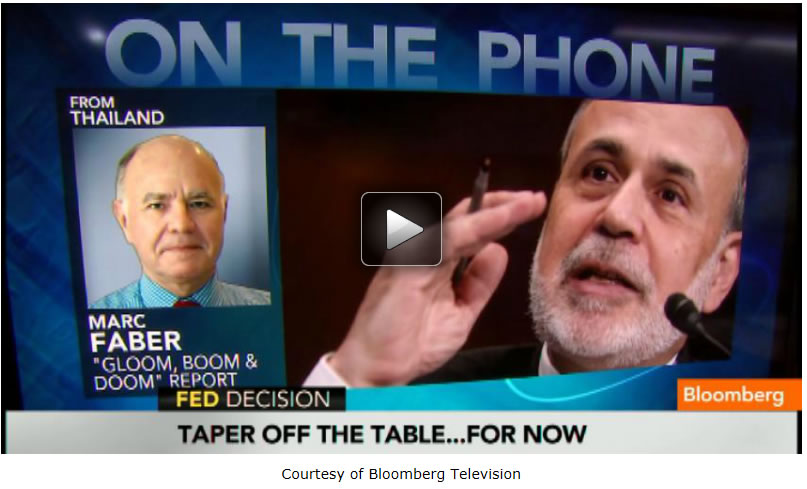

Faber: On Bernanke Failure to Taper QE

Interest-Rates / US Federal Reserve Bank Sep 19, 2013 - 03:11 AM GMTBy: Bloomberg

Marc Faber, publisher of the Gloom, Boom and Doom Report, stopped by Bloomberg Television's "Street Smart" today and told Trish Regan, Adam Johnson and Matt Miller that Janet Yellen would "make Mr. Bernanke look like a hawk."

Marc Faber, publisher of the Gloom, Boom and Doom Report, stopped by Bloomberg Television's "Street Smart" today and told Trish Regan, Adam Johnson and Matt Miller that Janet Yellen would "make Mr. Bernanke look like a hawk."

Faber also said, "When I look at the market action today, I would like to see the next few days, because it may be a one-day event. The markets are overbought. The Feds have already lost control of the bond market. The question is when will it lose control of the stock market."

Faber on the reaction that there's going to be no taper for now:

"My view was that they would taper by about $10 billion to $15 billion, but I'm not surprised that they don't do it for the simple reason that I think we are in QE unlimited. The people at the Fed are professors, academics. They never worked a single life in the business of ordinary people. And they don't understand that if you print money, it benefits basically a handful of people maybe--not even 5% of the population, 3% of the population. And when you look today at the market action, ok, stocks are up 1%. Silver is up more than 6%, gold up more than 4%, copper 2.9%, crude oil 2.68%, and so forth. Crude oil, gasoline are things people need, ordinary people buy everyday. Thank you very much, the Fed boosts these items that people need to go to their work, to heat their homes, and so forth and at the same time, asset prices go up, but the majority of people do not own stocks. Only 11% of Americans own directly shares."

On whether interest rates are held down when the Fed continues this type of policy:

"On September 14, 2012, when the Fed announced QE3, that was then extended into QE4, and now basically QE unlimited, the bond markets had peaked out. Interest rates had bottomed out on July 25, 2012--a year ago--at 1.43% on the 10-year Treasury note. Mr. Bernanke said at that time at a press conference, the objective of the Fed is to lower interest rates. Since then, they have doubled. Thank you very much. Great success."

On what the endgame is:

"Well, the endgame is a total collapse, but from a higher diving board. The Fed will continue to print and if the stock market goes down 10%, they will print even more. And they don't know anything else to do. And quite frankly, they have boxed themselves into a corner where they are now kind of desperate."

On Janet Yellen:

"She will make Mr. Bernanke look like a hawk. She, in 2010, said if could vote for negative interest rates, in other words, you would have a deposit with the bank of $100,000 at the beginning of the year and at the end, you would only get $95,000 back, that she would be voting for that. And that basically her view will be to keep interest rates in real terms, in other words, inflation-adjusted. And don't believe a minute the inflation figures published by the bureau of labor statistics. You live in New York. You should know very well how much costs of living are increasing every day. Now, the consequences of these monetary policies and artificially low interest rates is of course that the government becomes bigger and bigger and you have less and less freedom and you have people like Mr. De Blasio, who comes in and says let's tax people who have high incomes more. And, of course, immediately, because in a democracy, there are more poor people than rich people, they all applaud and vote for him. That is the consequence."

On where he sees gold heading:

"When I look at the market action today, I would like to see the next few days, because it may be a one-day event. The markets are overbought. The Feds have already lost control of the bond market. The question is when will it lose control of the stock market. So, I'm a little bit apprehensive. I would like to wait a few days to see how the markets react after the initial reaction."

On whether the 10-year yield will float back up to where it was before 2pm today:

"I will confess to you, longer-term, I am of course, negative about government bonds and i think that yields will go up and that eventually there will be sovereign default. But in the last few days, when yields went to 2.9% and 3% on the 10-year for the first time in years i bought some treasuries because I have the view that they overshot and that they could ease down to around 2.2% to 2.5% because the economy is much weaker than people think...I think in the next three months or so."

On gold prices:

"I always buy gold and I own gold. I don't even value it. I regard it as an insurance policy. I think responsible citizens should own gold, period."

Copyright © 2013 Bloomberg - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Bloomberg Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.