US Dollar-Gold: A Perfect Hyper-Stagflationary Storm

Economics / Stagflation Mar 07, 2008 - 01:52 AM GMTBy: Jim_Willie_CB

The title should really be “Psychology of 1000-20-100” to give respect to the major signpost price targets. The $1000 gold target is within reach. The $20 silver target has been breached. The $100 crude oil price has been breached. Before long, all three price levels will serve as support. When a gold target of $1000 was proposed three to four years ago, most people dominated (or bound) by conventional thinking dismissed such talk as silly, irresponsible, even ludicrous. Not any more! The same goes for silver and crude oil with their respective distant price targets, each attained. Profound market psychology is in the process of changing. Many new wrong analyses will come to the table, like so many casseroles containing rancid meat and rotten vegetables as ingredients. They will maintain that now these three goals have been met, the great sell off can begin. They will be dead wrong.

The title should really be “Psychology of 1000-20-100” to give respect to the major signpost price targets. The $1000 gold target is within reach. The $20 silver target has been breached. The $100 crude oil price has been breached. Before long, all three price levels will serve as support. When a gold target of $1000 was proposed three to four years ago, most people dominated (or bound) by conventional thinking dismissed such talk as silly, irresponsible, even ludicrous. Not any more! The same goes for silver and crude oil with their respective distant price targets, each attained. Profound market psychology is in the process of changing. Many new wrong analyses will come to the table, like so many casseroles containing rancid meat and rotten vegetables as ingredients. They will maintain that now these three goals have been met, the great sell off can begin. They will be dead wrong.

The great commodity bull market is entering into its second crucial phase , marked by a failing US financial system, a US Dollar in free fall, an insolvent US banking system, a perfect storm in US housing, the beginning of an endless US Economic recession, inept banking leadership, and equally bankrupt economic stewardship.

As the futility of policy measures becomes recognized, as rescue packages have almost no effect, as various markets refuse to stabilize, the gold price will rise further. In time the steps will be massive, like $100 in a single day. My guess is the year 2009 will see such days. Already, in the last two weeks we have been treated to two different days with at least a $1 range in the silver price. Volatility is here, to the upside, crushing shorts, lifting spirits for bulls.

PERFECT STORM DEVELOPS

Numerous vicious cycles have begun to strike at the core of the US system, both the economy and the banking system. They are each powerful. They will not relent. They will inflict horrendous damage. They will rip apart the ramparts of the US Economy, then the fabric of American life. My colleague Roger Wiegand has been vocal in his dire warnings, one of few who see the upcoming carnage, disruption, and chaos. When people ask whether the US Dollar has hit bottom, a simple question goes out as my reply.

HAS ANYTHING BEEN FIXED? HAVE ALL DESPERATE MEASURES BEEN INVOKED?

The answer to the first question is NO WAY! and to the second question NOT EVEN CLOSE! So the declines will continue, as US economic, banking, and political leaders squirm in reaction to utter futility in their policies to date, and continued futility in their upcoming policies.

Their errors are many, in prescribing solutions which are more of the same inflationary wallpaper , which demonstrate no conceivable depth of understanding for the corner they have painted the United States into. YOU CANNOT FIX INFLATION PROBLEMS WITH MORE INFLATION, any more than you can treat an alcoholic with a morning whisky chaser! This 2008 year the system breaks, and it is breaking on almost all fronts. Feedback loops are kicking into gear, and they are incredibly powerful, vicious, and difficult to interrupt.

During my 20 years in Boston , on at least four or five occasions, residents were treated to Nor'Easters, nasty storms off the Atlantic Coast that resembles an egg beater. Storms would lift moisture from the ocean, circulate air in the upper lofts, as warm air current would come north from New York, cold air would come south from Montreal, and heavy water-filled air would come east from the ocean itself. Storms would sometimes last for days on end, dumping wave after wave of snow. The most beautiful aspect of the storms in my view was the bluish hue of the snow itself, having taken and deposited blue algae from the ocean water. In certain sunlight afterward, the awesome display of nature was something to behold.

The Nor'Easter storm was a vicious circle. People would ask if the storm would ever end. Eventually, one of the three directions of wind strength would prevail, usually the south along the eastern seaboard. My imagination marvels at the power of nature embedded in rare weather systems. In the last few years, other vicious cycles have captured my attention. The Halloween Nor'Easter off the east coast in November 1991 was devastating (shown below). Its story was told in a movie called The Perfect Storm in 2000. This killer storm was an unusual Nor'easter that escaped the tropical zone, absorbed one hurricane, and ultimately evolved into a small hurricane late in its life cycle. Damage totaled $208 million while the death toll climbed to 12 people. The hurricane was the second costliest storm of the season, behind only Hurricane Bob.

VICIOUS CYCLES ENGAGE

The HOUSING vicious cycle will ensure steady decline in home prices. Numerous factors are at work to keep the damaging process caught in cycle after cycle. Questions continue on whether the worst is over for housing. The answer is NO.

The BANK vicious cycle will ensure steady losses in bonds and portfolios. Numerous factors are at work to keep the damaging process caught in cycle after cycle. Questions continue on whether the worst is over for banking. The answer is NO.

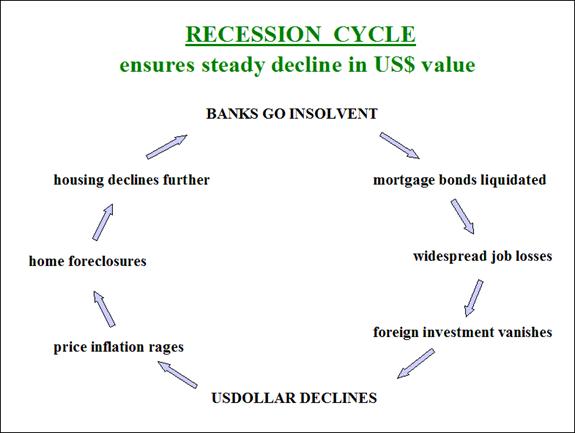

The RECESSION vicious cycle will ensure steady decline in US Dollar value, since it is the stock of the Untied States. Numerous factors are at work to keep the damaging process caught in cycle after cycle. Questions continue on whether the worst is over for the US Economy The answer is NO.

DEVASTATING EFFECT

The end result of these vicious cycles is round after round of harmful blows to the US Dollar A perfect storm has fully developed. After forming, it is gathering power. The psychology behind the storm becomes intense when the feedback loops become clear. Remarkably, parallel vicious cycles work to render horrible damage on both the tangible economy, with the housing market as foundation, and the financial sector, with the banking industry as foundation.

Reaction by the financial markets to the US housing market decline, the US bank system meltdown, and the US Economic recession, whose collective report card will increasingly be perceived through the US Dollar lens, might resemble what is seen in the movie by actors heart-throb George Clooney and bad boy Mark Wahlberg. Giant waves overtake their tiny fishing vessel, much like similar images of FOREX waves of US$ exchange rate declines overwhelming the US Economy Never does prosperity come amidst a powerful currency decline. Instead of slower economic growth bringing down prices, the opposite will occur. The falling US Dollar will force commodity and energy prices higher, the ugly consequence of decades of import dependence. Most economic policy directed by US banking and political leaders has fostered that dependence. Case in point is rising gasoline prices, amidst falling volume demand!!! Bernanke has it wrong. Next comes picking the rancid fruit from the withered industrial vines.

The final arbiter will be the gold price, along with its sibling the silver price. Great difficulty comes in fighting US giant corporations. The big US banks freely sell fraudulent bonds on a global scale with impunity, protected by the USGovt and US Congress. The big US corporations enjoy advantages with capitalization from a brisk bond and stock market, from size, and from the ability to subsidize losses. Mostly honest firms, they are hard to compete against.

However, Microsoft does stand out, with a recent $1.35 billion fine imposed by the European Commission for chronic foul play of some monopoly shade. Microsoft treats the string of similar rulings with contempt, regarding such levies as mere cost of doing business. The big US Military cannot be opposed on its terms, but can suffer from being bogged down in guerrilla wars, not to mention the devastating ignored effects of sand damage. That leaves the US Dollar as the remaining vulnerable to wave after wave of selling, from foreign disgust, utter shock over the seemingly unstoppable deterioration, and basic good judgment to sell the stock in “USA Inc” which is the US Dollar itself. The reality is that the Untied States are gradually morphing into a Third World nation, complete with a puppet leadership.

A bearish triangle was much more prominent within what mistakenly was identified as a double bottom reversal pattern. The primary trend exerted itself in strong terms. The breakdown was sudden. The 20-week moving average proved formidable as resistance. US Fed Chairman Bernanke and the minion knights of his Knothead Table gave a full green light for continued interest rate cuts, acknowledging the US Economic distress, fully aware of the bank insolvency. They recklessly opened the door to heavy volume US Dollar sales. The world noticed, did not blink, and hit the SELL button. Buttressed by continued monetary ease, unleashed waves of monetary inflation, complete with attendant rabid price inflation, factors behind the gold bull are increasing in number. Continue to watch silver, whose ratio with gold will surely improve. In other words, silver gains will outpace those of gold. The desperate central banks have no silver to dump on the market.

By the way, the announcement of Intl Monetary Fund gold sales is huge bullish. The Swiss announcement of heavy gold sales last summer was also bullish. These are desperate signals, as they are running out of gold bullion to dump. IN BASIC TERMS, THEY ARE DESPERATE. The Euro Central Bank will be the last to cut official interest rates. The gold bull will return to European shores sooner than Trichet might expect. That event will usher in the gold price vaulting past the millennium mark.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“Your financial commentaries are extremely insightful and have saved me a ton of money. The subscription has more than paid for itself. This should be an interesting year to say the least!” (RickF in Texas )

“The unfortunate demise of Dr. Kurt Richebacher leaves Jim Willie, Bob Chapman, and Jim Sinclair as the finest financial minds on the scene today.” (DougR in Nevada )

“There are four writers that I MUST READ. You are absolutely one of those favorites!! William Buckler, Ty Andros, Richard Russell, and YOU!!” (BettyS in Missouri )

“Your newsletter caught my attention when the Richebächer report ended. Yours has more depth and is broader in coverage for the difficult topics of relevance today. You pick up where he left off, and take it one level deeper, a tribute.” (JoeS in New York )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retaicl forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.