure and environmentally-friendly technologies, rebuild the economy from the ground up, reestablish fiscal sanity and minimize deficit spending, put America back to work making things that people use and that improve society, and (as Roach says) “help the innocent victims of the bubble's aftermath — especially lower- and middle-income families”. And, most importantly, abolish the Federal Reserve and give the control of our money back to our elected representatives in Congress. That is the only way to put America's economic future back in the hands of the people.

That's a plan we can all get behind. It's time to split the new wood and start fresh.

Bravo, Stephen

By Mike Whitney

Email: fergiewhitney@msn.com

Mike is a well respected freelance writer living in Washington state, interested in politics and economics from a libertarian perspective.

Mike Whitney Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.