Commodities - Three Cheers for The Fear Trade!

Commodities / Commodities Trading Jul 11, 2014 - 10:56 AM GMTBy: Clif_Droke

The long-anticipated summer rally for the precious metals (PM) sector gained strength this week even as the U.S. broad market stumbled. The recent plunge in small cap stocks isn't an unrelated phenomenon, however; it's one of the reasons behind the rally in the PM sector. In this commentary we'll examine the main drivers behind the latest push to multi-week highs for gold and silver.

The long-anticipated summer rally for the precious metals (PM) sector gained strength this week even as the U.S. broad market stumbled. The recent plunge in small cap stocks isn't an unrelated phenomenon, however; it's one of the reasons behind the rally in the PM sector. In this commentary we'll examine the main drivers behind the latest push to multi-week highs for gold and silver.

Since the start of the year we've talked about the relationship between heightened levels of investor fear and rising gold prices. I've long contended that fear - not inflation - has been the primary catalyst behind gold's rallies in recent years. As long as investors feel uncertainty toward the future of the economy and financial market, gold stands to benefit. The two major gold rallies this year have been mainly a function of gold's safe haven status as opposed to investors' concerns over inflation.

The fact that the leading safe havens - gold and Treasuries - are rising while stocks and other commodities stumble is proof enough that investors are desperately seeking safely. And there's currently no shortage of fear to feed the move to safety. Anxieties range from concerns over geopolitical instability in Iraq and eastern Ukraine, debt crisis in Argentina, and of course, the ever-present fear that stocks are in a speculative bubble destined to implode. Never mind that none of these fears is likely to be realized anytime soon, it's the anticipation of the event that is fueling the rush to gold. And where the investment markets are concerned, perception is reality.

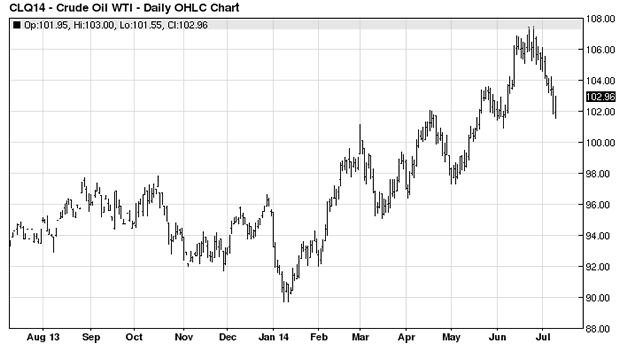

Added to the growing list of concerns is a worry that hasn't been seen in several years, namely the fear of inflation. Indeed, increased use of the word "inflation" in news articles and financial commentaries has been noticeable lately. The recent spike in the crude oil price has economists worried and the turmoil in Iraq is the catalyst. A Businesweek report put the threat of rising oil prices in emotive terms, referring to oil as an "old enemy" and stating that its latest rise threatens a global economic slump.

Economists like to say that every $10 increase in the crude oil price reduces global growth by two-tenths of a percentage point. It's not surprising then that the World Bank cut its 2014 global growth outlook from 3.2 percent in January to 2.8 percent in June. Julian Jessop of Capital Economics points out that economic recovery is "unlikely" if oil rises above $100/barrel, which was an economic tipping point in both 2008 and 2011.

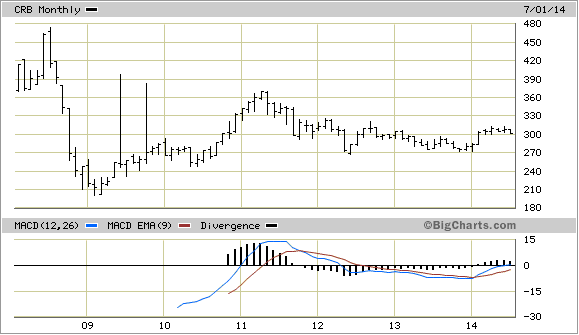

Yet inflation is still a ways off from being a serious threat to the economy. One look at the long-term chart of the CRB Commodities Index shows that commodity prices are well below their 10-year highs and have been relatively weak in the last three years. Moreover, another important gauge of inflationary pressure, namely interest rates, is still near 50-year lows.

Adding to the public's growing sense of fear, a number of brokerage firms took up the line from the Wall Street press and acknowledged the possibility of a market decline. Online discount broker Scottrade sent out an email to clients entitled, "Is a Market Correction Coming?" Without commenting on the obvious contrarian implication of this headline, suffice it to say that there's more than enough mortar to keep the "wall of worry" intact. Gold will accordingly benefit from this fear for as long as it persists.

Deflation

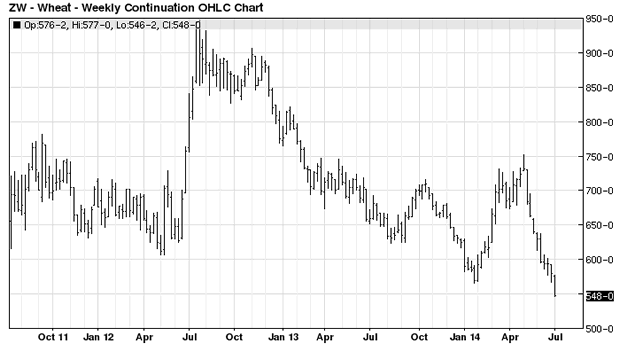

Not only is there a complete absence of inflation in most major inflation barometers, but deflation is still a problem in some quarters. We've already seen that several major commodities are under intense selling pressure, including agricultural commodities like corn and wheat. This is all the more amazing when you consider that crop conditions are less than ideal in many parts of the country and ag prices should be rising if the fundamental factors are to be believed. Instead we see plunging prices for several major commodities along with a worrisome trend in China's producer price index.

Economist Ed Yardeni points out that China's monetary and fiscal stimulus has, ironically, produced the unintended result of excess capacity. "The result," he writes, "has been deflation in China's various PPI measures." China's overall PPI fell 1.1% year-over-year during the latest reporting period. The decline was precipitated by an 11% drop in the coal industry, a 6.5% drop in ferrous metals and a 5% decline in chemicals.

With the world's number two economy experiencing such deflationary currents, it's no wonder that global growth has been lackluster in recent years. If the Kress Cycle theory is a reliable guide, this trend should reverse starting in 2015 or shortly thereafter as deflation gives way to re-inflation.

The pathway to re-inflation is likely to be a gradual one. There are two potential scenarios which could cause inflation to become a problem much sooner, though. One is an outbreak of major war. Normally it takes at least 10-15 years after the bottom of the 120-year Kress cycle before inflation becomes firmly entrenched in the economy. But following the 120-year cycle bottom of 1774, inflation was a major problem in the colonies during the U.S. Revolutionary war in 1777-79. At that time a pound of butter cost $12 a pound while flour fetched nearly $1,600 per barrel in Revolutionary Massachusetts. Keep in mind this was only 3-5 years after the long-term Kress cycle bottomed.

In his commentary of Benjamin Graham's classic book, The Intelligent Investor, Jason Zweig observed that inflation was also a major problem during the U.S. Civil War. During the war years in the early-to-mid 1860s, "inflation raged at annual rates of 29% (in the North) and nearly 200% (in the Confederacy)," he writes. He also points out that immediately following World War II, inflation hit 18.1% in the U.S.

The other possible scenario for a rapid re-inflation in the next couple of years would be if the world suddenly became smaller, i.e., if China and the other major components of the global economy inexplicably decided to withdraw and restrict imports and exports. If this ever happened it would reverse the trend toward excess capacity and would eventually lead to the classic inflationary problem of "too much money chasing too few goods." It should be emphasized, however, that this scenario is a major outlier and not at all likely to occur.

The most important lesson to take away from this is that the deflationary undercurrent is still very much alive and appears to be accelerating as we head closer to the long-term Kress cycle bottom this fall.

Kress Cycles

Cycle analysis is essential to successful long-term financial planning. While stock selection begins with fundamental analysis and technical analysis is crucial for short-term market timing, cycles provide the context for the market's intermediate- and longer-term trends.

While cycles are important, having the right set of cycles is absolutely critical to an investor's success. They can make all the difference between a winning year and a losing one. One of the best cycle methods for capturing stock market turning points is the set of weekly and yearly rhythms known as the Kress cycles. This series of weekly cycles has been used with excellent long-term results for over 20 years after having been perfected by the late Samuel J. Kress.

In my latest book "Kress Cycles" I explain the weekly cycles which are paramount to understanding the timing of stock market turning points. Never before have the weekly cycles been revealed which Mr. Kress himself used to great effect in trading the SPX and OEX. If you have ever wanted to learn the Kress cycles in their entirety, now is your chance. The book is now available for sale at: http://www.clifdroke.com/books/kresscycles.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.