The Great Depression, World War II, And What They Really Mean

Economics / Global Economy Sep 17, 2014 - 01:48 PM GMTBy: John_Rubino

Nearly a century after the fact, the Great Depression remains THE object lesson for virtually every branch of economics. To monetarists the fact that the US money supply fell by nearly a third in the 1930s illustrates the need for a central bank to maintain steady money growth. To Keynesians the Depression’s depth and duration proved that capitalist systems are inherently unstable and need a big, powerful government to manage them. World War II, in this framework, saved the US economy from permanent 25% unemployment.

Nearly a century after the fact, the Great Depression remains THE object lesson for virtually every branch of economics. To monetarists the fact that the US money supply fell by nearly a third in the 1930s illustrates the need for a central bank to maintain steady money growth. To Keynesians the Depression’s depth and duration proved that capitalist systems are inherently unstable and need a big, powerful government to manage them. World War II, in this framework, saved the US economy from permanent 25% unemployment.

To Austrians, meanwhile, the Depression demonstrated that 1) the best way to prevent a bust is to avoid the preceding boom, which is another way of saying that the size and composition of the national balance sheet is the key to everything, and 2) the best way to get through a bust is to let market forces liquidate the bad debt as quickly as possible.

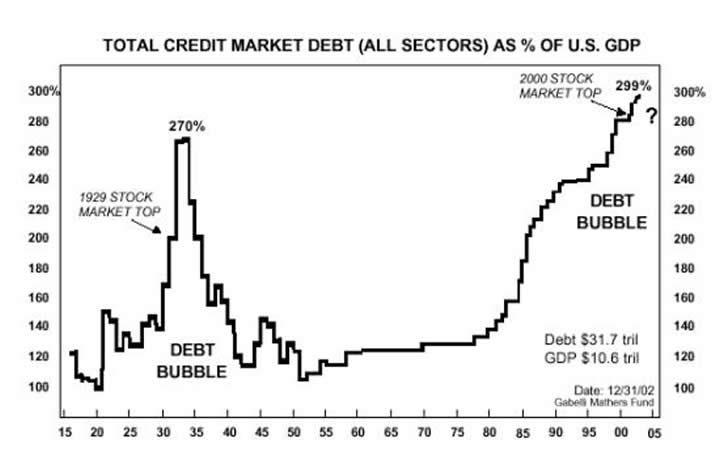

A September 14 DollarCollapse column took the Austrians’ side in the debate and illustrated the point with the following chart, which depicts the massive deleveraging of the 1930s.

Not surprisingly, since the Depression means so much to so many, this generated some conflicting comments, the most challenging of which came from reader Eric Original:

The spike in debt/GDP in the 30′s was due to the collapse in GDP. Basic math. It’s a ratio. And therefore, the supposed deleveraging prior to WW2 is baloney as well. Just like your entire last paragraph, and pretty much the whole article, as usual.

You hard money Austrian econ goons need to come out of your caves and get a life.

This is response-worthy both because the final spike in debt/GDP was indeed partially caused by GDP shrinking faster than debt, and because it gets at some of the deeper, more interesting parts of the story. So, here goes:

During the initial stages of a credit bubble debt soars but debt/GDP rises more slowly, because the proceeds from all those new loans get spent, thus producing “growth” which shows up as rising GDP. In other words both the numerator and denominator of the ratio go up. But — and this, I think, is the crucial fact for Austrians — extremely easy money leads people to buy things and make investments that they wouldn’t otherwise buy or make. This “malinvestment” pumps up growth in the near-term but doesn’t generate sufficient cash flow thereafter to service the related debt.

So the initial debt-driven pop in GDP is an illusion. Later, when those bad investments can’t cover their interest payments and go bust the economy shrinks, for a time, faster than societal debt, which causes debt/GDP to spike. But the actual spike in debt/true GDP happened earlier. It isn’t reflected in official statistics because there’s no way, in the heat of an asset bubble, to separate good investments from bad. As Warren Buffett likes to say, it’s only when the tide goes out that you see who’s swimming naked.

But if the above chart could be constructed using 20-20 hindsight, the late 1920s would show a huge increase in debt/true GDP and the early 1930s would show a quick deleveraging rather than a gradual one lasting a decade. By 1939, not only would debt be a smaller part of the economy than in 1929, but the quality of the remaining debt would be far higher. That society would be ready to grow again, regardless of whether or not there’s a war.

The other thing that keeps this debate alive is the assumption that there are painless alternatives to deleveraging after a credit bubble. Keynesians (who are now mostly running things) believe that if the government borrows to make up for the private sector’s deleveraging — or convinces the private sector to keep borrowing to replace those old bad debts — growth will resume without the need for layoffs and bankruptcies.

Variations on this strategy are being tried by virtually every major country. Japan has been at it since the 1990s and has lately added extreme debt monetization to its ongoing huge deficits. The US since 2008 has gone the same route, expanding government debt by enough to offset the credit card and mortgage debt that’s been written off, while buying back several trillion dollars of bonds with newly-created dollars. Now Europe is getting ready to do something equally big (see OECD slashes growth forecasts, urges aggressive ECB action).

So far the results aren’t encouraging: Japan is stagnant while continuing to pile up government debt, and now appears to be out of options. The US is reporting official GDP growth and falling unemployment but the case can be made that those numbers are largely fictitious (full-time jobs continue to decline, for instance, which means real unemployment continues to increase) and in any event a rising dollar is threatening even that modest momentum. Europe seems to be beyond saving, but the ECB is still going to try.

The mainstream response of “well, we just need more debt and faster money printing” is disturbing both because it fits the common definition of mental illness (repeating the same behavior while expecting a different outcome) and because it magnifies the consequences of failure. If, as Austrians believe, there is no alternative to deleveraging after a boom — in other words, if booms and busts are two sides of the same event and therefore by definition have to occur together — then the extra $100 or so trillion dollars the world has taken on since the tech stock bust of 2000 makes the resulting, inevitable, deleveraging that much scarier.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.