2014 Year of Commodities (March Update)

Commodities / Agricultural Commodities Mar 25, 2014 - 04:42 PM GMTBy: Ned_W_Schmidt

That 2013 was a year when equities ruled supreme is now well recorded history. Generally speaking, expectations at the end of the year were that 2014 would be more of the same. Among the popularly reported forecasts were the S&P 500 going to 2,000 while $Gold would plunge to $1,050. While the calendar will ultimately decide the wisdom of those forecasts, reality is already casting doubt on them. Perhaps the numbers in those forecasts were inadvertently switched.

That 2013 was a year when equities ruled supreme is now well recorded history. Generally speaking, expectations at the end of the year were that 2014 would be more of the same. Among the popularly reported forecasts were the S&P 500 going to 2,000 while $Gold would plunge to $1,050. While the calendar will ultimately decide the wisdom of those forecasts, reality is already casting doubt on them. Perhaps the numbers in those forecasts were inadvertently switched.

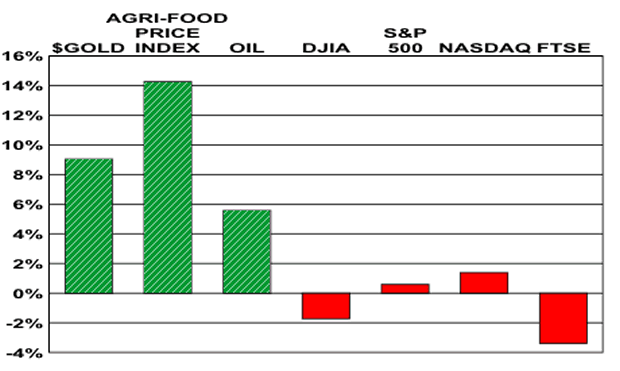

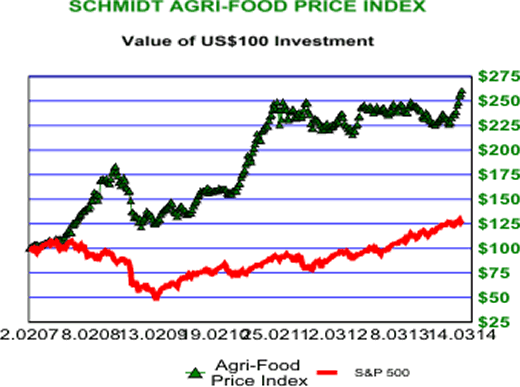

In the above chart are plotted year-to-date returns for some popular investment strategies. Immediately obvious is that the three components of the commodity group are all up while equities, depending on the index, are either down or up only modestly. Also readily apparent is that the Agri-Food Price Index has risen by the greatest amount, achieving a new all time high as shown below. Gold followed in second place. Equities follow in clearly fourth place.

These price returns tell us that demand for Gold and Agri-Foods is stronger than supply. Weak equity prices indicate that supply is in excess of demand. Quite simply, the supply of equities is excessive and the supply of Gold and Agri-Foods is inadequate.

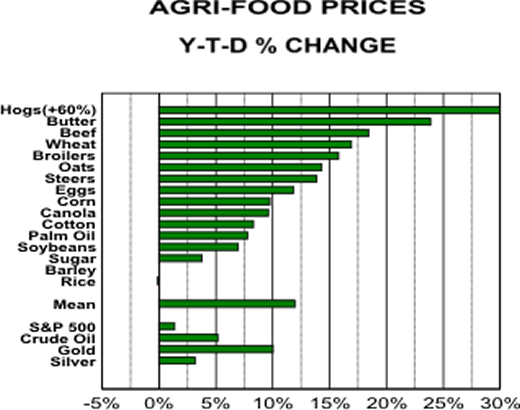

That the Agri-Food Price Index is at a new high is made more significant by pervasiveness of the move in Agri-Commodities thus far this year. As shown in chart below of year-to-date price changes, 14 of 16, or 98%, of the Agri-Commodities have experience price increases thus far in 2014. Those price increases range from +4% for sugar to +60% for hogs. Corn, which some had forecast to trade at US$2.50, has instead risen by 10% and traded over $5 briefly. Why have the prices of Agri-Commodities, as well as those of Gold and oil, risen despite warnings of strong supply? Answer is simple: Demand is stronger than supply.

One perhaps important flaw in the consensus global outlook at turn of the year was that U.S. economic activity would strengthen while outside the U.S. it would weaken. The likelihood that this forecast is "upside down" is increasing. Consumer demand within China, and most of Asia, is strong. For example, milk prices recently hit an all time high in Chicago. Chinese milk imports during 2013 rose 25% and are expected to rise 28% in 2014(theagriinfo.com, 28 December 2013). Such consumption is an indication of rising consumer incomes as milk has not historically been a common consumer product there. Clearly, demand for dairy products is stronger than supply.

Chinese consumers, recognizing a bargain when the Street saw none, bought 40% more Gold in 2013 than in the previous year(bloomberg.com, 9 March). Because of higher prices, Chinese demand for Gold is expected to begin the year weak. Note the wording carefully. Chinese are not selling Gold, they just might buy less than the 1,176 tons purchased last year. We also suspect they are not buying NASDAQ fantasy stocks either. And which of those two are they likely to buy in the future?

Demand for Gold and Agri-Commodities seems to be the dominant factor for prices this year, even after taking into account unique supply situations in some cases. As the year continues to unfold, investor attitudes on commodities, and in particular Gold and Agri-Commodities, need to adapt to the reality of the situation. Street fantasies, like those noted in the first paragraph, are not likely to enhance your wealth. Have they ever?

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2014 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.