China's Big Gold Buyer

Commodities / Gold and Silver 2013 Nov 21, 2013 - 04:19 AM GMTBy: Adrian_Ash

Private Chinese demand for gold has leapt ahead of economic growth...

Private Chinese demand for gold has leapt ahead of economic growth...

ONE MAN'S investor is, apparently, another's middle-aged housekeeping auntie in China.

"Yang Cuiyan," says Bloomberg, "a 41-year-old housekeeper from Anhui province, is one reason China is poised to topple India as the world's top consumer of gold, even as investors desert the metal."

Yes, of course the sub-editors got to this article. Yes, we should never take such "slice-of-life" reporting as anything serious.

But that distinction, between the middle-aged Chinese "auntie" (as women of Yang's age are apparently known) and the "investor" smacks loudly of a West-centric view.

Clearly, she's dumb to buy jewelry in the hope of retaining her savings when investors here in the West are "deserting" precious metals. Nevermind that Yang, and the army of Chinese aunties, is an investor herself. Nevermind that, buying only an ounce each (as she has), that army of 120 million Chinese women in their 40s today (the prime age for China's stereotypical "goldbug" according to brokerage Nomura, although it says he's male and buys at his bank) would outweigh the 2013 sales from Western ETF contracts five times over.

And nevermind that the world's still-fastest growing major economy is now the world's No.1 private gold buyer too, finally overtaking India in 2013.

Of course, that army of aunties doesn't have the cash to purchase one ounce each at will. Nor will they all choose to buy gold, let alone all at once. But unlike here in the West, precious metals are not a minority sport in China today. And as our friend Marcus Grubb at the World Gold Council notes in this interview, the 2013 slowdown in China's economic growth has NOT seen a slowdown in China's gold demand.

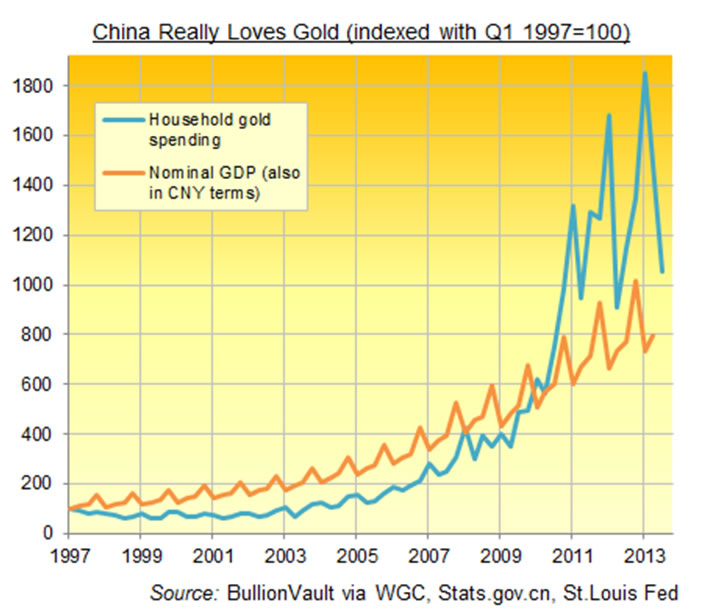

It's been a while since we looked at China's gold demand in depth, or the share of China's household savings going to gold. But as our chart above shows, after the 2011 surge, there was indeed something of a 2012 gold panic in China. Consumer demand only grew greater this year, pulling the gross spend on jewelry, coins, investment bars and gold trinkets some 18% higher over the first 9 months of the year in Yuan terms.

No, you don't need to misread the available, well-established and rigorous data to reach some startling conclusions. Based on the World Gold Council's numbers, produced by the GFMS consultancy (now part of Thomson Reuters), private consumer spending on gold, in Yuan terms, has risen up to 18 times over in the last decade. Crunching the numbers today, we reckon 0.8% of China's entire GDP was spent by private households on physical gold in the first quarter – which includes the peak seasonal demand of lunar New Year – of both 2012 and 2013.

Whether for jewelry, bars or coin, it's very hard – and very old-skool colonial – to deny the investment motive in that world-beating demand today. But one man's investor is another's housekeeping auntie. Making it all the easier to dismiss the countless decisions to acquire gold made by households in the hardest-saving and fastest-growing big economy.

By Adrian Ash

BullionVault.com

Gold price chart, no delay | Buy gold online at live prices

Adrian Ash is head of research at BullionVault, the secure, low-cost gold and silver market for private investors online, where you can buy gold and silver in Zurich, Switzerland for just 0.5% commission.

(c) BullionVault 2013

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

Adrian Ash Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.