US Government Shutdown - Wall Street Signals Concern on Debt Ceiling

Politics / US Debt Oct 06, 2013 - 09:41 PM GMTBy: Global_Research

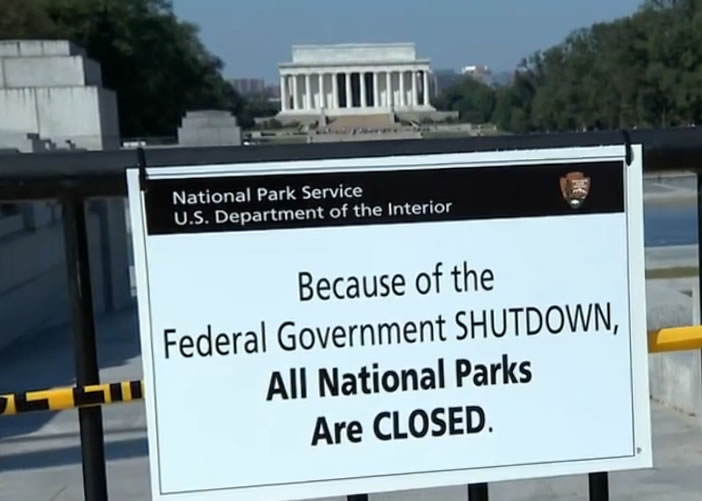

Bill Van Auken writes: With the partial shutdown of the US government ending its fourth day on Friday, leaving 800,000 federal employees out in the street and vital social, environmental and other services paralyzed, the US Congress appeared no closer to an agreement on a bill that would provide the appropriations to keep the government running in the new fiscal year that began Tuesday.In immediate jeopardy are programs like WIC, which provides supplemental food assistance to some 9 million low-income women, infants and children, and Head Start, with nearly 20,000 children in programs whose grants kick in on October 1 already facing the threat of being locked out.

Bill Van Auken writes: With the partial shutdown of the US government ending its fourth day on Friday, leaving 800,000 federal employees out in the street and vital social, environmental and other services paralyzed, the US Congress appeared no closer to an agreement on a bill that would provide the appropriations to keep the government running in the new fiscal year that began Tuesday.In immediate jeopardy are programs like WIC, which provides supplemental food assistance to some 9 million low-income women, infants and children, and Head Start, with nearly 20,000 children in programs whose grants kick in on October 1 already facing the threat of being locked out.

The shutdown has also begun spilling over to the private sector, with government contractors laying off employees, in some cases because they work in shuttered government buildings or depend upon government inspectors to approve their work. Lockheed Martin Corp. announced on Friday that it would begin furloughing 3,000 of its employees and would be forced to increase the number each additional week of the shutdown. Boeing also said it would begin furloughing workers.

Nonetheless, Wall Street appeared unfazed by the government funding crisis, with the Dow Jones Industrial Average closing up by a little more than half a percent on Friday. Indifferent to the mass suffering caused by the shutdown, the banks and finance houses appeared confident that congressional leaders would do their bidding by raising the debt ceiling and averting a default before the government reaches its borrowing limit on October 17.

During a closed-door House Republican caucus meeting Friday, House Speaker John Boehner reportedly told his fellow Republicans that he would not allow the government to default, while indicating that the debate on raising the debt ceiling would likely become tied into the shutdown issue as well as proposals for far-reaching cuts to core social programs such as Social Security and Medicare and fresh tax cuts for the corporations and the wealthy.

“I don’t believe we should default on our debt,” Boehner told reporters after the Republican caucus meeting Friday. He added, however, “If we are going to raise the amount of money we can borrow, we ought to do something about our spending problem and lack of economic growth.”

The likelihood that the government shutdown will continue for at least another week was underscored by a procedural maneuver unveiled by House Democrats Friday, aimed at forcing a vote by the Republican-led chamber on a so-called “clean” spending bill, i.e., one not tied to Republican demands for changes in the Affordable Health Care Act, otherwise known as Obamacare.

The Democrats’ plan, which revolves around a so-called discharge petition, would result in a measure which funds the government only through November 15. It requires getting all 200 House Democrats to sign a petition along with at least 18 Republicans, who would have to defy their own party leadership. Congressman Steny Hoyer of Maryland, the second-ranking Democrat in the House, while backing the maneuver, warned that “the fear factor on the Republican side is very high” and that members of the majority were being “threatened” not to support any clean spending bill.

Perhaps the most significant feature of this Democratic strategy is that even in the unlikely event that it garnered the required number of signatures and moved through the House, the earliest any vote could take place would be October 14, extending the shutdown for at least another 10 days.

The attitude of US finance capital toward the political wrangling in Washington was summed up by Brian Belski, chief investment strategist at BMO Capital Markets, who told USA Today: “The shutdown is a sideshow. It’s all about the debt ceiling and potential default.”

This sentiment was echoed by Scott Clemons, chief investment strategist at Brown Brothers Harriman Wealth Management, who told CNBC Friday: “I find it painful to say this, but the government shutdown doesn’t tend to affect markets at all. The debt ceiling debate, however, is a different matter… we’re likely to have uncertainty until the 11th hour.”

Billionaire investor Warren Buffett, in an interview with Fortune magazine, argued that politicians should be prohibited from using approval of the government’s borrowing authority as leverage for shifting other policies. “It ought to be banned as a weapon,” he said. “It should be like nuclear bombs, basically too horrible to use.”

On Thursday, the US Treasury Department said that failure to raise the debt limit and a resulting default on US government debt “has the potential to be catastrophic,” likely triggering a financial meltdown that would “echo the events of 2008 or worse.”

According to Treasury estimates, without an increase in the borrowing cap by October 17, it will be left with only $30 billion to meet $60 billion in daily outlays. Failing to meet interest payments on government bonds would result in default.

Such a default, the Treasury report warned, would cause the seizing up of credit markets, a collapse in the value of the dollar and a skyrocketing of US interest rates, with effects that would “reverberate around the world.”

The pretense of the political debate in Washington is that Obama and the Democrats are committed to “clean” bills funding the government and raising the debt ceiling, while Republicans are attempting to condition such legislation on the inclusion of delays or alterations of Obamacare and cuts in core entitlement programs. The reality is that both parties are in agreement that attacks must be carried out on Social Security, Medicare and other programs in order to pay for the massive and continuing bailout of Wall Street. Whether they will accompany or follow bills to fund government operations and raise the debt ceiling remains to be seen.

A CBS News poll released Thursday showed that nearly nine out of ten Americans disapprove of the government shutdown, with 43 percent describing themselves as angered by it. In this poll as well as others, Obama, as well as congressional Democrats and Republicans, all receive record negative ratings, with the larger share of blame falling on the Republicans.

Among growing sections of working people, there is a recognition that the Democrats and Republicans are not merely involved in a dysfunctional partisan confrontation, but are preparing to carry out punishing new attacks on social services living standards. Tens of millions of workers are well acquainted with being thrown out of their jobs and losing income, like the federal workers today.

The isolation from and indifference to the concerns of ordinary working people on the part of the Congress and the entire government, together with the recognition that they are widely hated throughout the country, contributes to an atmosphere of fear in Washington that found tragic expression Thursday in the gunning down of an emotionally disturbed young woman in the streets of the US capital.

Miriam Carey, 34, a dental hygienist from Connecticut, died in a hail of bullets after ramming her car, carrying herself and her infant daughter, into barricades and police vehicles outside the White House and the Capitol building.

There are growing questions over the behavior of the Secret Service and Capitol Police, who fired multiple rounds at her vehicle as it sped away—in contravention of basic protocols for the use of deadly force—and then killed the woman after, according to some reports, she had gotten out of the car. It was reported that Carey, who was unarmed, was shot at least six times and that her wounds were so devastating that it made identification difficult.

One tourist compared the response of security forces to Carey’s ramming of a police barricade to someone having “poked a hornets’ nest,” with heavily armed paramilitary police swarming through the center of official Washington and placing Congress in lockdown, with legislators ordered to “shelter in place.”

The incident underscored that while services vital to the quality of life of millions have been shuttered by the budget confrontation, the massive military, police and intelligence apparatus continues to operate at full throttle.

Bill Van Auken is a frequent contributor to Global Research. Global Research Articles by Bill Van Auken

© Copyright Bill Van Auken , Global Research, 2013

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.