UK Housing Market Surge In Mortgage Repossession Orders

Housing-Market / UK Housing May 11, 2008 - 08:51 AM GMTBy: Mick_Phoenix

Welcome to the Weekly Report. This week we look at Gordon Brown the UK Prime Minister, US and UK mortgage markets and the US consumer.

Welcome to the Weekly Report. This week we look at Gordon Brown the UK Prime Minister, US and UK mortgage markets and the US consumer.

We are all aware of the US mortgage problems which are now beginning to show up within prime mortgages but some people, outside the UK, might not be so aware of the problem growing in the 5th largest economy in the World.

Before we start, a friend sent me an email that I would like to show you. I'm sure he would appreciate the readers help:

Hi to all my friends

Please say a prayer for my wife Sam as she had a heart attack on thursday, I nearly lost her on that day, she is now in the Royal Brompton hospital in London and it looks like she is going to have a pacemaker fitted

Please give her a positive thought that all will be well as I believe in the power of prayer and positive thought.

Thanks

David

In the early nineties the UK suffered a housing bust that lasted for at least 7 years, possibly longer if you measure it until the bottom of the cycle. Indeed, I well remember selling a property in London in 2000 that the Estate Agent was pessimistic about, needless to say the price eventually went much higher than their estimate. They didn't get the sale. From 2000 to 2006 the property market could be viewed as benign, prices went up (and up) whilst affordability from a debt servicing point of view increased. This coupled with loose lending standards (125% mortgages, mortgage limits set at multiples of 5 or 6 times gross earnings) encouraged a buying spree.

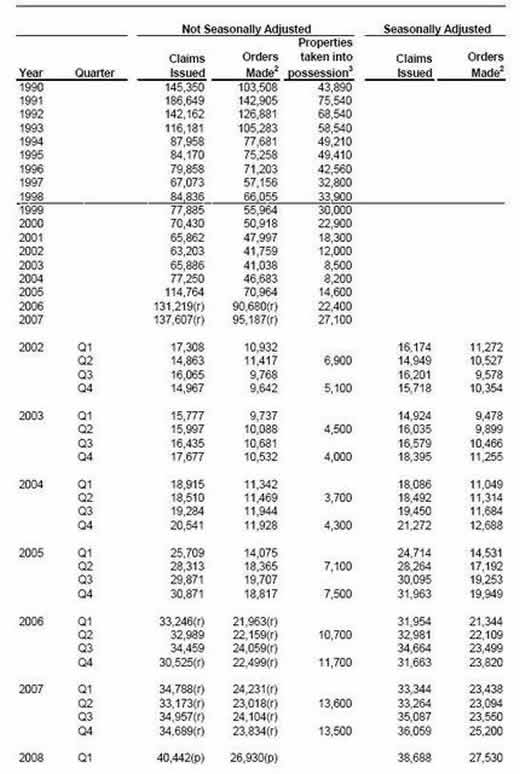

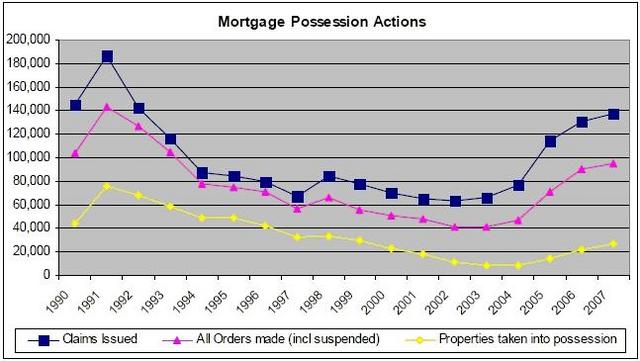

However, when you view the figures of mortgage possession actions in County Courts, you can see the clear "suckers rally" that has now turned sour:

Possession claims, orders and repossessions have risen markedly since 2004 and show signs of acceleration. Notice the Q1 '08 growth when compared to Q1 '06 and '07, that's not a good indicator of the future prospects of UK housing. Here is a chart that shows the previous peak in possession activity, the retracement to a low and now the new rise:

I know it's a dangerous game to try and extrapolate a future trend from one figure but let me be conservative in this. If the rest of '08 shows no further acceleration of possession action, then the final figure will be around 161k. For the final figure to be back inside the 2000-2004 good times then only a 20-30k increase over the next 3 quarters is allowed. I doubt very much the latter is going to happen, personally I see 2008 as going on record as the 2nd worst year for home repossessions. There is an extremely strong possibility that it may try and take out the figures for 1991. Why do I feel this is possible?

It is down to the difference between the US Govt/Fed reaction to the mortgage market implosion and that of the UK powers that be.

The US has attempted to loosen regulation, expand the book of the GSE's, lowering capital ratio requirements, slashed rates and actively pursued a dialogue with lending banks and institutions. The icing on the cake was the direct interference with the credit system, allowing credit markets to function using the Feds assets.

The UK has a lending facility that is expensive and restrictive, rates have stayed high, lending banks have ignored pleas from the Government and mortgage products have disappeared in their 1000's and the remaining products have new, tighter standards. The UK Governments response is shoddy at best, negligent at worse. This is the best they can offer:

- Chancellor of the Exchequer Alistair Darling yesterday met mortgage lenders to discuss lending conditions. Caroline Flint today said that the government will also ask lenders to improve the advice it offers customers seeking to refinance debts. ``For the minority of owners who may need support and advice now, we want to ensure it is there for them in the right place and at the right time''

In other words, they are doing nothing. Notice it is the lenders who are asked to offer better advice. Now you know me, I hate intervention in free markets and believe that bubbles of any nature would not form if the participants understood that there was no safety net. However, in the "real" world, away from my ideals, there is interference and intervention that is causing participants to rely on a safety net.

The problem for the UK is the flawed character that is Gordon Brown.

To read the rest of the Weekly Report go to An Occasional Letter From The Collection Agency at www.caletters.com and sign up to the 14 day free trial.

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.