Can U.S. Stock Market Avoid A Serious Correction Again?

Stock-Markets / Stock Markets 2014 Mar 14, 2014 - 07:32 PM GMTBy: Sy_Harding

The Dow is down about 2% for the week, so minor that it’s hardly a blip on the charts. However, given the similar declines in global markets, the continuing dismal economic news out of China, and concerns about the Ukraine/Russia situation, the decline has gotten some attention.

The Dow is down about 2% for the week, so minor that it’s hardly a blip on the charts. However, given the similar declines in global markets, the continuing dismal economic news out of China, and concerns about the Ukraine/Russia situation, the decline has gotten some attention.

Wall Street and the bulls say the pullback means nothing. At this point anyway, they are correct. The bears, who had moved into the shadows as the market recovered to new highs in February, have come back out of the shadows to reiterate their warnings about 2014. So far, they need more confirmation that trouble for the market expected later in 2014 has begun early.

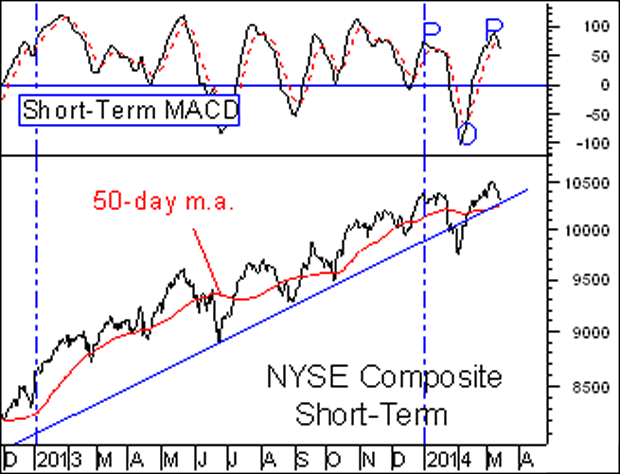

Technically, the pullback did do some short-term damage, since short-term technical indicators had climbed back to their overbought zones, and the loss of momentum has triggered another short-term sell signal.

Last year, after similar short-term signals, the market stumbled but found support at the trendline that had halted its previous attempts to correct during the year.

However, this year, in January, when the economy began to stumble again, and the Fed began to taper back its QE stimulus, the market experienced a pullback that did not find support at the trendline, breaking beneath it.

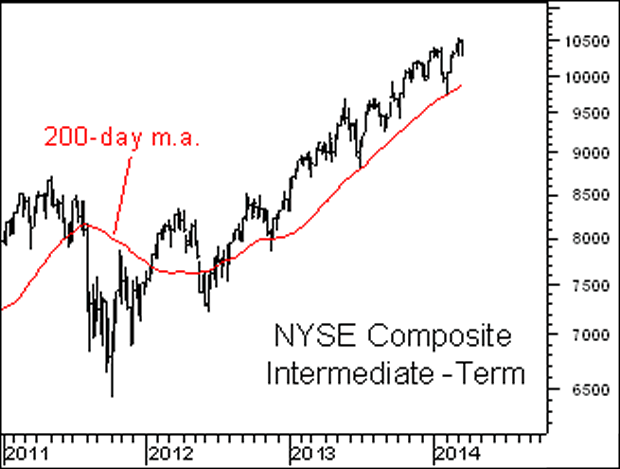

However, before the decline could amount to anything, the market found support at its more important long-term 200-day moving average, and rallied back to a new high in February.

This week, the NYSE Composite has already pulled back to the potential short-term trendline support. Will it find support here this time, or tumble further to the 200-day m.a., as it did in January. Yet, even that would only be another minor pullback of 6.2%.

However, now that the market does not have the Fed pumping in more stimulus, and in fact less, could it also break below the 200-day m.a., as it did in 2011? In that decline the NYSE Composite and S&P 500 fell 20% before the Fed decided to jump back in with more stimulus.

Meanwhile, the U.S. market remains positive and resilient. U.S. investors remain confident, hoping for another year like last year.

However, looking through the windshield may be more important this year than looking in the rear-view mirror. Last year was a very unusual year. In spite of an economy that grew only 1.9%, the S&P 500 surged up an abnormal 26% for the year.

We need to realize how very different conditions are now, than they were at the beginning of last year.

It’s not just that the Fed is no longer providing $85 billion a month of stimulus. With its additional removal of $10 billion this month, it’s down to $55 billion a month.

It is also the significant rise in the market’s valuation level. The Shiller CAPE P/E ratio is now at 24.6, 49% above its historical mean of 16.6. It is the age of the bull market. It is the worsening economy of China, the world’s second largest economy, and its bear market. It is the plunge in the stock market of Japan, the world’s third largest economy, already down 12% since its December peak. It is new concerns about Europe that has its markets looking toppy.

It is the action of gold and bonds so far this year. Gold and bonds tend to move opposite to the stock market. Gold plunged 28% last year. Bonds declined 6%. And the S&P 500 rose 26%.

So far this year, both gold and bonds have rallied strongly while the U.S. stock market has also rallied, reaching a new record high two weeks ago. It is highly unlikely they will continue to rally together. Which will reverse, gold and bonds, or the stock market? And how soon?

With the significantly changed conditions in a so far disappointing 2014, I expect that technical support levels, and momentum reversal indicators, are going to be a lot more important to being on the right side of the market going forward, than looking back at last year.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.