The Rising U.S. Dollar Myth

Currencies / US Dollar May 01, 2013 - 04:38 AM GMTBy: Axel_Merk

Year-to-date, the U.S. dollar is up; does that mean we are in a rising dollar environment? Or is it an opportunity to diversify out of the greenback?

Year-to-date, the U.S. dollar is up; does that mean we are in a rising dollar environment? Or is it an opportunity to diversify out of the greenback?

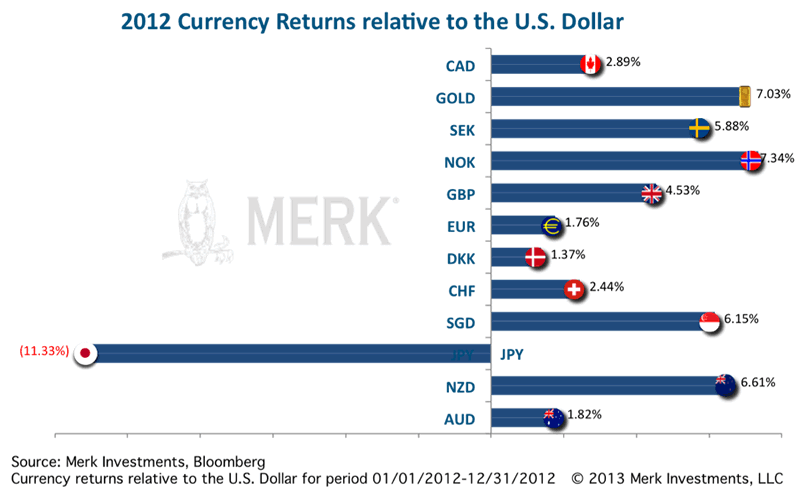

Last year, with all the turmoil in the Eurozone, the euro was up 1.79% versus the dollar; that appeared to be the best the U.S. dollar could do in times of turmoil. Of the major currencies only the Japanese yen was down versus the U.S. dollar:

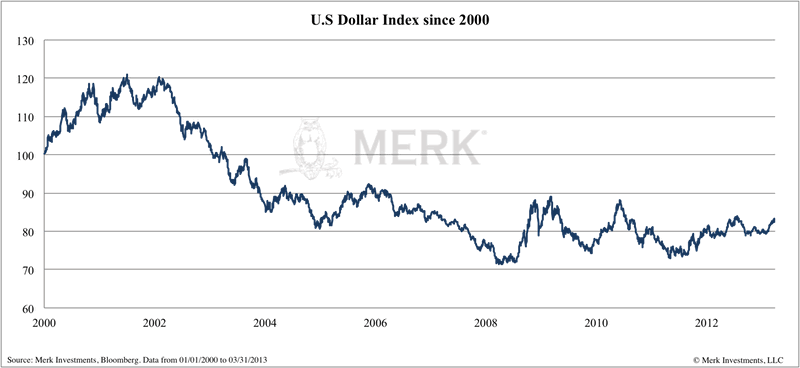

Year-to-date, the dollar index, a trade weighted index comparing the U.S. dollar to a basket of six major currencies, is up 2.95% as of April 29, 2013. What many are not aware is that this index has not really been updated since it was first created in the early 1970s, giving the euro a 57.6% exposure. The dollar’s downward trend has been slowed in recent years in large part by the turmoil in the Eurozone. Additionally, the New Zealand dollar for example, which is not in the index, is up 3.37% year-to-date.

To ascertain what may happen to the dollar, let’s look at the greenback from a couple of different angles:

Myth: U.S. dollar’s safe haven status

In recent years, when there has been talk about a “flight to quality” benefiting the U.S. dollar, we had a couple of observations:

•Flight to quality may be a misnomer: our analysis suggests the dollar tends to be in demand in times of turmoil because of liquidity, not quality considerations;

•Since the onset of the financial crisis, each time the pendulum swings in favor of the U.S. dollar, it may be swinging there less so;

•The balance sheet of the U.S. appears to be deteriorating at a faster pace than the balance sheets of much of the rest of the world;

•Wherever there is a crisis, it is being “patched up”, suggesting that when the pendulum once again favors risky assets, more money might flow towards those assets; and when the pendulum swings once again in favor of the U.S. dollar, it may be less and less of a beneficiary.

In other words, the safe haven status of the U.S. dollar may slowly be eroding.

Myth: a rising rate environment favors the U.S. dollar

Assuming one believes interest rates are to head higher, it may be an expensive proposition to buy the U.S. dollar: as foreigners have historically had a major appetite for U.S. debt, their enthusiasm is historically trimmed back as the bond market turns into a bear market. As a result, early to mid phases of tightening by the Federal Reserve (Fed) have historically often been associated with a weaker dollar. It’s the late phases of a tightening cycle that the dollar historically tends to benefit, as the next bull market is anticipated for bonds. There may be little historic precedent for the environment we are in, but a rising rate environment, in our assessment, does not favor the U.S. dollar.

Myth: the Fed’s exit is near

It was just about a year ago that Fed Chair Ben Bernanke pronounced in a press conference: Let’s be humble. He then clarified that meant that liquidity should not be mopped up too early; that we have to be sure that the recovery is firmly entrenched before one should consider an exit from the highly accommodative monetary policy.

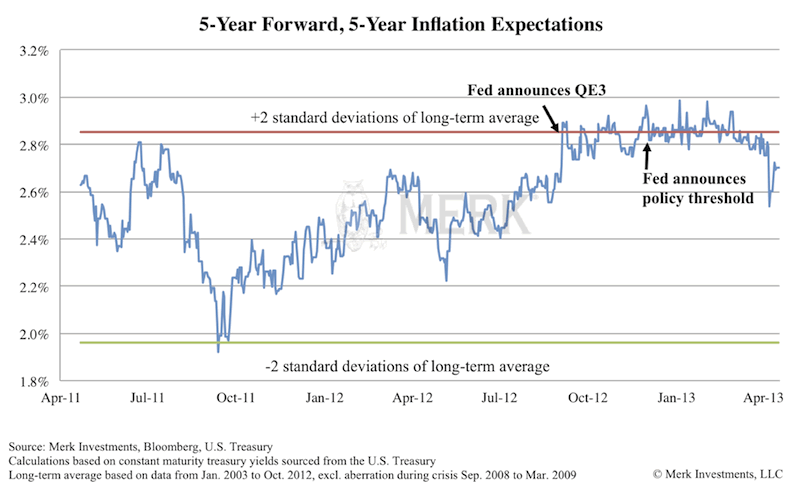

To understand Bernanke, consider that in his own words, he has repeatedly stated that he believes one of the biggest mistakes during the Great Depression was to raise rates too early. As a result, the Fed has promised to keep rates low, purchased longer-term bonds, and engaged in Operation Twist. All of these policies reflect an effort to keep long-term rates low. Yet, a little over a year ago, a series of good economic data points caused the bond market to sell off rather sharply on the long end. In our assessment of Bernanke’s thinking, that was undesirable as the recovery was nascent. Hence, the Fed doubled down by announcing an unemployment rate numerical threshold that would guide rate policy, moving the focus evermore away from inflation and towards employment. Not surprisingly, inflation expectations inched higher. The below chart is one of the many ways one can look at inflation expectations:

Bernanke has emphasized the Fed’s communication strategy and the importance of guiding market expectations. Without getting too technical about the chart, our assessment is that Bernanke is comfortable with inflation expectations at the upper range of this chart and may even consider more aggressive monetary easing when inflation expectations drop, as has occurred in recent weeks. A lowering of inflation expectations may suggest to the Fed that all the monetary action, all the “money printing” hasn’t been enough.

Myth: economic growth will support the U.S. dollar.

Skeptics still point out that it doesn’t really matter whether the “exit” will come tomorrow or down the road: the “exit” is now coming closer and, with it, the market has to start pricing it in. Well, if it does, we might be in for another surprise. In our analysis, the biggest threat to the U.S. dollar may be economic growth. Let all the money that’s been created by the Fed “stick” (economic growth may drive excess bank reserves to work), and it may be rather difficult to mop up the liquidity that’s been made available to the system:

•Technically, the Fed has pretty much ruled out selling the securities it has acquired. That’s because the Fed might have to sell them at a loss.

•The Fed has indicated it may increase the interest it pays on reserves to mop up liquidity when the time comes. Not only may that result in no longer paying over $80 billion in “profits” to the Treasury (the more securities the Fed buys by creating money with the stroke of a keyboard, the more interest it earns, the higher the Fed’s “profits”), but it will lead to tens, if not hundreds, of billions in direct payments to large banks. While there may be an academic justification to make such payments, the political fallout could lead Congress to suspend the Fed’s ability to pay interest on reserves, botching the exit strategy.

Additionally, it’s likely that economic growth would drive interest rates higher across the yield curve. More important than the technical restrictions mentioned above may be the fact that the U.S. government cannot afford a high cost of borrowing to service the national debt. The average cost of servicing U.S. debt has come down from about 6% in 2001 to just over 2%. That cost of borrowing should continue to drift downward for a while as higher coupon Treasuries mature and are refinanced with lower coupon Treasuries. We are not predicting that the average cost of borrowing will zoom back up to 6% in the short-term, but what can come down, can also go back up. Even at 4%, discretionary spending by Congress will be crowded out by interest payments. Importantly, it may matter little what cost of borrowing the government can bear; more relevant may be the perception of the sustainability of U.S. government debt. Spain had very prudent debt management, with an average maturity of about 7 years for its debt outstanding; yet it took very little time for Spain’s government to be on the brink of a bailout.

The U.S. bond market does not currently reflect serious concern about the sustainability of U.S. debt. However, without major entitlement reform, in particular in social security and Medicare, the numbers simply don’t add up. Many have argued that, over time, Congress will come to its senses and indeed engage in reform. We are actually quite optimistic ourselves: however, we believe that the only language politicians listen to is that of the bond market. The Eurozone is proof that policy makers choose between the cost of acting versus the cost of not acting. Whenever possible, politicians kick the can down the road. But unlike the Eurozone the U.S. has a current account deficit. That is, the U.S. dollar may be far more vulnerable to a bond market that’s imposing reform on policy makers than the Euro has ever been.

The reason we put this discussion under the header of economic growth is that it may well be good economic data that help to unravel the perception that U.S. debt is sustainable as yields return to more historic levels.

For a more detailed outlook on currencies, please read the Merk Gold and Currency Outlook. For purposes of this analysis, we want to show that it’s far from clear that the U.S. dollar will benefit in the environment to come. Indeed, the downside risks to the dollar might be as high as ever. Ultimately, there may be no such thing as a safe asset anymore and investors may want to take a diversified approach to something as mundane as cash. Please make sure you sign up for our newsletter to be the first to learn as we discuss global dynamics affecting the dollar. Please also register to join an upcoming Webinar; our next Webinar is on Thursday, May 23, expanding on the discussion herein.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.