Refutation of Economic Illusion with Gold and Silver Safety Perfect Timing

Economics / Global Economy Jul 06, 2013 - 10:57 AM GMTBy: Richard_Mills

Illusions trick us into perceiving something different than what actually exists and the mainstream media is very good at creating them. Currently they have the herd convinced there is an economic recovery underway.

Illusions trick us into perceiving something different than what actually exists and the mainstream media is very good at creating them. Currently they have the herd convinced there is an economic recovery underway.

We all need to understand that to have a real, and sustainable recovery for an economy that relies on consumer spending for 70 percent of its activity we need to have a jobs recovery.

Okun's Law holds that an economy, it's GDP, must grow above its potential to reduce the unemployment rate. Year-on-year economic growth of two percent above the trend (considered to be 2-3 percent) is needed to lower unemployment by one point.

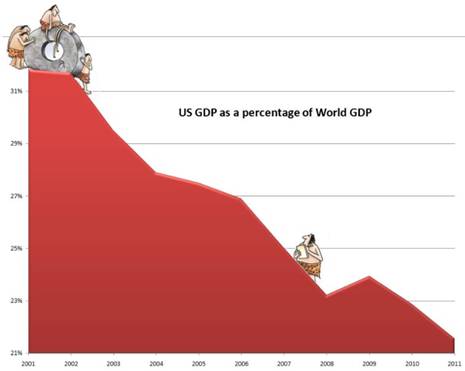

Acrossthestreet.met.wordpress.com

A third downgrade of U.S. economic growth for the first quarter 2013 showed the country's GDP grew at just a 1.8 percent annualized pace.

Bloomberg and IHS Global Insight estimate the U.S. economy will grow by 1.6 percent this year.

Industrial production was unchanged in May, the second straight weak monthly report. Capacity utilization - a measure of how fully the nation's mines, factories and utilities are deploying their resources - fell to 77.6 percent, well below the average of 80.2 percent experienced from 1972-2012.

The Commerce Department revised growth in private investment to 7.4 percent in the first quarter, down from its original estimate of 12.3 percent.

Imports were originally reported as growing by 5.4 percent but the revised number is now 0.4 percent.

Sequestration - what remains of the 'fiscal cliff' after the U.S. Congress passed the American Taxpayer Relief Act - could trim economic growth in 2013 by 0.6 percentage points by cutting $85 billion worth of Federal government spending this year. Over its ten year life sequestration will cut $600 billion of government spending from the economy.

" The drop in growth rate is not temporary, but over the span of at least 10 years in which the sequestration will take effect. And its impact will be more strongly felt in later years, once the fiscal sequestration translates through its negative multiplier effects." Benjarong Suwankiri, 'After Fiscal Cliff, Sequestration' nationmultimedia.com

Hourly pay for U.S. nonfarm workers fell a record 3.8 percent annualized in the first quarter, the largest decline since records started being kept in 1947. This record first quarter decline was on top of the 2012 third weakest annual increase in hourly pay since 1947. Hourly worker pay rose only 1.9 percent in 2012, barely keeping up with the 1.8 percent gain in the fudged downward and much maligned consumer price index.

The growth rate of consumer spending was revised downward to 2.6 percent annualized in the first quarter from an earlier estimate of 3.4 percent.

The labor force participation rate is the percentage of working-age persons in an economy who:

- Are employed

- Are unemployed but looking for a job

"Working-age persons" is defined as most people between the ages of 16-64. Excluded are students, homemakers, and people under the age of 64 who are retired.

According to the Bureau of Labor Statistics the labor force participation rate dropped 0.2 percentage points to 63.3 percent. This is the lowest rate in 34 years.

Considering population growth in the U.S. is positive and is one of the highest rates in developed countries, you'd think labor force participation would be growing, not dropping. The U.S. economy needs to add 150,000 to 250,000 jobs per month just to absorb the workforce's new entrants never mind make up for what's been lost since the Great Recession.

"February's headline unemployment rate was portrayed as 7.7%, down from 7.9% in January. The dip was accompanied by huzzahs in the news media claiming the improvement to be "outstanding" and "amazing." But if you account for the people who are excluded from that number--such as "discouraged workers" no longer looking for a job, involuntary part-time workers and others who are "marginally attached" to the labor force--then the real unemployment rate is somewhere between 14% and 15%." Mortimer Zuckerman, 'The Great Recession Has Been Followed by the Grand Illusion,' wsj.com

U.S. labor force participation is now down to where it was in 1979. The unprecedented 2.5 percentage point decline in labor force participation under President Obama amounts to 6.2 million Americans being pushed out of the job market - 6,200,000 have stopped looking for work, these people have been forced to give up.

Many of the jobs that are being created are part-time low wage second or third jobs going to those already working. The average work week is now a very short 34.5 hours because employers are shortening workers' hours or asking employees to take unpaid leave.

"The financial crisis destroyed some $16 trillion in household wealth. Americans have only recovered 45 percent of that amount...But when you break down that wealth recovery by income level, it gets worse. The Fed estimates that 62 percent of that wealth people have regained since the depths of the recession has come in the form of higher stock prices. And 80 percent of stock wealth is held by people in the top 10 percent of the income distribution." Erika Eichelberger, 'Sorry, There's Been No Economic Recovery for Poor and Minority Households'

Here's a few facts:

- Medium household income has declined. Adjusted for inflation household incomes are now back to levels last seen in the 1990s - average per capita wage is around $26,000, household median income is at $50,000

- Few Americans own any significant amount of financial wealth. The bottom 80 percent of Americans hold roughly 5 to 8 percent of all financial wealth (non-housing related)

- U.S. Employment rate is not recovering, one in 12 Americans are jobless

- The number of Americans living in poverty has now reached a level not seen since the 1960s. There are 50 million poor people in America. There are more than 146 million Americans considered either poor or low income

- There are over 47 million Americans on food stamps

- The banking system backs $7.4 trillion in insured deposits with $32 billion, that's just .43 percent

- 1 out of 3 Americans have no savings

- Nearly half of American's die broke

- There are less Americans working manufacturing jobs today than in 1950 even though the country's population has doubled

- The U.S. has run a trade deficit with the rest of the world of more than 8 trillion dollars since 1975

- The U.S. Social Security system is facing a 134 trillion dollar shortfall over the next 75 years

"The employment trend in manufacturing is overwhelmingly negative and has been for nearly twenty years. This country does not simply lack manufacturing jobs, it lacks entire industries.

The Manufacturers Alliance for Productivity and Innovation (MAPI) released a report in January 2013 detailing the generational decline in manufacturing output and capacity in the United States. In general, for every two new plants that come on line, three others are shut down. For every two jobs created at one plant, three are lost somewhere else.

The companies that make up our so-called "manufacturing base" often survive, but they do so by moving jobs and production overseas. The MAPI report shows dramatic increases in overseas production and sales by the foreign affiliates of American multinationals alongside virtual stagnation of domestic metrics in the United States." Craig Harrington, The Continued Decline of American Manufacturing, economyincrisis.org

Global

According to the Organization for Economic Co-operation and Development (OECD), the combined government debt held by the world's advanced economies is at its highest point since the Second World War. In 1945, the debt topped out at 116 percent of GDP; at the end of 2012 it hit 114.4 percent. The OECD says we'll hit a new high in 2013.

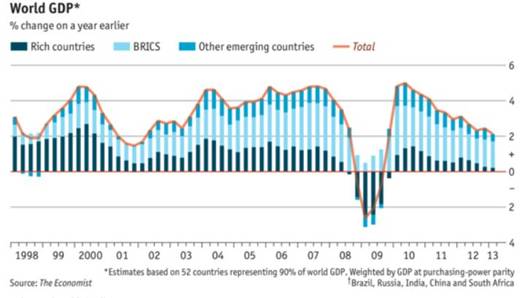

Global trade has slowed. According to the World Trade Organization (WTO) international trade rose 5.2 percent in 2011, two percent in 2012 and growth has been revised downward to 3.3 percent in 2013 instead of the 4.5 percent the WTO predicted last September.

According to The Economist world GDP grew by just 2.1 percent during the first quarter of 2013. The UN Department of Economic and Social Affairs (DESA) says growth of world gross product (WGP) is now projected at 2.3 per cent in 2013, the same pace as in 2012.

In a report titled 'Update to Global Macro Outlook 2013-14: Loss of Momentum,' Moody's, an international credit rating agency, expected the euro area economy to experience a deeper and lengthier recession than previously thought. Moody's also expects the real GDP growth of developed economies in the G20 countries to stand at around 1.2 percent in 2013 followed by 1.9 percent in 2014.

Unemployment in the euro area has reached an all-time high and is forecast to average 12.8 per cent in 2014.

"A prolonged period of subdued growth and fiscal austerity in many economies has added about 4 million more to the ranks of the unemployed." Assistant Secretary-General for Economic Development Shamshad Akhtar

Chinese May exports rose by just one percent year on year - the lowest rate since last July - while imports fell by 0.3 percent. Exports to Japan were down by 5.7 percent, exports to the US decreased by 1.6 percent and by 9.7 percent to the European Union. Exports to both the U.S and EU have been falling for three months in a row.

Two gauges of China's manufacturing fell in June - an official Purchasing Managers' Index dropped to 50.1 from 50.8 - 50.1 is the lowest level in four months. The PMI report showed declines in sub-categories including output, new orders, input prices and employment - the export orders sub-index was reported at 47.7, the lowest reading since February.

A private PMI from HSBC Holdings Plc and Markit Economics was 48.2, the weakest since September - readings above 50 signal expansion.

The June HSBC/Markit PMI for the services industry (the services sector accounted for 46 percent of China's economy in 2012) inched up to 51.3 in June from May's 51.2. Growth in new orders hit a 55 month low and business confidence slumped to 2005 levels.

"China's President Xi Jinping said over the weekend that officials should no longer be evaluated against economic growth but with consideration to other indicators including welfare and ecological improvements and social development." Reuters, ' China June HSBC services PMI expands modestly'

Growth in India has slowed significantly over the last two years while Markit factory gauges for South Korea slipped to the lowest level since November 2012.

Japan, the world's third largest economy, would seem to be an economic ray of sunshine as its economy grew at an annualized 4.1 percent in the first quarter. A closer look under the hood reveals it was done by flooding the system with money. The flood of fiat has depreciated the yen by 25 percent against the U.S. dollar since the start of the year. A weaker yen has helped boost exports and drive local stock exchanges higher, to five year highs.

"In Japan, a dynamic relaxation of macroeconomic policy has sparked an uptick in activity, at least over the short-term." The Japan Times News, 'Japan growth estimate gets World Bank boost'

Abenomics is going to fail because:

- Consumers in Japan remain convinced the threat is deflation, not inflation, they are not spending

- Japan's debt is 240 percent of GDP limiting government spending

- The Prime Ministers own party is against structural reforms

- Japanese corporations are not buying into 'Abenomics' - corporate investment fell by 4.9 percent in the first quarter

- Abenomics is nothing more than a policy of beggaring your neighbor.

Conclusion

The world's four largest economies - the U.S., China, Japan and the EU - face extremely strong headwinds on their way to recovery; the lack of jobs and consumer spending, a liquidity crisis and an insolvency crisis. The much ballyhooed recovery is simply an illusion bought and paid for by the world's central banks with loose monetary policy - money printing has driven the rise in stock markets and house prices.

"The global financial crisis that began in the United States in the summer of 2007 was triggered by a bank run, just like those of 1837, 1857, 1873, 1893, 1907 and 1933." Yale economist Gary Gorton's Misunderstanding Financial Crises, Why We Don't See Them Coming

Gorton writes the 2007-2008 crisis was systemic, spreading from one institution to another, and set off by a run on "repos and asset backed commercial paper" which are "forms of bank debt that grew to significant amounts and were vulnerable to being run on."

Panic set in, selling becomes widespread - everyone was trying to squeeze out a narrow exit at the same time - from shorter term instruments like repos and commercial paper to longer term obligations like bonds, stocks, commodities and real estate.

Firms thought too big to fail, like Merrill Lynch, Lehman Brothers, Bear Stearns, Wachovia, Washington Mutual and Countrywide Financial disappeared.

In this author's opinion it's going to happen again.

It certainly couldn't be a bad thing to have a little gold and silver tucked away for a rainy day. The recent drop in bullion prices makes for perfect timing.

Is establishing an easily accessible rainy day fund consisting of cash, gold and silver on your radar?

If not, maybe it should be.

If not, maybe one should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.