Gold - Bloomberg TV Blows It Big Time

Commodities / Gold and Silver 2014 Dec 01, 2014 - 05:16 PM GMTBy: Jesse

Sometimes you just have to chuckle. I had been out all morning picking up some visiting in-laws in the City. When I came home I flipped on the news, and turned on the equipment in my home office.

Sometimes you just have to chuckle. I had been out all morning picking up some visiting in-laws in the City. When I came home I flipped on the news, and turned on the equipment in my home office.

The mid-day news highlight on Bloomberg TV at about fifteen minutes after noon today was to say that gold was down sharply, over fifty dollars, because of the Swiss gold referendum vote.

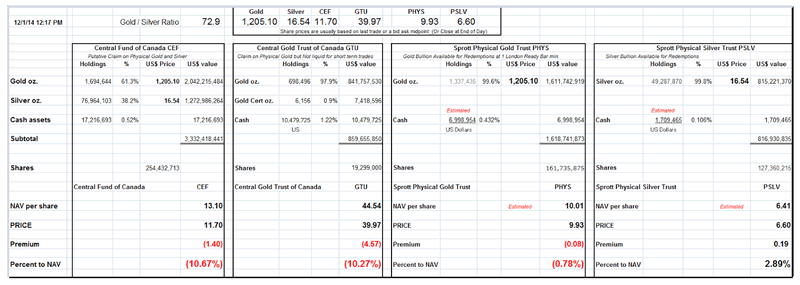

But then I looked at my trading terminal and said, 'huh?' Gold is rallying hard, and silver is taking the shorts out of the pits on stretchers. What is up with this?

And as a reference they cited this 'highly popular story' they ran from early this morning. In the updates they mentioned absolutely nothing about gold's spectacular comeback in the morning trade, as if it had not even occurred.

Swiss Gold Rejection Deals Blow to Investors Hurt By Slump

What is the point of a real time television network when you maintain the immediacy of daily newspaper?

A clue to this might be the presence of Willem Buiter in the early morning feature, the Citigroup chief economist who says some almost absurdly myopic things about gold every so often. Buiter Fitfully Obsessing About Gold

I really don't mind that they put out this feature story piece about the big gold decline early this morning. After all, it must have taken some production planning.

But to completely ignore the big reversal that occurred during the morning New York trading hours in the later daily updates makes one wonder about their mission as a financial news network first and foremost, when the preconceived features get in the way of the straight news. Someone is asleep at the credibility switch.

Would Bloomberg TV be this far behind the curve on stocks or bonds, for example, if they had declined sharply and then corrected all the way back up and then broken out higher? They certainly followed the rebound in AAPL this morning quite keenly, and it did not begin to match the rebound in gold.

Granted, some of the US financial spokesmodels seem remarkably uninformed about what is happening outside the confines of North America. China? What is that, a supplier to AAPL? A subsidiary of BABA? The difference between US based news anchors and those from the same networks based in Europe and Asia is often remarkable.

But to be this behind the curve on their own Bloomberg news terminal quotes, a first rate service by the way, on an important global commodity and resurgent paracurrency is appalling. Central banks went from long time net sellers to net buyers of gold around 2006 and that means nothing? Russia and China and their central banks are buying gold hand over fist, and it doesn't even merit a mention in their meme?

Gold and silver are certainly in bear markets, and still are even after today's surprising reversal. Whether that changes or not who can say? We will have to wait and see.

But there are many unusual and newsworthy things happening in the world of global finance and central banking these days. And choosing to ignore them is not necessarily effective financial management. There is something going on called 'the currency war,' and its effects make be significant, and quite possibly historic in its importance.

The tremendous sea change that has been occurring in the international monetary markets is apparently buried under a barrage of barbarous fiatscos. And only a few can see the implications.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2014 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.