Why Isn’t U.S. Housing Market A Bubble?

Housing-Market / US Housing Sep 23, 2014 - 10:20 AM GMTBy: John_Rubino

In his book The Postcatastrophe Economy, iTulip’s Eric Janszen notes that financial bubbles don’t repeat. That is, yesterday’s bubble is never tomorrow’s because hot money likes to chase the next big thing, not the last big thing. Which explains how US equities, government bonds, fine art, and trophy properties like London penthouses can all be sizzling while US houses, the epicenter of the previous decade’s financial orgy, just sit there.

In his book The Postcatastrophe Economy, iTulip’s Eric Janszen notes that financial bubbles don’t repeat. That is, yesterday’s bubble is never tomorrow’s because hot money likes to chase the next big thing, not the last big thing. Which explains how US equities, government bonds, fine art, and trophy properties like London penthouses can all be sizzling while US houses, the epicenter of the previous decade’s financial orgy, just sit there.

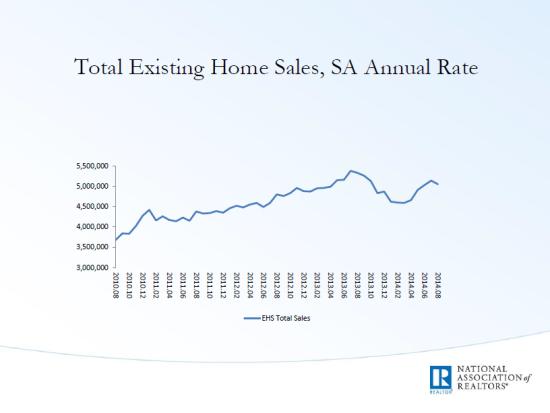

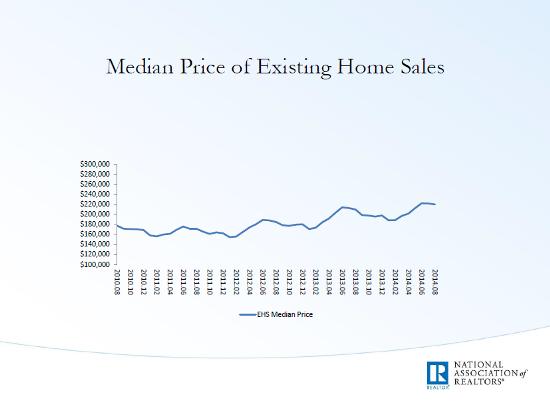

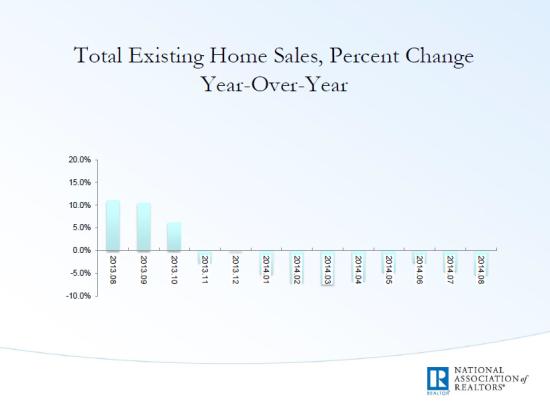

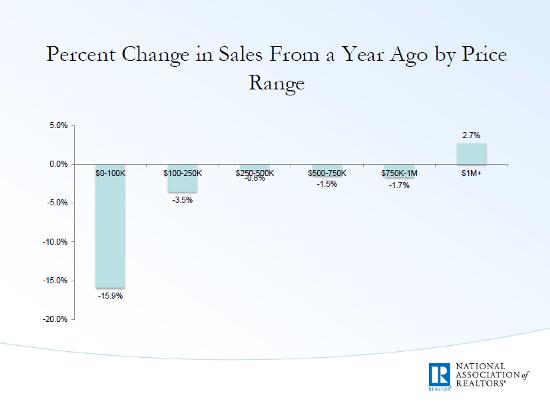

Some charts from the National Association of Realtors illustrate just how boring the US housing market has become:

To summarize the first three charts, overall sales have declined year-over-year for ten straight months, prices are barely up from a year ago, and near-term trends imply more of the same. The fourth chart explains why: All the positive action is in high-end properties while the entry level part of the market is imploding.

There are several reasons for this:

1) Today’s college students are graduating with so much debt that many can’t even conceive of buying a house. Instead, their choice is between a cheap apartment or a bedroom in their parents’ home.

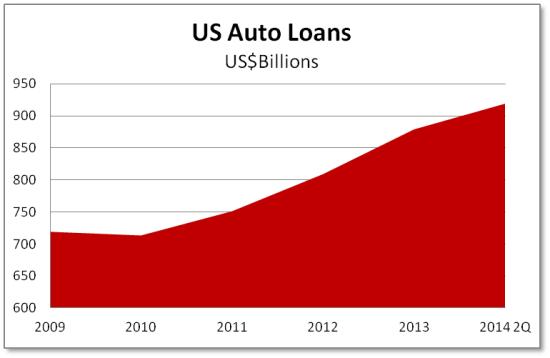

2) US consumers, after a few years of deleveraging, are once again borrowing, but in large part this is to pay for necessities like gas and food. When they buy something discretionary, it’s now likely to be a new car. Auto loans are rapidly approaching the $1 trillion milestone achieved by student loans a couple of years back.

3) Back in 2004-2007, banks handed out home equity lines of credit (HELOCs) to pretty much anyone with a house and a heartbeat (heartbeat frequently optional). Those loans generally require only interest payments for the first ten years and then begin demanding repayment of principal. So the loans made during the housing bubble are now starting to step up, hitting their owners with hundreds of dollars of extra monthly payments at a time when they’re already strapped. For more see Why the Real Estate Market Remains Fragile.

Rich folks, meanwhile, own the stocks and bonds that have soared lately, so they’re ready and able to diversify out of financial assets and into real stuff like million-dollar houses. Take these extravagant buyers out of the equation and the housing market for the rest of us is contracting at what looks like a steady 5% per year, with no end in sight.

So what does this mean for the overall economy? Specifically, can a country as dependent on consumer spending as the US generate sustained growth when the one major asset owned by most families isn’t participating? The answer is probably not. For the wealth effect (rising asset prices leading people to spend more) to really get going, all the pressure is now on the narrow shoulders of the stock market.

And so is all the risk. If stock prices were to correct from their current record levels, the impact would be directly painful for the 1% who are now buying those mansions, and at least scary for the 99% who aren’t losing on the stocks they were never able to buy, but can’t escape the ubiquitous headlines about “crashes” and “crises” and such. The net effect would be to snuff out the recovery and leave a desperate government with only one remaining weapon: a high-profile monetary shock designed to replace the scary headlines with a perception that our bold, innovative leaders once again have our backs. Japan has already reached this point (see Abenomics Approaches Moment of Reckoning), Europe is getting there (Pressure Builds on ECB Chief) and the US, unless housing turns around or stocks double from here, will be there soon.

Welcome to the brave new world of global coordinated monetary debasement.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.