Death of the U.S. Dollar? Gold an Inflation Hedge? Really?

Commodities / Gold and Silver 2014 Jul 29, 2014 - 07:18 PM GMTBy: Submissions

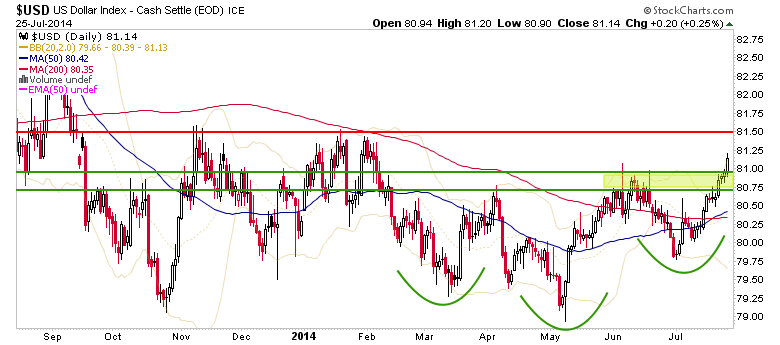

Gary Tanashian writes: Take a look around the gold bull landscape and tell me how many of them are featuring a chart like this, showing the US dollar in a bullish short-term stance (to go with the weekly bullish stance we have noted for so long in the ‘Currencies’ segment).

Gary Tanashian writes: Take a look around the gold bull landscape and tell me how many of them are featuring a chart like this, showing the US dollar in a bullish short-term stance (to go with the weekly bullish stance we have noted for so long in the ‘Currencies’ segment).

This is not to say that the US dollar has real value. How can it when it is hopelessly dragged down by a national debt-for-growth obsession. But as with gold, value is one thing and price is quite another. It is just that one (USD) receives a price bid due to a ‘nowhere else to hide’ sort of mentality by the majority when asset market liquidity becomes constrained and the other (Gold) receives a more solid value bid, over time.

We saw what happened when gold got the price bid as the panicked ‘Knee Jerks’ flooded in during the acute phase of the Euro crisis in 2011. That was the exclamation point on the first major phase of the gold bull market and the dawn of a cyclical bear market.

We continue to await economic contraction, in which the price of the USD can benefit for a while as capital comes out of assets and into what it thinks is a safe haven. Gold remember, has been soundly discredited as a store of value and that has been the bear market’s job… well done I might add.

That is why with gold you either have a long (and I mean loooonnnggg) term outlook or you become distracted (at best) and lost (at worst) in the game of currency Whack-a-Mole (where global policy makers compete in trying to hammer down their own currencies in the name of politically expedient asset market appreciation) and the rolling asset market speculations that result.

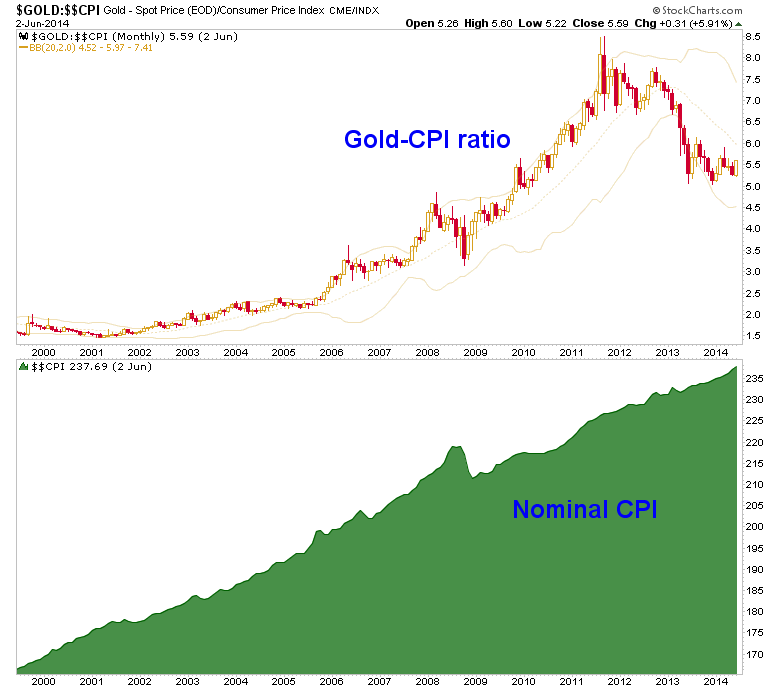

The obsession with inflation is a Red Herring where gold is concerned. On the anti-gold side you have Harvey and Erb, by way of this intro from the National Bureau of Economic Research, and their inflation obsessive, CPI-centric view:

“While gold objects have existed for thousands of years, gold’s role in diversified portfolios is not well understood. We critically examine popular stories such as ‘gold is an inflation hedge’. We show that gold may be an effective hedge if the investment horizon is measured in centuries. Over practical investment horizons, gold is an unreliable inflation hedge. We also explore valuation. The real price of gold is currently high compared to history. In the past, when the real price of gold was above average, subsequent real gold returns have been below average consistent with mean reversion. On the demand side, we focus on the official gold holdings of many countries. If prominent emerging markets increase their gold holdings to average per capita or per GDP holdings of developed countries, the real price of gold may rise even further from today’s elevated levels. In the end, investors face a golden dilemma: 1) embrace a view that ‘those who cannot remember the past are condemned to repeat it’ and the purchasing power of gold is likely to revert to its mean or 2) embrace a view that the emergence of new markets represent a structural change and ‘this time is different’.”

On the pro-gold side you have legions of gold bugs also obsessing on the effects of inflation, wondering why the US dollar just will not go down despite all the pins already stuck into their Uncle Buck voodoo dolls over the last 10 years.

Both sides of the debate are confused, confusing and either through agenda or naiveté, totally out to lunch. The word “inflation” has been sanitized and simplified to mean ‘rising prices’ to a majority of people. But in the age of ‘Inflation onDemand’ ©, inflation is the thing that is officially promoted with its effects often resulting in rising prices on an interim basis, yes, but ultimately in asset market liquidations.

Don’t let academics like Harvey and Erb over simplify this to a cartoon-like analysis that even an intellectual can understand; and don’t let the gold ‘community’ over simplify it to cartoons, caricatures and promotions that even the most narrow viewed of its followers (the ones calling non-gold bugs “sheeple”, for instance) can understand.

It is not simple! It is very complicated, but in its complication there is simplicity as well. In the modern casino we have lost the idea and the ideal of value. We are crack whores and casino patrons gaming at the hot tables unable to tune down the noise of all those promoters in there pitching, playing and trying to be heard above the noise.

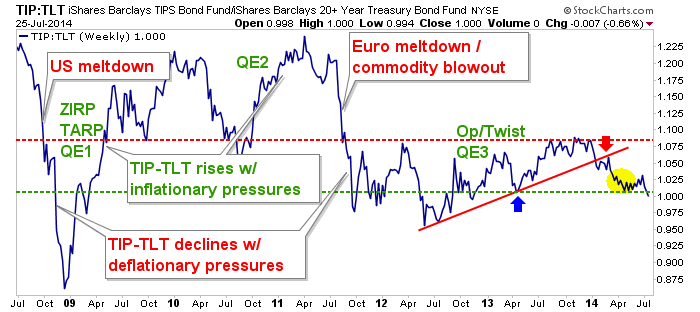

TIP (inflation protected) vs. TLT (unprotected long-term T bonds) AKA our ‘inflation anxiety’ monitor is breaking down, not up. We have noted that Goldilocks has lived quite comfortably (porridge is ‘just right’) within the green and red dotted support and resistance lines. Above the red, public anxiety about inflation would be indicated to be getting too hot and below it, too cold. Well, last week it hinted a break down. This bears watching.

In combination with the USD chart above, the average gold booster (a different flavor of casino patron) must be wondering ‘what the… ?!?’ But this is in keeping with our favored view of a positive fundamental backdrop for gold because with inflation expectations potentially becoming ‘too cold’ we might anticipate a difficult time for Goldilocks and by extension the stock market (and commodities).

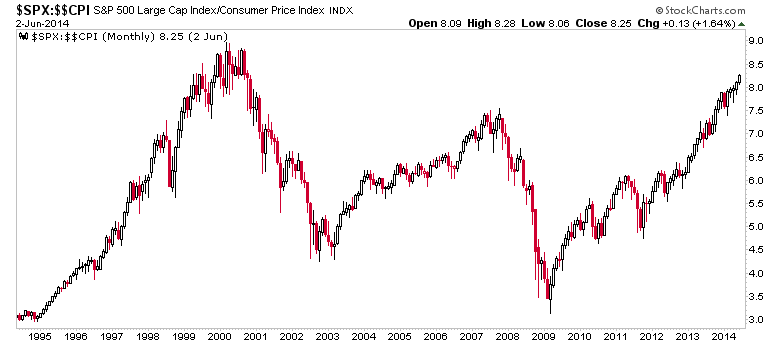

That would mean that the “real price of gold” so inaccurately described by Harvey and Erb as gold vs. the CPI, would be due to rise.

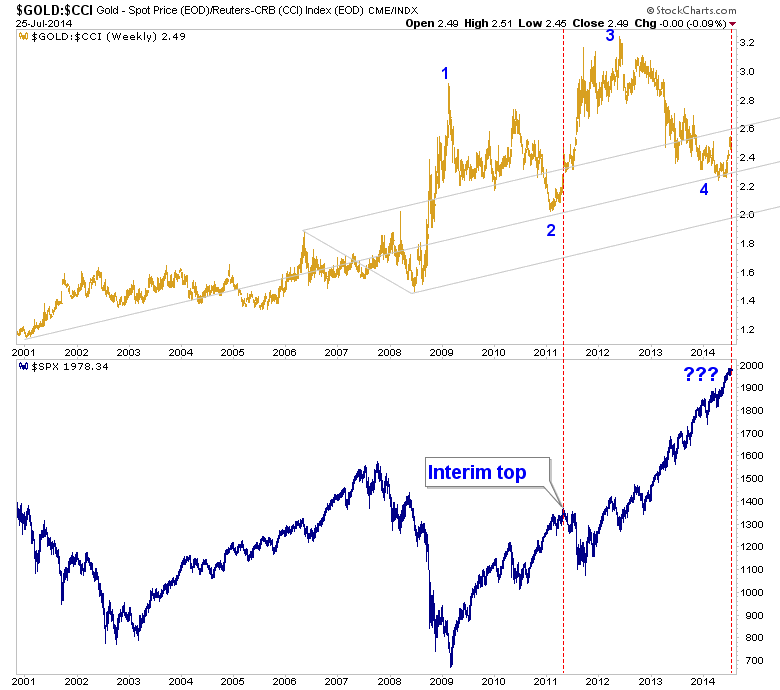

I do not disagree with the statement underlined above, but I do disagree with their CPI-centric view and also would note that the real ‘real price of gold’ as adjusted by commodities [ref: Bob Hoye's work over the years and cycles], has been declining throughout the cyclical bear market and indeed looks like it may be resetting for the next cyclical up turn.

Here once again is the view of gold’s real [commodity adjusted] price, still in a bear market over the span of point 3 to point 4, but making a potential bottom at 4’s higher low to point 2. Gold’s Euro crisis distorted real price has been very nicely adjusted over the last 2+ years.

If gold were to resume its long-term rise vs. commodities it would very likely be against a deflationary backdrop, which would feature economic contraction. In other words, it would come against the failure of policy makers’ most recent operations that were enacted in response to the last crises, namely the ‘Financial Crisis’ that people in the US now speak of in the past tense and the ‘Euro Crisis’ that I assume (with Spanish 10 year bond yields are at an incredible low of 2.54%) an increasing number of Europeans came to consider a thing of the past.

If the recent up turn in Gold vs. Commodities is real and if history repeats, the US stock market has a clock ticking on a coming high. But if we have learned one thing over the recent cycle (stocks up, way up and gold down, way down) it is to give the Devil his due and not make too many assumptions and never make predictions. Just do the work in workman-like fashion week to week and we’ll let this epic play out.

In what is becoming an unintended long-winded segment, let’s finish by noting that even if Harvey and Erb are correct to call Gold vs. CPI the real ‘real’ price of gold, the correction has been brutal. Odds are coming back in gold’s favor vs. holding other (inflated) assets in an attempt to counteract the CPI’s negative effects on our every day lives.

Could the ratio drop from the current 5.5 to 4? Sure it could. Could nominal gold go to Harvey and Erb’s target of 800? Gold is about value not price, so yes it is possible.

But if that is a bottoming pattern in gold vs. CPI, then monetary value seekers would be glad to have not nickel-dimed gold as a price (as opposed to value) play.

Bottom Line

The inflation has rooted in a stock bubble on this cycle. Policy has worked toward its goals thus far. That ‘inflation trade’ is long in the tooth and due to be liquidated at some point. At the every least the gold vs. CPI ratio is much less at risk than the SPX vs. CPI ratio…

The stock market has been the new defense mechanism against the long-term damaging effects of inflation, i.e. rising prices. Since the ‘Financial Crisis’ our heroes at Policy Central have managed to blow a stock bubble*, finally getting it right after previous such inflationary operations have yielded bubbles in everything from Uranium to Crude Oil to Copper to Silver. Even gold caught a mini bubble in 2011.

* Look, he’s calling stocks a bubble! A Perma-Bear!! Well not really; for most of the intense phase of this bull market we have simply noted that the bubble was in policy, not stock prices as gauged by conventional market analysts. But recently, valuations have well exceeded even the metrics used in conventional analysis. It’s a bubble, to one degree or another and like previous bubbles, it will pop eventually.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart/trade ideas!

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.