Bernanke’s Gift - Tempering the Taper Tantrum

Interest-Rates / Quantitative Easing Aug 01, 2013 - 10:42 AM GMTWASHINGTON (MarketWatch) — The Federal Reserve on Wednesday slightly downgraded its economic outlook but gave no hint about its plans for its $85 billion-a-month asset purchase program. The statement released after a meeting of the Fed’s policy making committee said that the economy was expanding at a “modest” pace, a change from the “moderate” pace seen in June. The Fed also noted that the rise in mortgage rates was a concern. It also said that persistently low inflation was a risk. There was only one dissent, by Kansas City Fed President Esther George.

This short report from MarketWatch captures the essence of the Fed’s announcement this afternoon, and it would be difficult to conjure how it could have been more dovish. A few weeks ago, after Fed chairman Ben Bernanke raised the spectrum of QE tapering and sent the ten year yield on a tear, I wrote an article titled “Bernanke’s Conundrum” in which I outlined the problem of market-induced rising interest rates, an end result precisely opposite Federal Reserve policy.

Today we get “Bernanke’s Gift” — a colorfully wrapped package for Wall Street from the soon to be departing Fed chairman complete with a big red bow, lots of loud horns and the Federal Reserve board singing in chorus (with the notable exception of Esther “Party Pooper” George). The Fed’s “concern” about rising mortgage rates coupled with the perception of low inflation as a “risk” amount to a back door assurance on the ten year rate and continued quantitative easing. In my view, Bernanke and company did not wish to leave any room whatsoever for ambiguity or having something lost in the translation — a message clearly intended to temper the markets’ recent taper tantrum.

From “Bernanke’s Conundrum” (and still true now):

“Ironically, the stock market, like the bond market, might already be reacting to the new rate reality, while gold’s sudden demise, if indeed caused by the so-called “paring down of quantitative easing,” might have been false. If that is the case, a make-up rally could be in the offing…..in fact it might already have been launched.

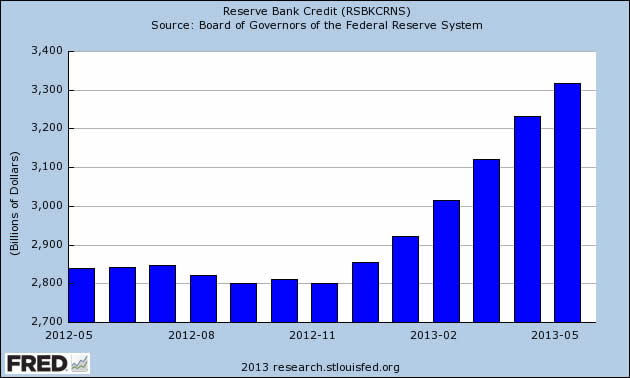

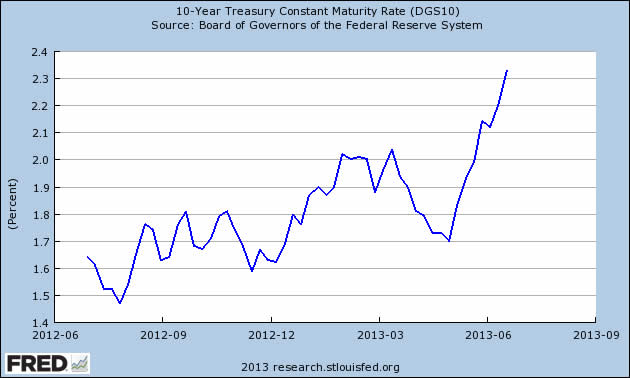

In an earlier article, I advised that we should take heed of what the Fed does, not what it says. In a certain sense, as you see in the two graphs below, the Federal Reserve may have already launched QE4 while simultaneously talking about ratcheting monetization down. The two graphs together show cause and effect and tell the real story of what is happening at the Fed. For a while, it wasn’t clear why bank reserve credit (QE) was rising. When you marry that chart to 10-year Treasury maturity rates, the reason becomes quite clear. The Fed is battling the market to keep rates low and the government (along with the rest of the economy) financed at favorable rates.”

In recent days, gold’s rally has been on hold, though the metal is still up over 7% for the month of July. By taking tapering off the table for the time-being, Bernanke might have brought gold off the bench to resume that make-up rally. The question likely to be asked (for which there is unlikely to be an answer) will be: “Well, what happened to tapering?” It is unlikely that we will experience a shortage of commentary or speculation on that score, so buckle your seat belts. The ride could get bumpy.

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD NEWS, COMMENTARY & ANALYSIS, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael Kosares has over 30 years experience in the gold business, and is the author of The ABCs of Gold Investing: How to Protect and Build Your Wealth with Gold, and numerous magazine and internet articles and essays. He is frequently interviewed in the financial press and is well-known for his on-going commentary on the gold market and its economic, political and financial underpinnings.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.