What the Facts Say About Inflation

Economics / Inflation Jul 16, 2014 - 06:01 PM GMTBy: DailyWealth

Dr. David Eifrig writes: Investors are terrified of inflation right now...

Dr. David Eifrig writes: Investors are terrified of inflation right now...

But is it really a worry? Is it poised to eat away at your savings and wreck your income investments?

Many newsletter writers and talking heads say yes... According to them, inflation is already a big problem.

So let's take a look at the facts. They may surprise you...

For people who own fixed-income investments (like bonds or preferred shares), inflation is always a major worry. It eats away at your returns. For example, if you earn 4% in annual interest on a bond, but inflation runs at 5%, you've actually lost purchasing power. We don't want to see inflation rear its ugly head.

And counter to what many people believe, I don't think it will any time soon.

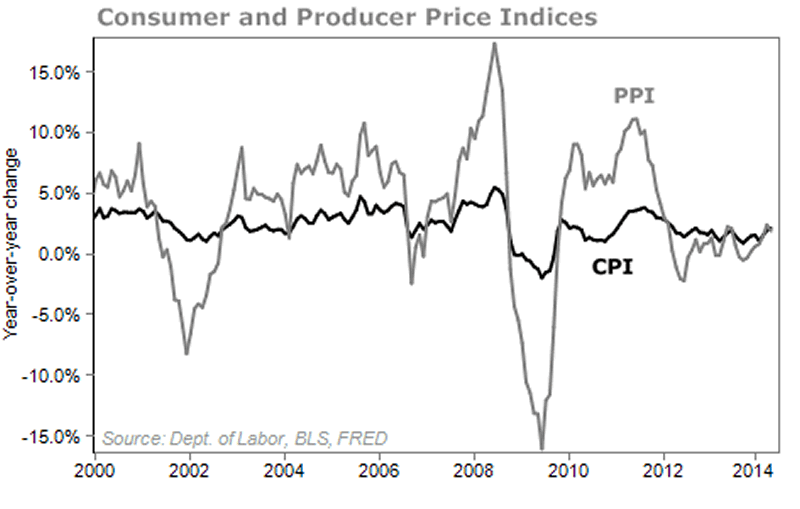

The mainstream media is starting to predict that inflation is heading higher... but I think the move could be smaller than most think. That's because producer prices tend to lead consumer prices, and the Producer Price Index (PPI) – which represents prices that producers pay for their input materials and supplies – is still subdued.

As you can see, the PPI is below the levels of the Consumer Price Index (CPI) – or the final prices consumers pay. The CPI trails the PPI, so we expect the CPI to head lower from here. And in today's situation – when the PPI is lower than the CPI and at low levels – it's a bullish sign for stocks, as companies enjoy higher profit margins. It's also good for bond investors.

Therefore, I'm still telling my readers to buy fixed-income investments, such as tax-free municipal bonds.

One of my favorite ways to invest in "muni" bonds, which I've discussed here before, is the Invesco Value Muni Fund (IIM).

Right now, IIM is offering you a little more than 6% in annual interest.

For those in higher tax brackets, the income you receive is equivalent to getting 9%-10% on your taxable investments. Even people in lower brackets benefit from getting tax-free income (6.5%-8% equivalent).

Those yields are similar to what you can get from high-yield corporate "junk" bonds, which yield a little less than 6%, according to the Merrill Lynch High Yield Index. But junk bonds are much riskier, with default rates that have ranged historically from 1% to 12%.

Plus, IIM is trading at an 8% discount to its underlying assets, which makes it an even better buy... It's like buying a dollar for 92 cents.

With oil prices over $100 and the economy starting to chug along, many of TV's talking heads and the financial media would have you believe inflation is a problem. But the facts tell us otherwise.

Don't let these worries keep you from making money. Hold on to your income investments and consider buying shares of a tax-free muni fund like IIM. As soon as the facts about inflation change, we'll let you know.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig Jr.

Editor's note: If you're interested in another way to generate safe, double-digit income streams, you'll want to check out Doc's controversial new book High Income Retirement. Probably fewer than 1% of the investors in America know about, use, or understand these strategies. But we believe these ideas are so important, everyone should know them. You can get all the details right here. (This does not link to a long video.)

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.